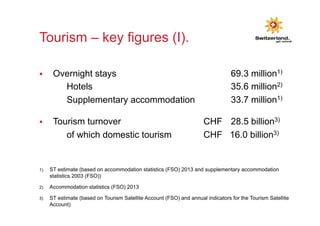

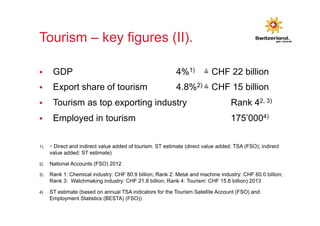

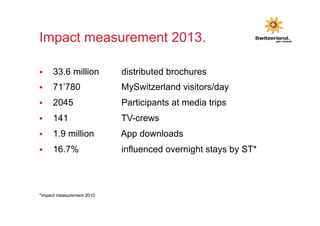

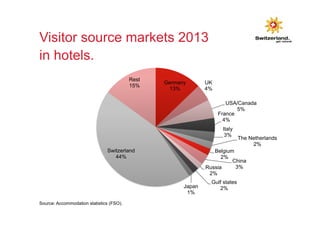

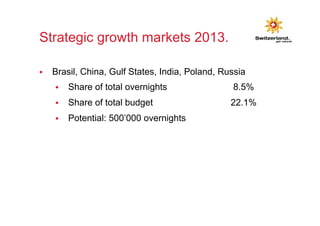

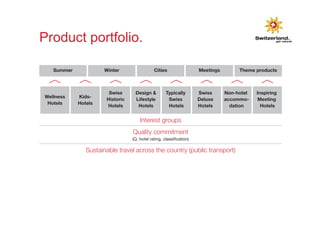

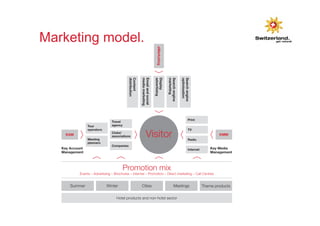

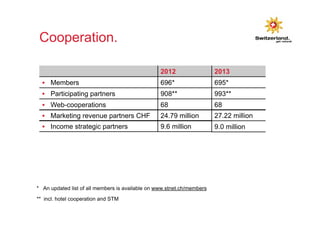

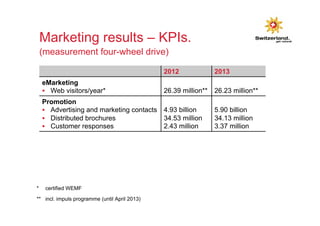

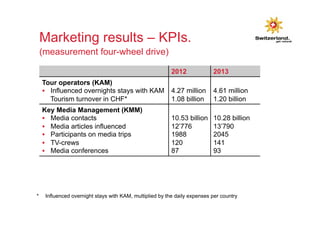

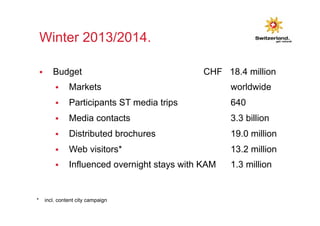

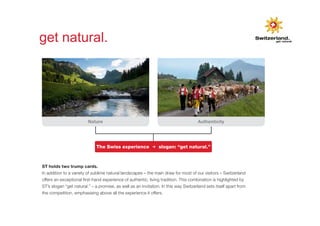

The document outlines the structure and key figures of Switzerland's tourism sector, detailing an introduction to Swiss tourism for students at HTW Chur, workshops, and various statistics related to tourism activities and contributions to GDP. It emphasizes the importance of marketing and emotional engagement in tourism, presenting strategies for promoting Switzerland as a premier travel destination. Additionally, it covers the performance metrics of tourism marketing efforts, including visitor statistics and the development of sustainable tourism practices.