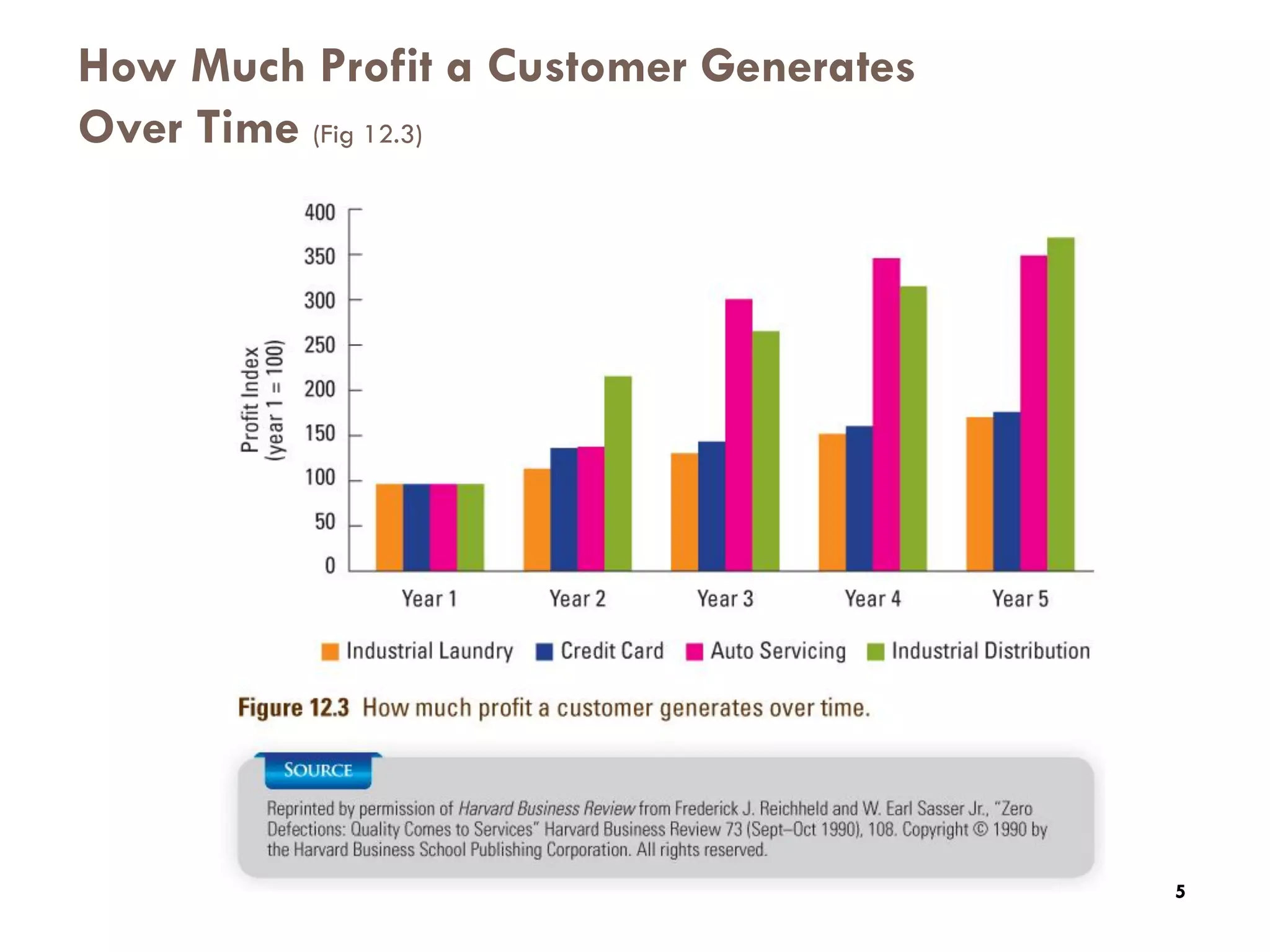

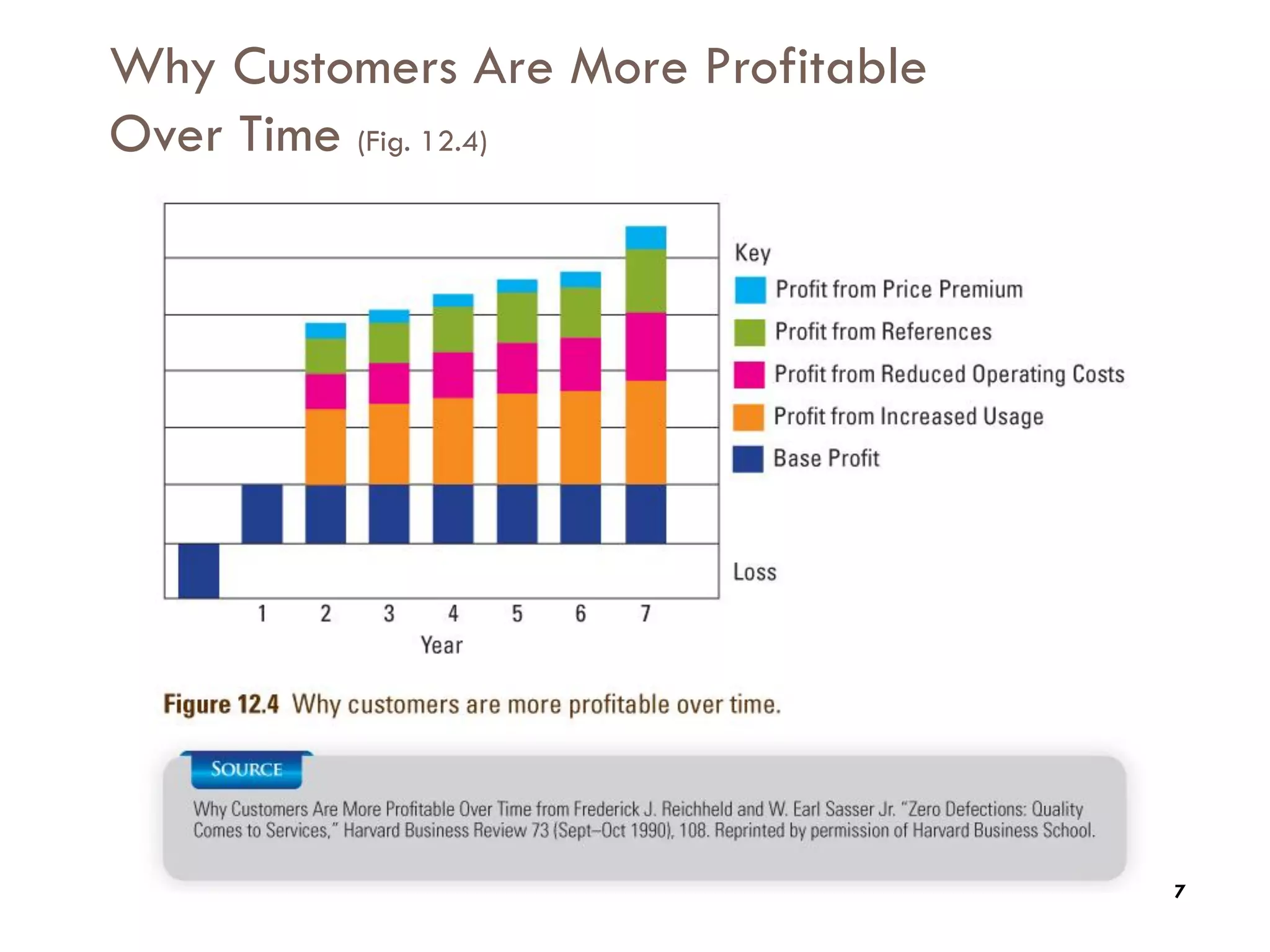

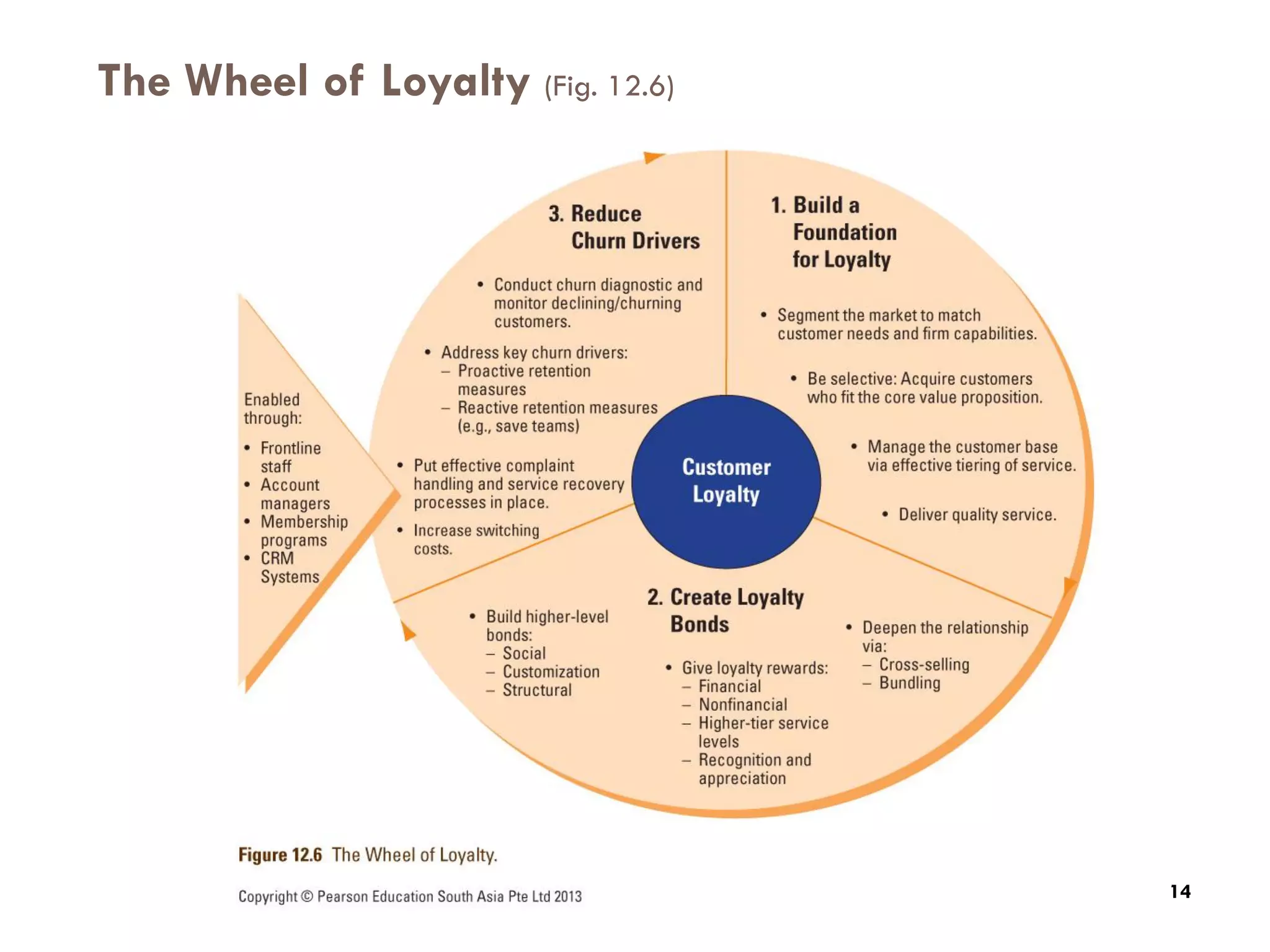

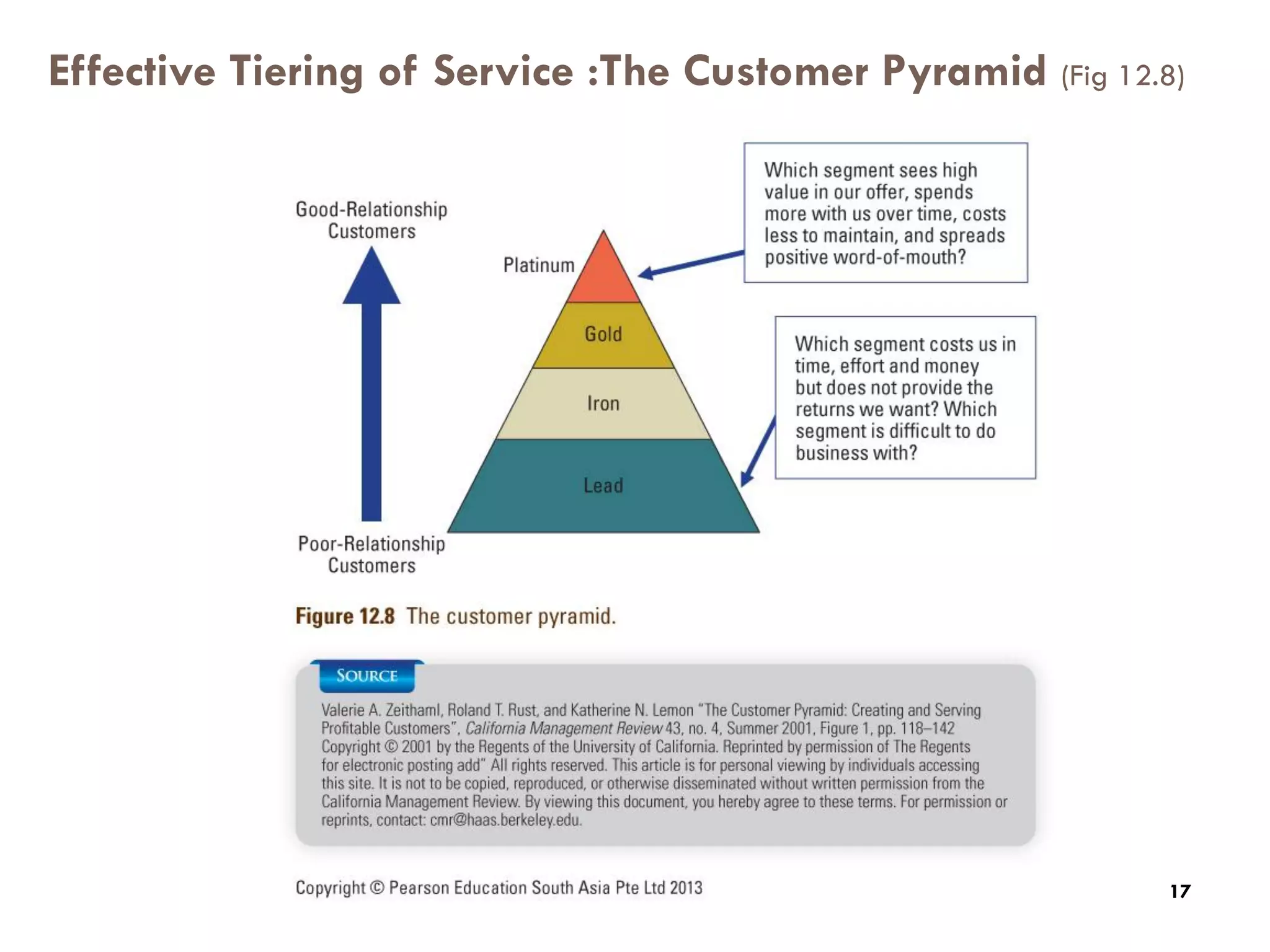

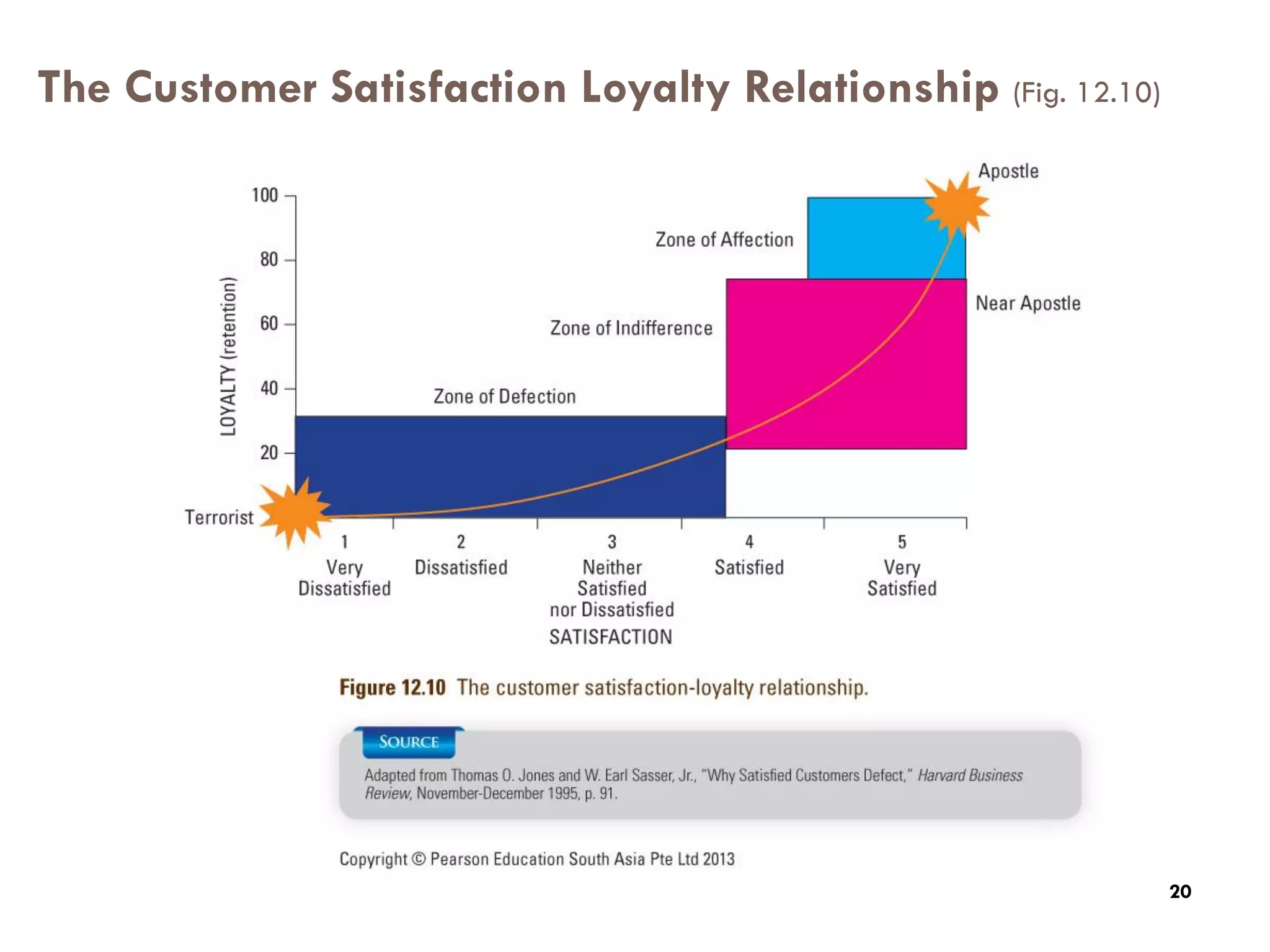

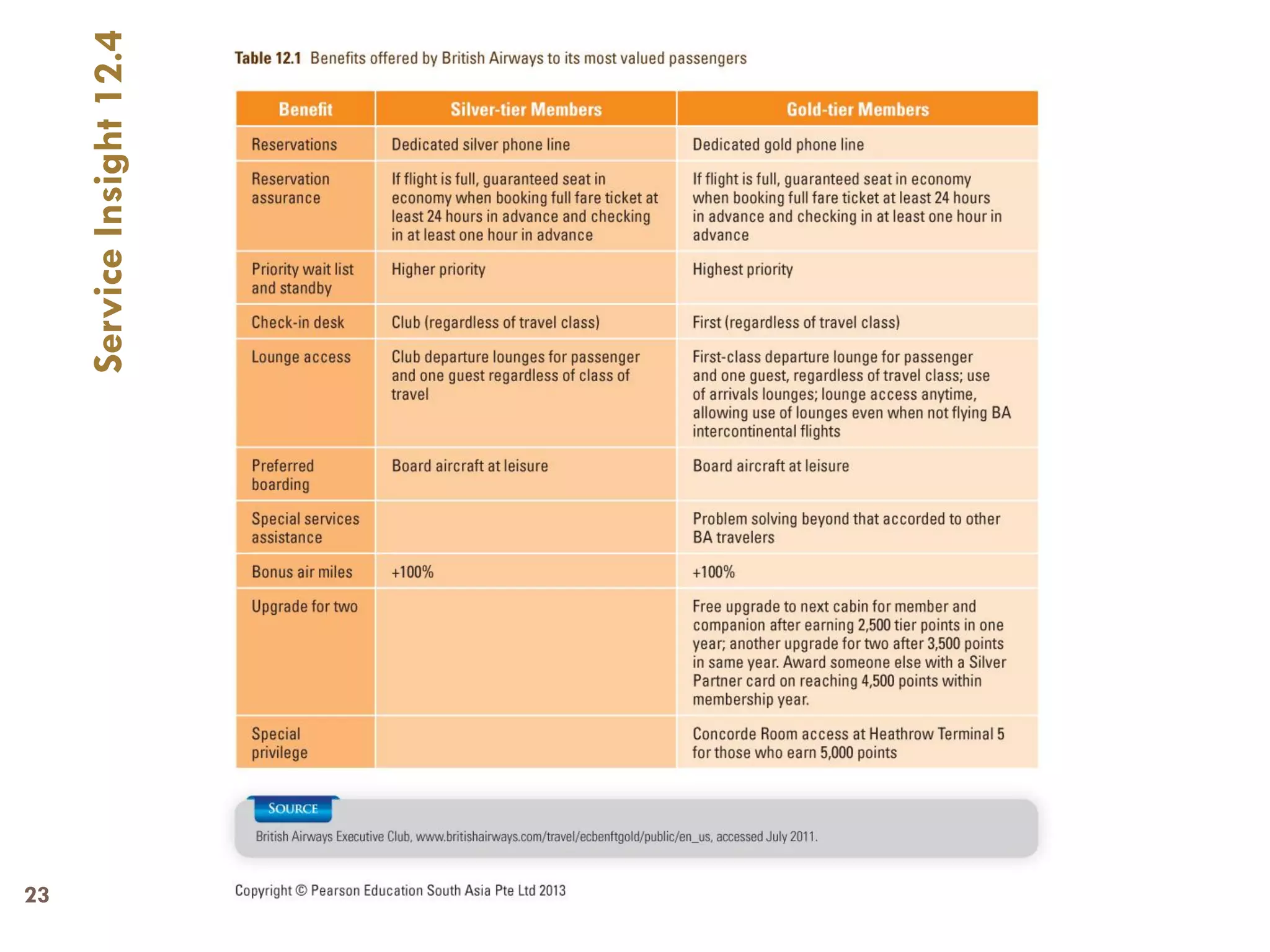

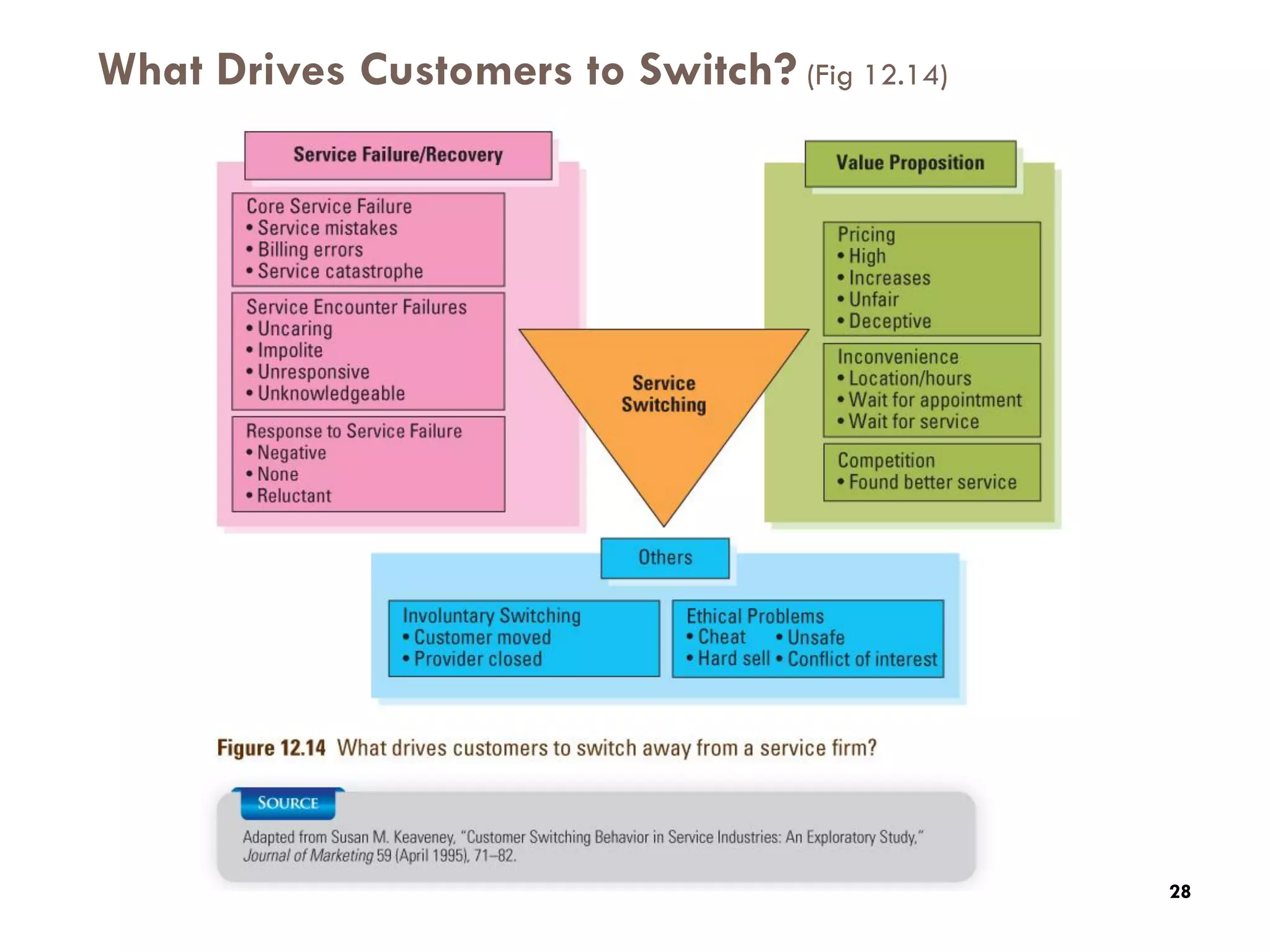

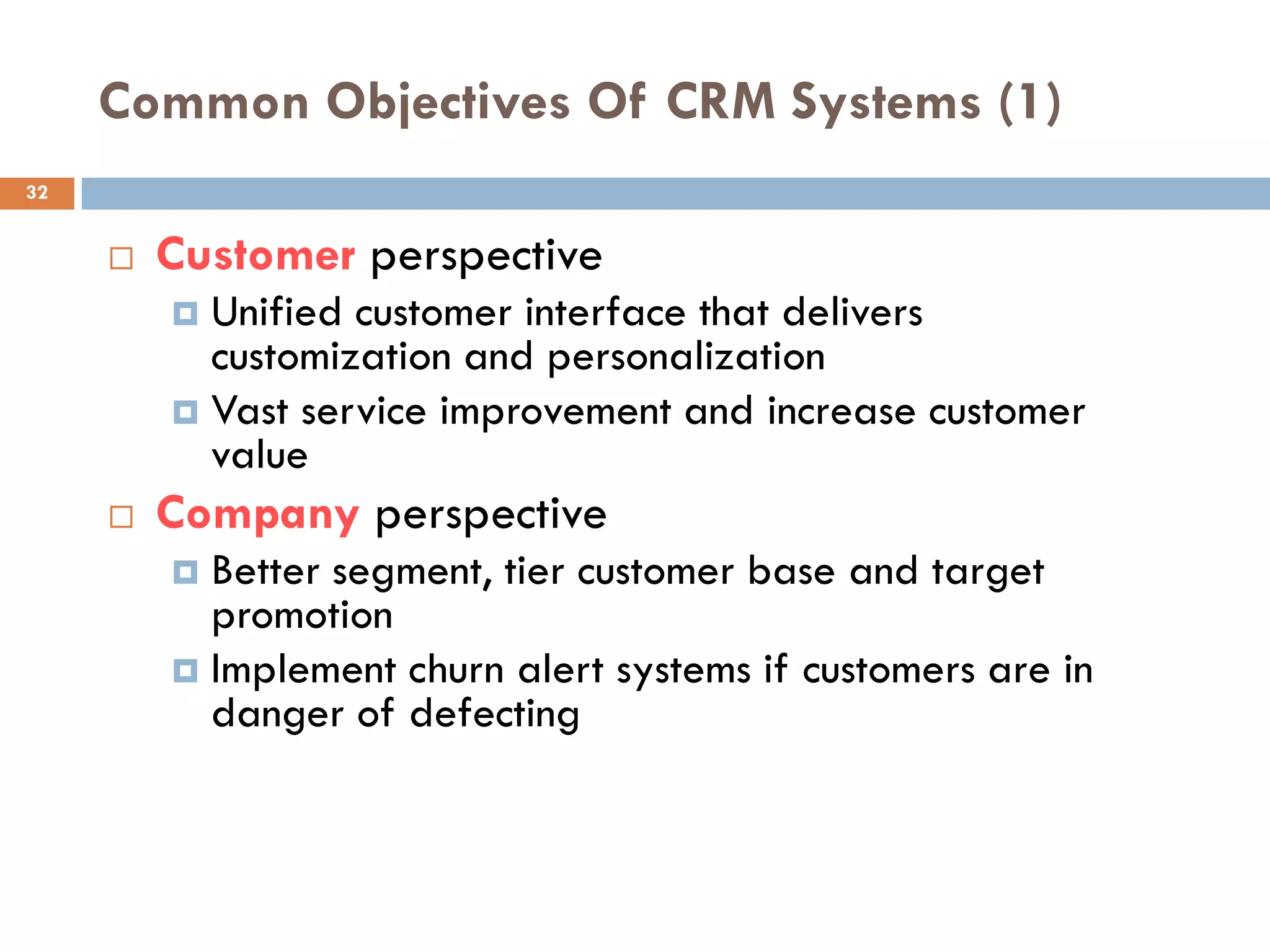

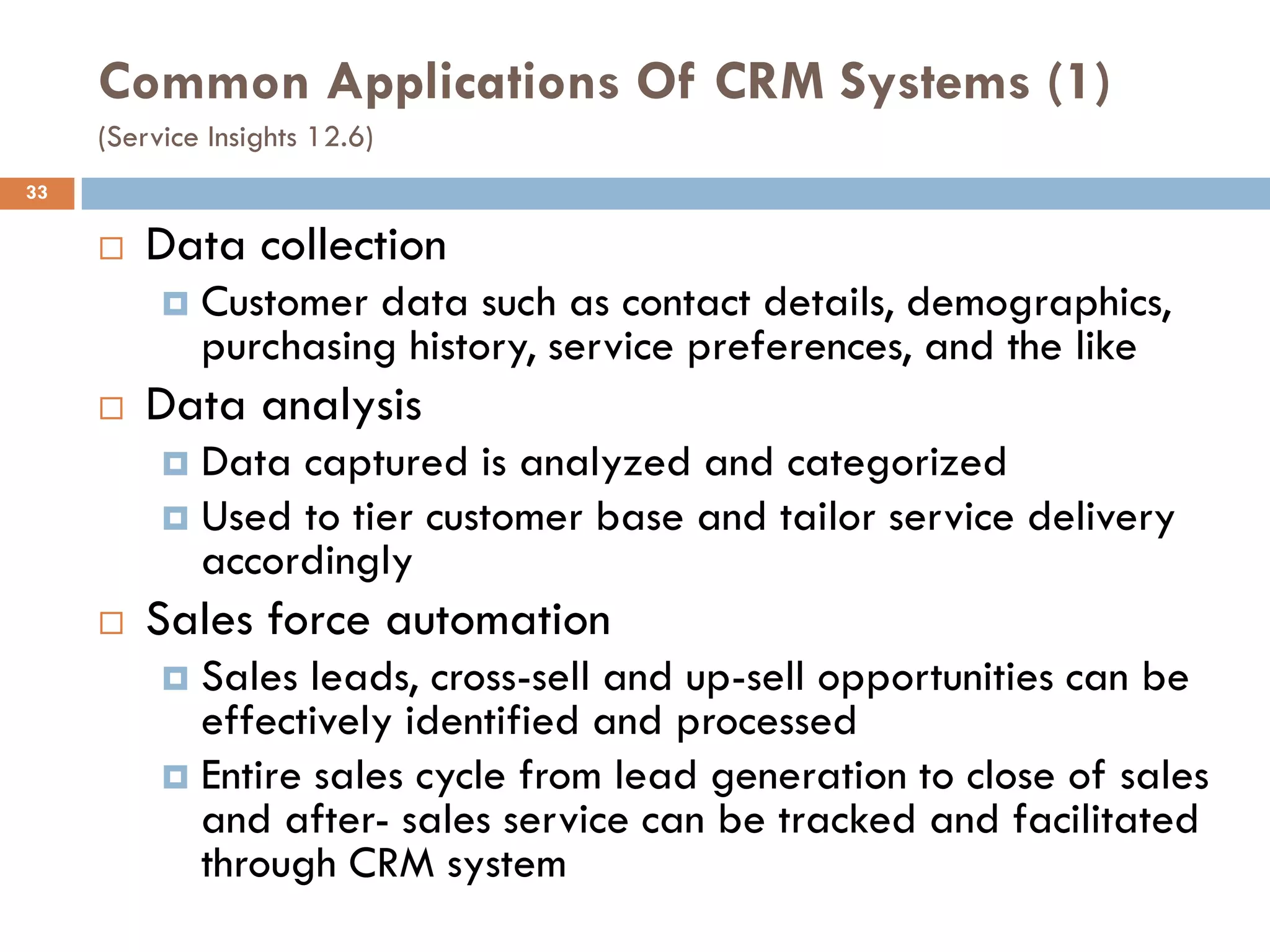

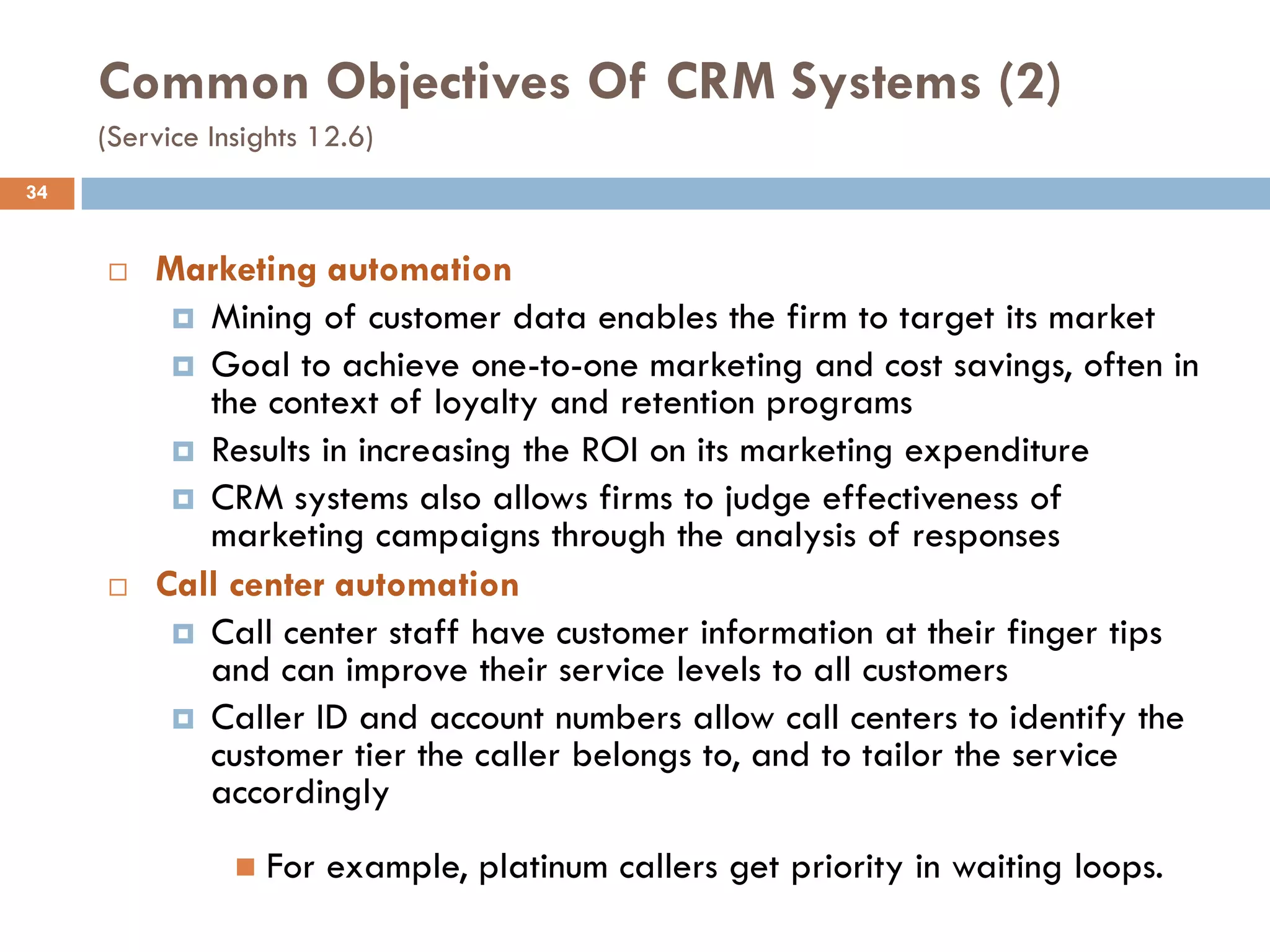

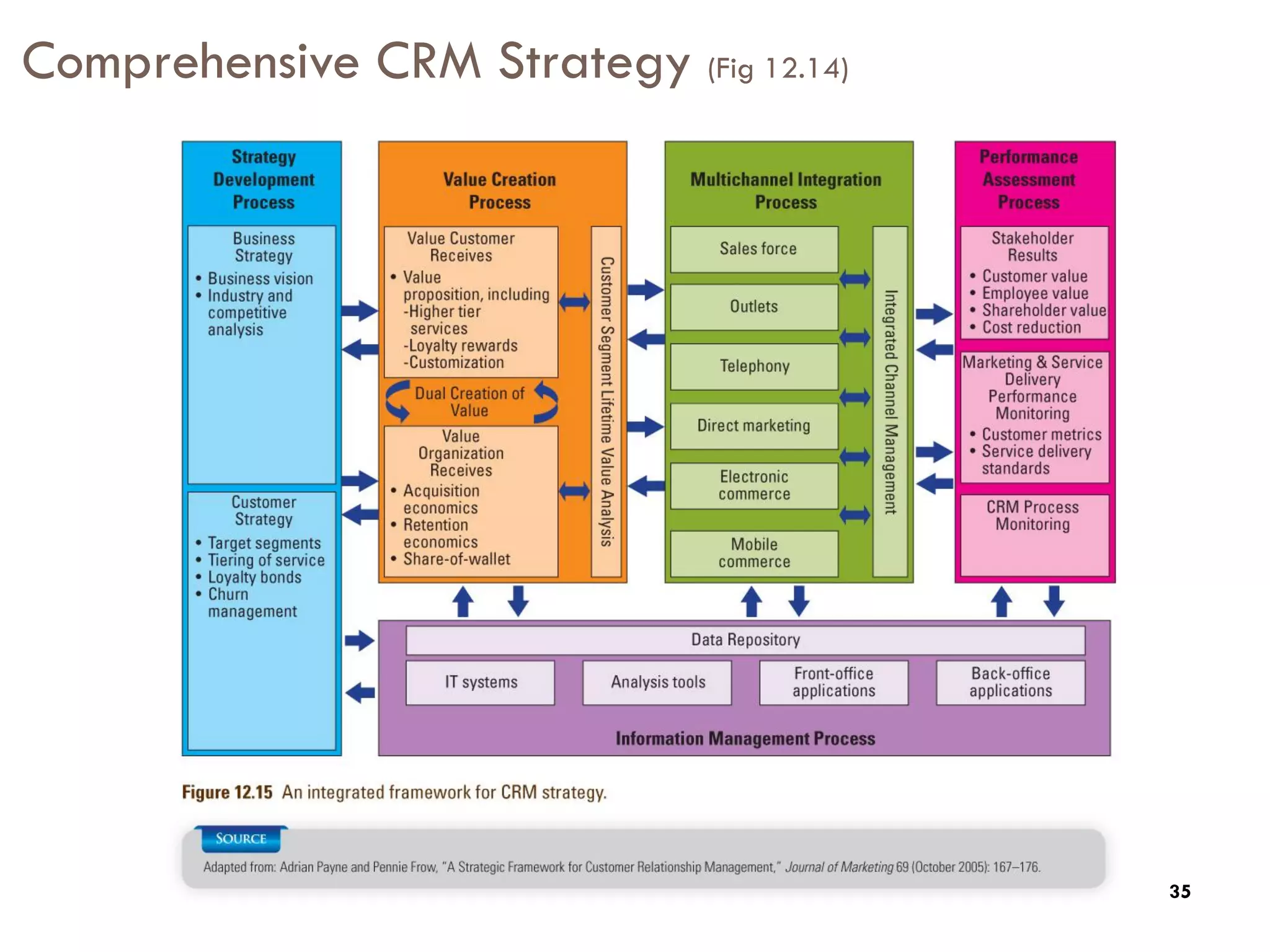

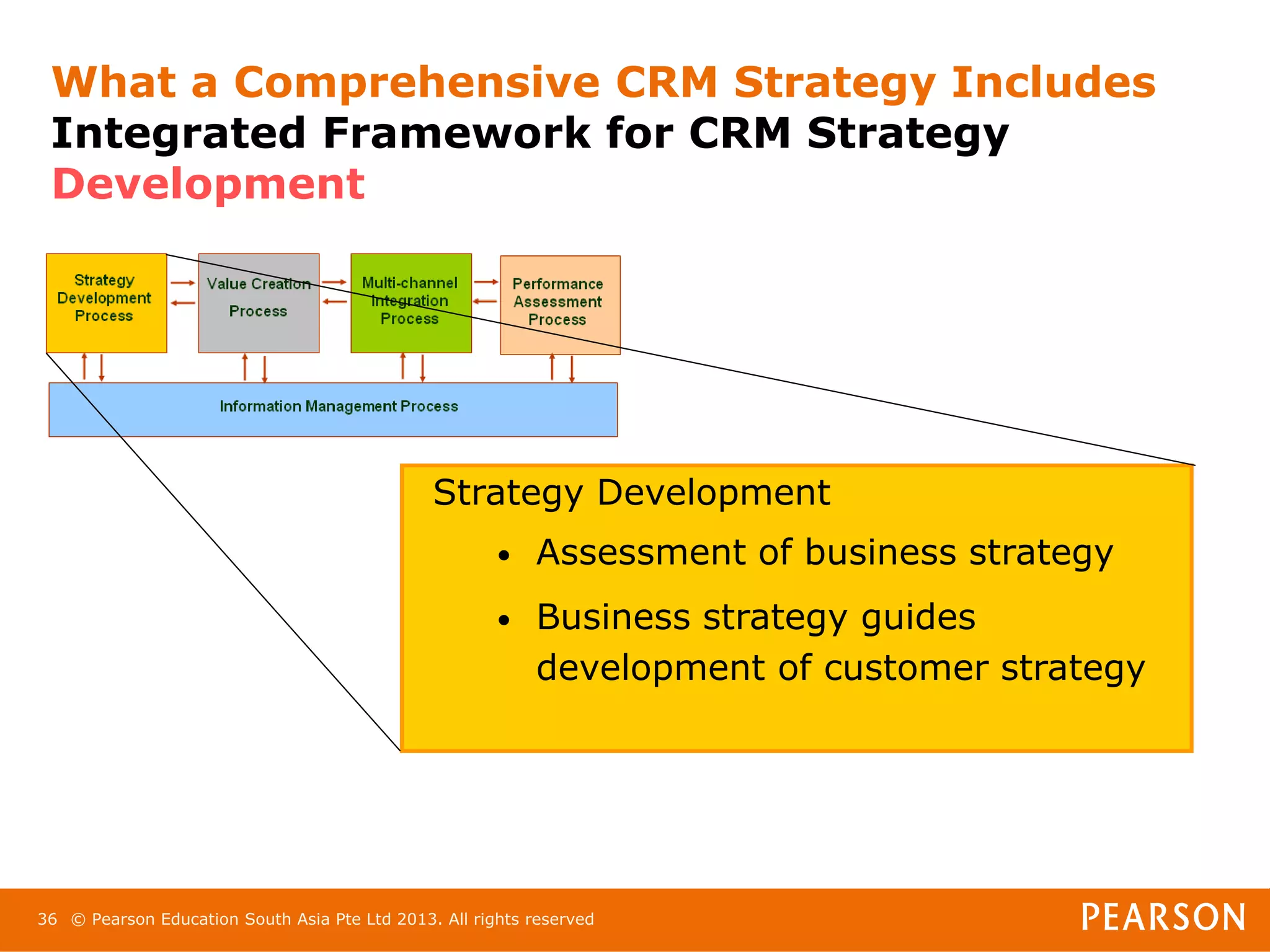

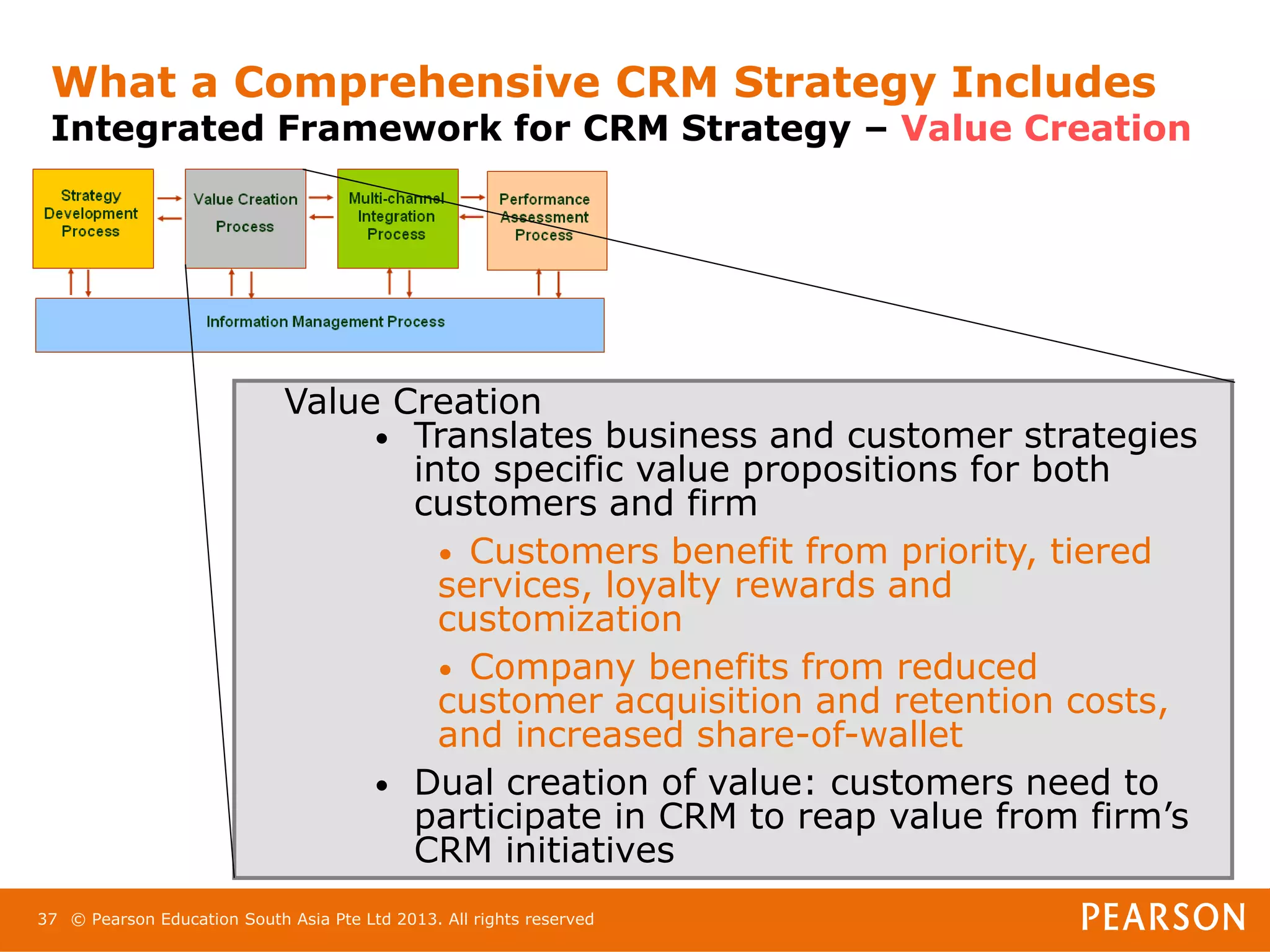

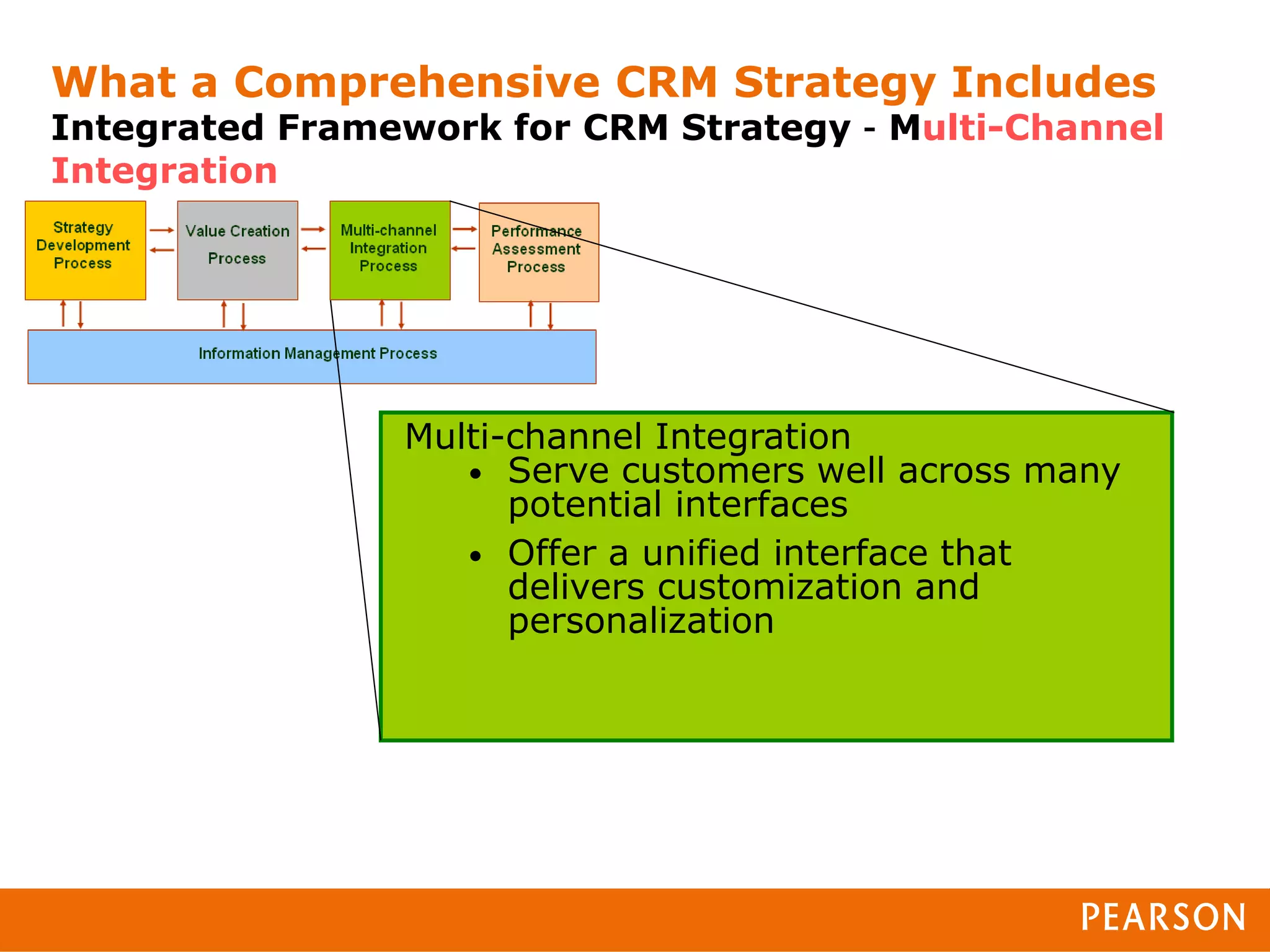

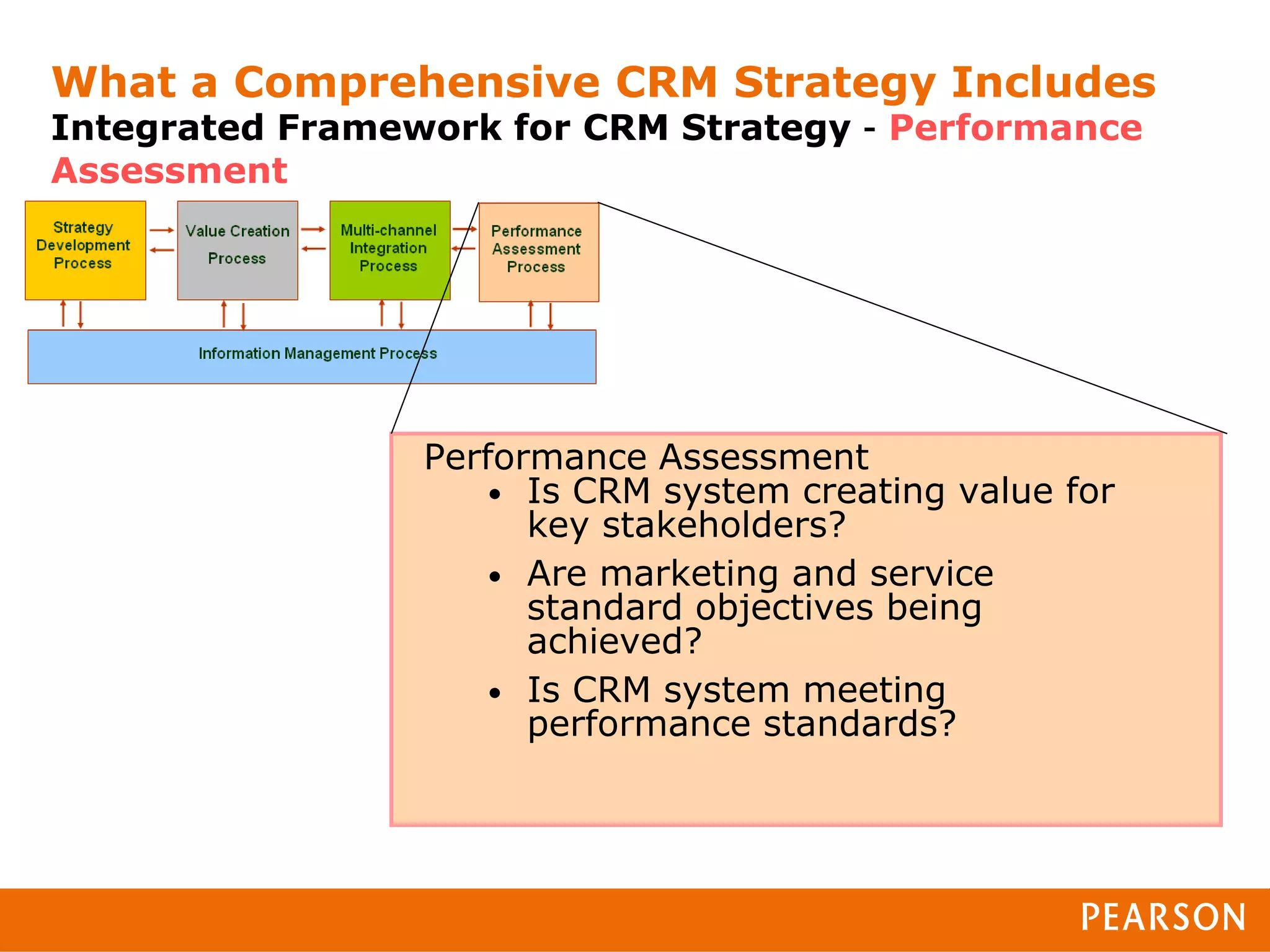

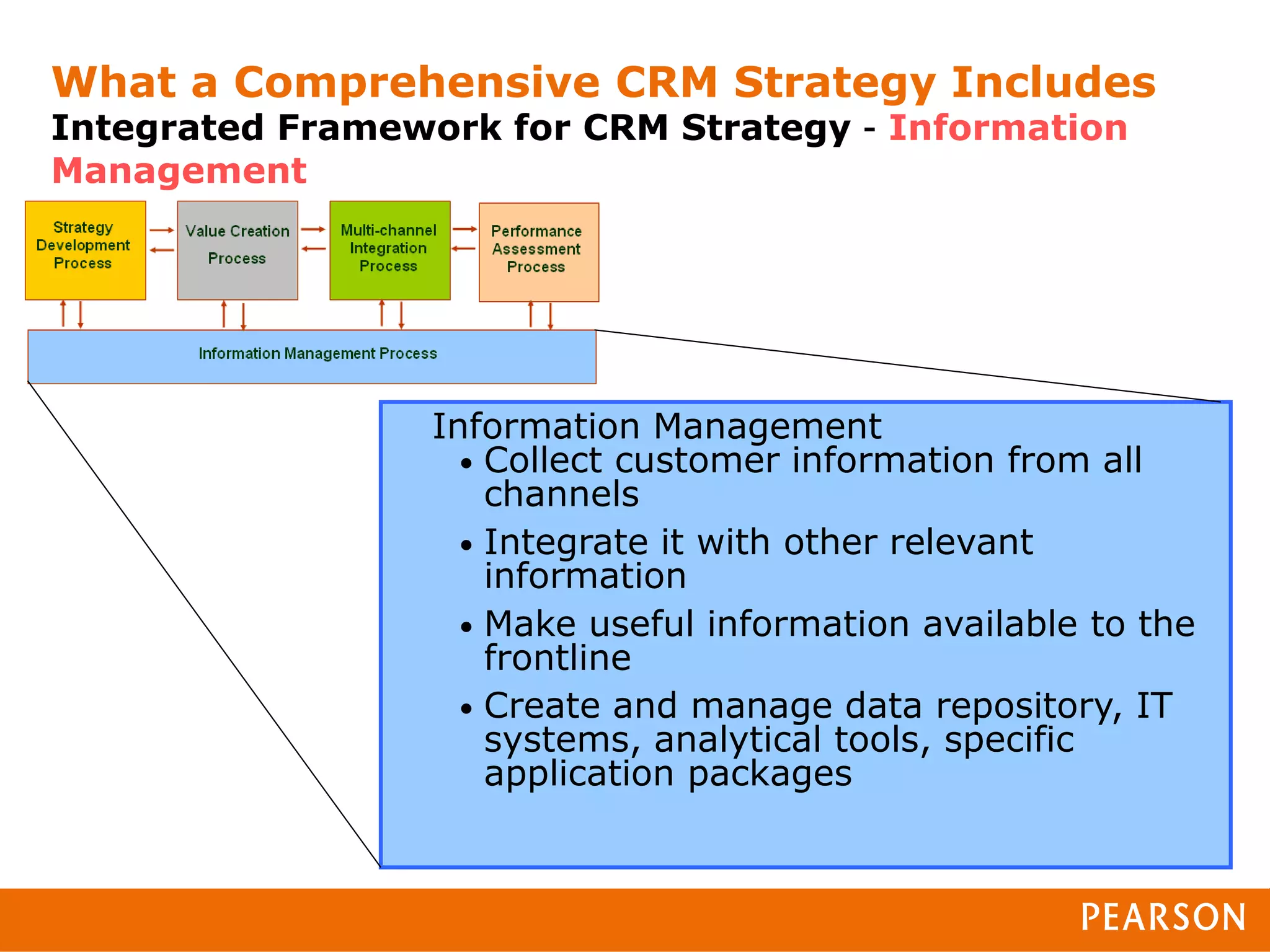

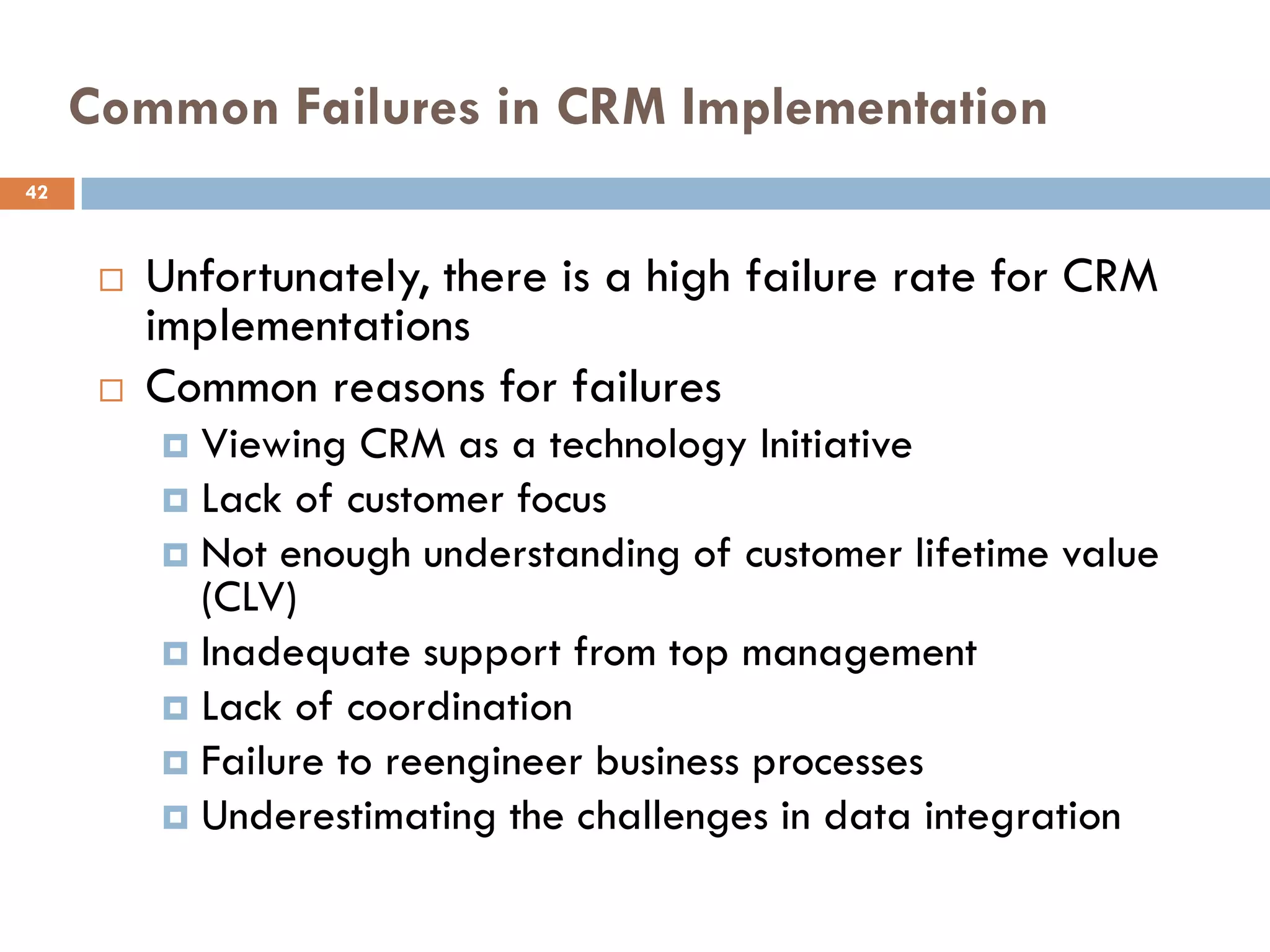

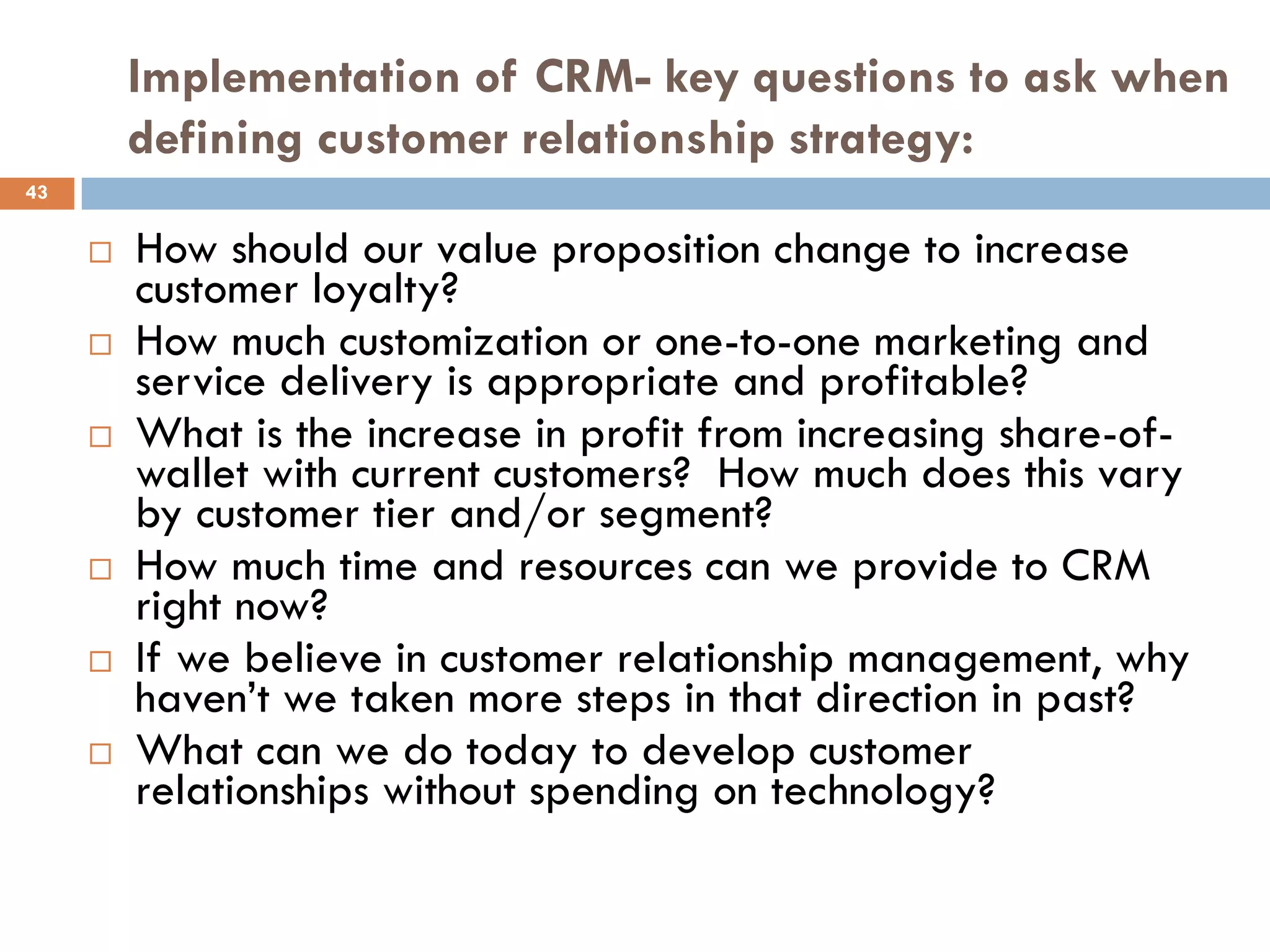

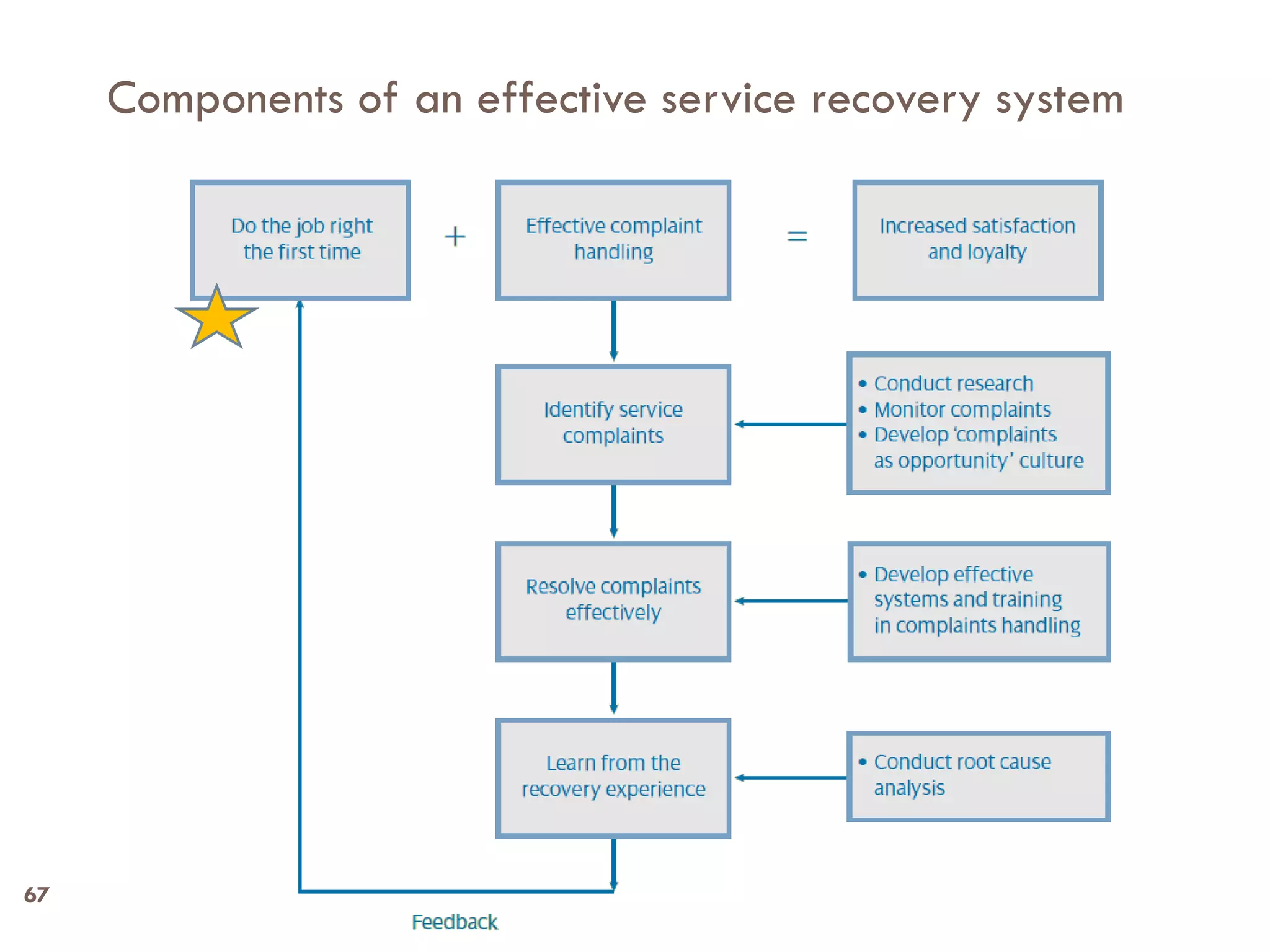

This document provides an overview and summary of key topics from Chapter 12 of the marketing textbook, including managing customer relationships and building loyalty. It discusses the importance of customer loyalty for a firm's profitability, strategies for developing loyalty bonds like deepening relationships, implementing reward programs, fostering social bonds, and offering customization. Graphs and figures are referenced to explain concepts such as the customer satisfaction-loyalty relationship, measuring customer lifetime value, and effective customer tiering. Case studies from companies like Harrah's and British Airways are also mentioned.