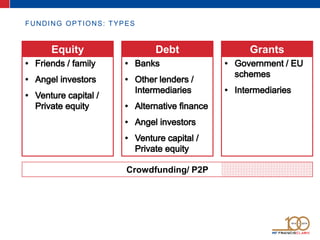

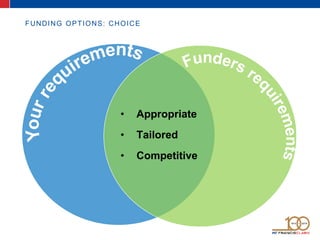

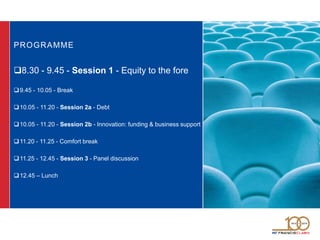

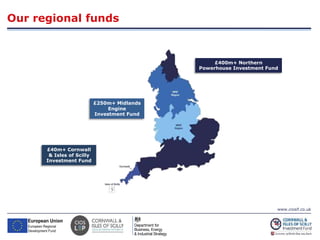

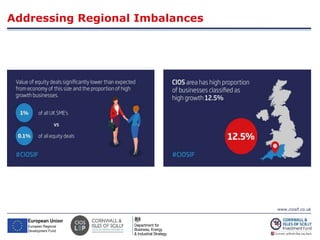

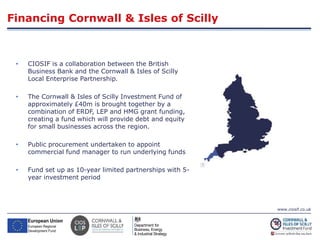

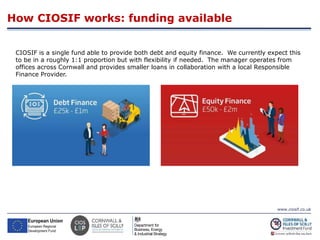

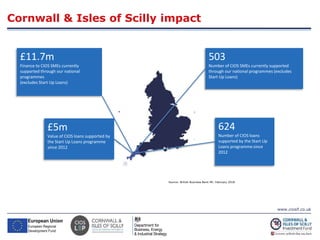

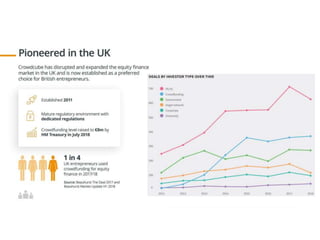

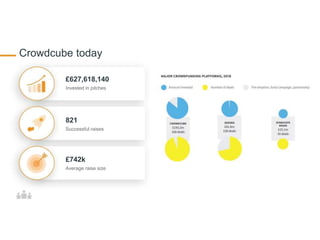

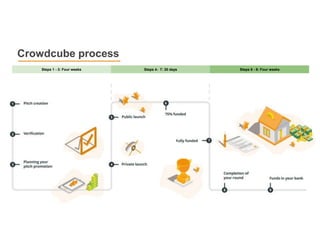

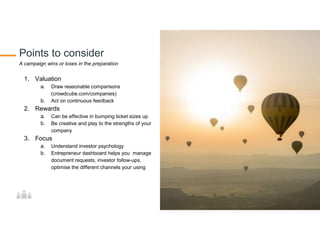

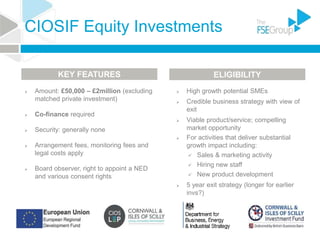

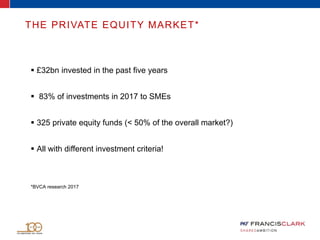

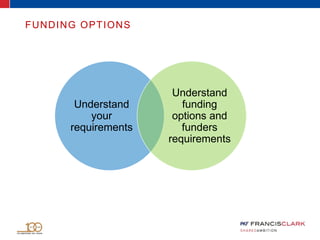

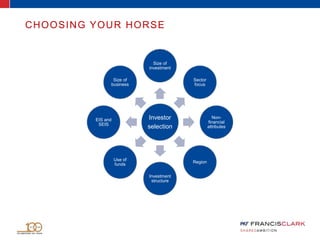

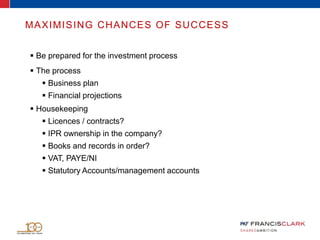

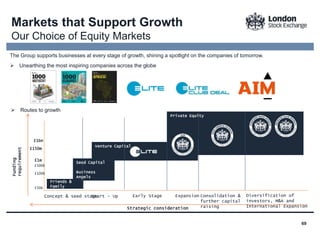

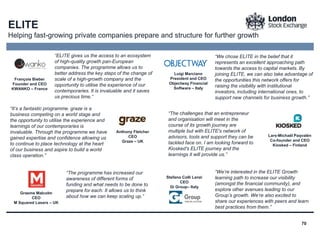

The document discusses financing opportunities for small and medium-sized enterprises (SMEs) in Cornwall, highlighting the significant funding gap and lack of awareness among SMEs regarding available funding options. It elaborates on various funding sources such as equity, debt, grants, and crowdfunding, along with the initiatives taken by the British Business Bank to enhance access to financing for businesses in the region. Additionally, it provides insight into specific investment strategies and criteria for attracting private equity funding.