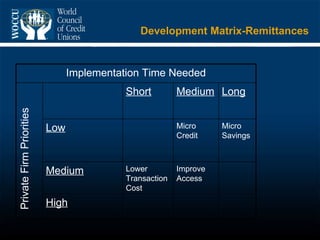

The World Council of Credit Unions (WOCCU) is a global trade association and development agency for credit unions worldwide. WOCCU's development priorities include remittances, microsavings, improving access and reducing costs. While private firms can lower remittance costs, they may not prioritize development goals like microsavings and microcredit. WOCCU advocates incentivizing development organizations to tackle consumption-related goals, and allowing private firms to reduce costs and improve access. WOCCU also operates financial services groups to offer remittances and diversify revenue streams.

![Saul Wolf Remittances Manager Madison, WI, USA [email_address] www.woccu.org Development opportunities and private sector lessons for Africa 10/23/2009](https://image.slidesharecdn.com/4asoulwolf-091023082113-phpapp01/75/Development-opportunities-and-private-sector-lessons-for-Africa-1-2048.jpg)

![Saul Wolf Remittances Manager Madison, WI, USA [email_address] www.woccu.org Development opportunities and private sector lessons for Africa 10/23/09](https://image.slidesharecdn.com/4asoulwolf-091023082113-phpapp01/85/Development-opportunities-and-private-sector-lessons-for-Africa-18-320.jpg)