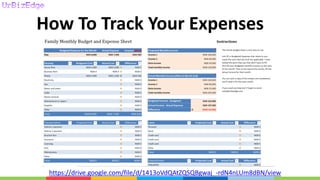

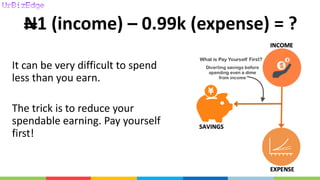

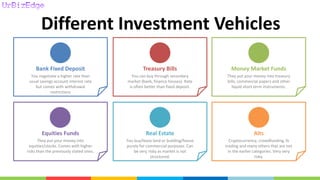

This document provides guidance on basic investment and financial planning. It emphasizes the importance of budgeting expenses religiously for 3 months to understand monthly needs and amounts that can be saved. It recommends tracking expenses using budgeting apps and suggests saving bonuses and windfalls instead of spending them. The document advises against saving only for future purchases and warns against savings accounts with no interest. Finally, it outlines different investment vehicles like fixed deposits, treasury bills, money market funds, equity funds, real estate, and alternatives, noting their risks.