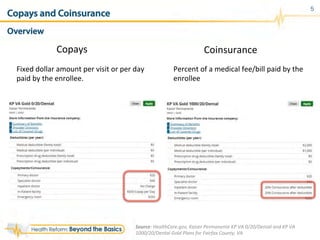

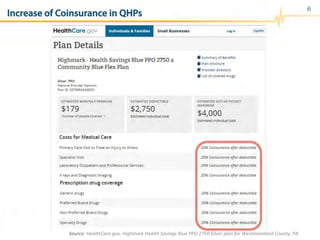

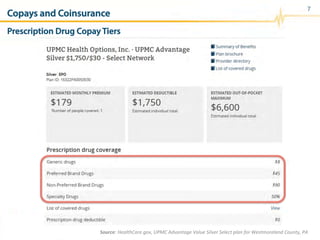

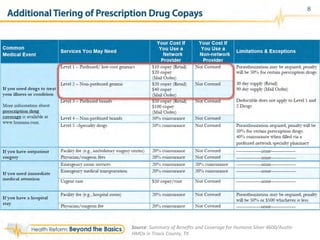

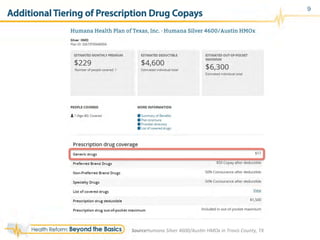

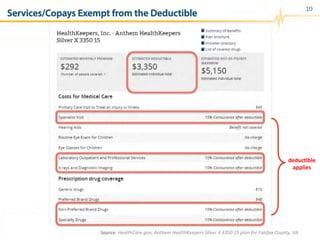

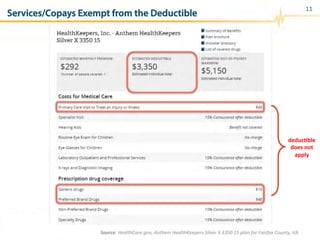

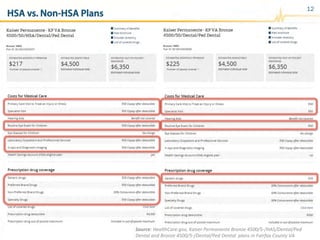

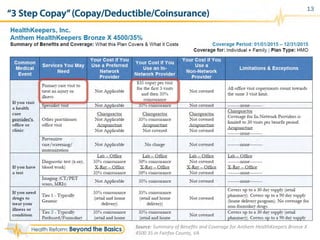

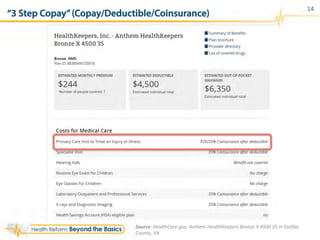

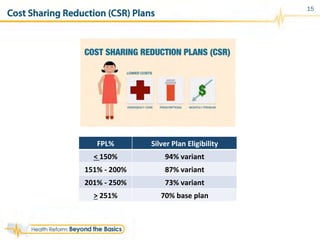

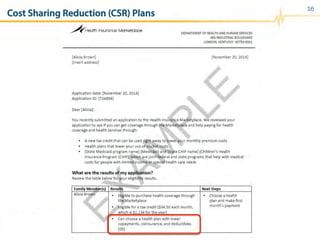

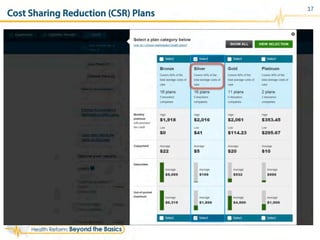

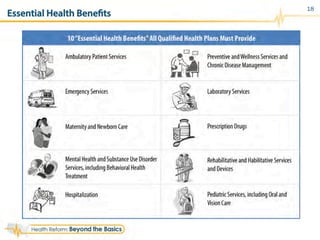

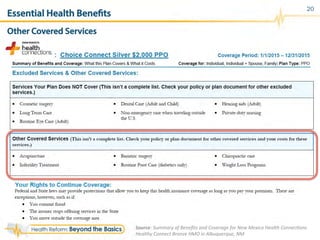

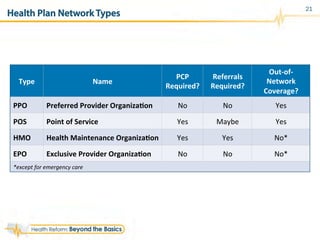

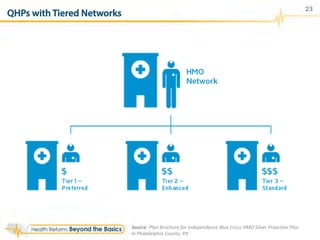

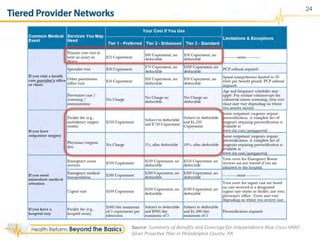

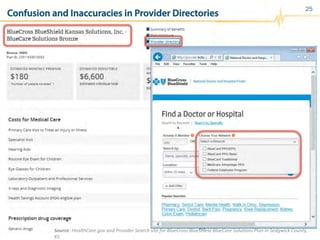

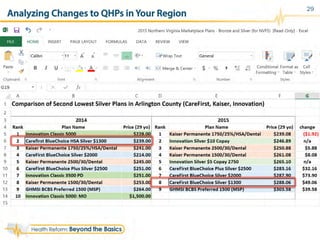

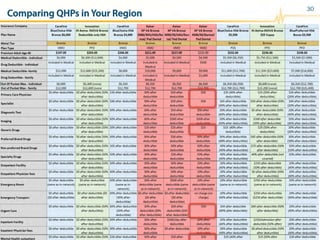

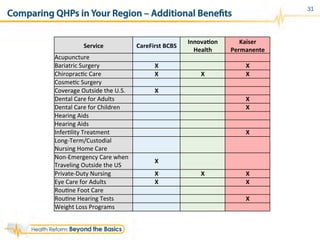

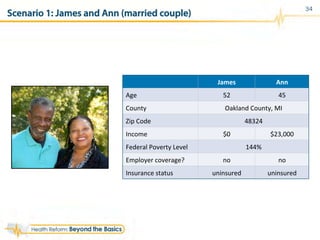

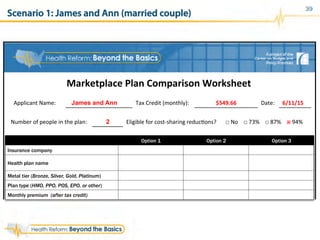

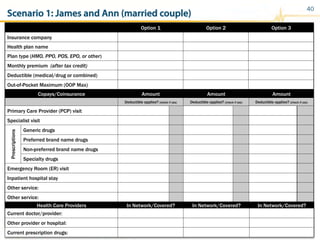

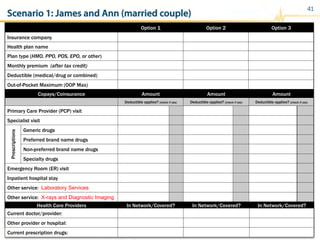

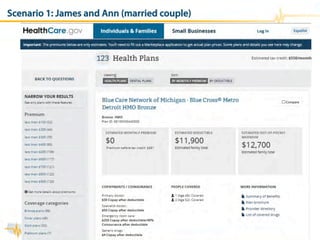

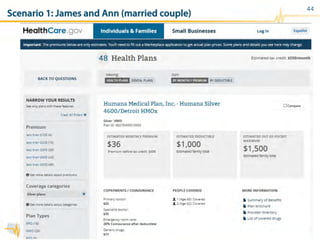

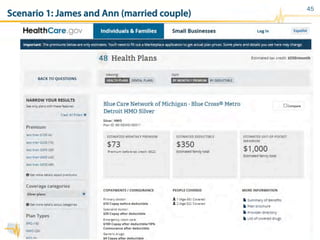

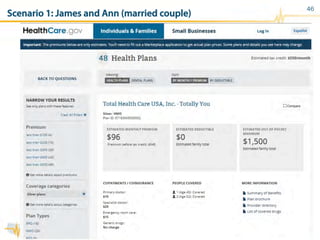

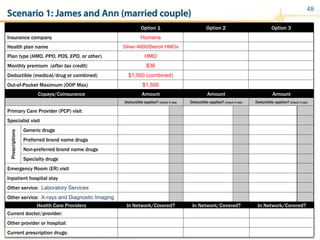

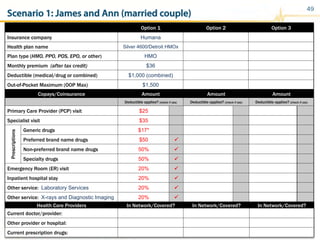

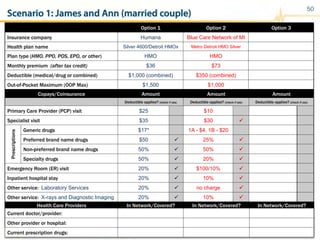

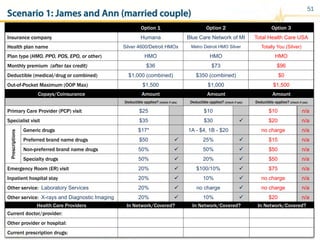

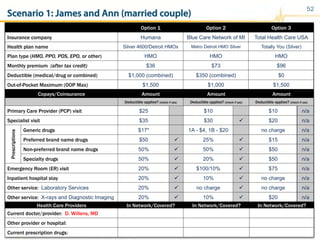

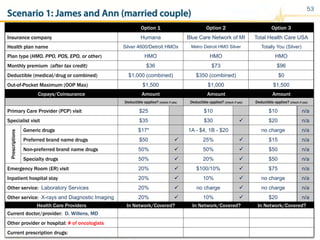

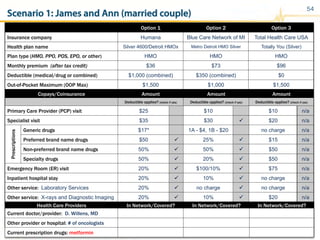

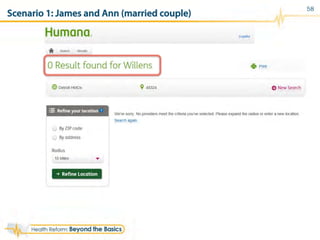

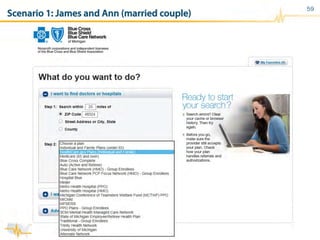

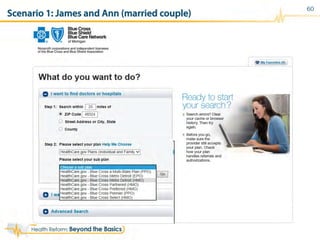

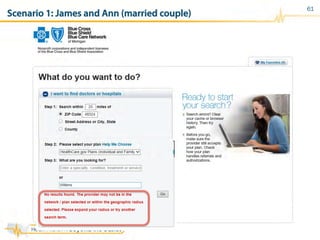

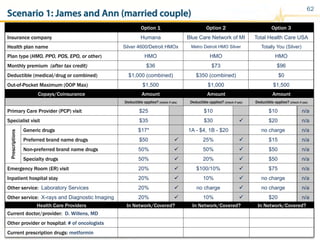

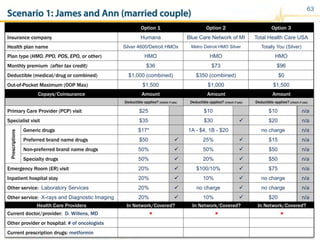

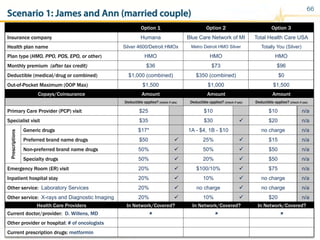

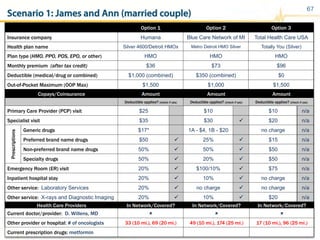

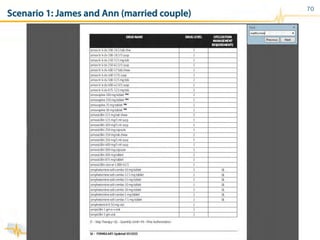

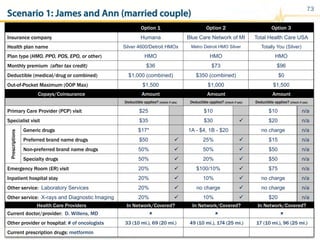

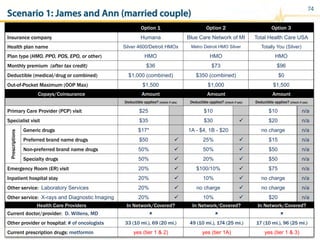

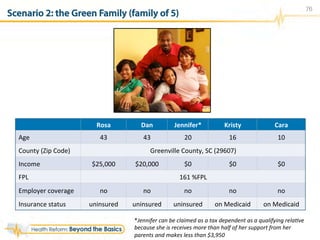

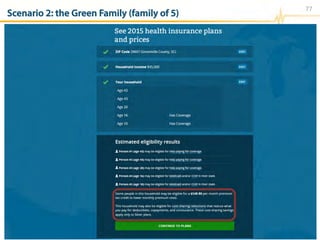

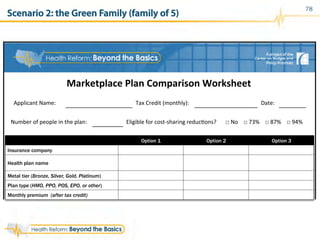

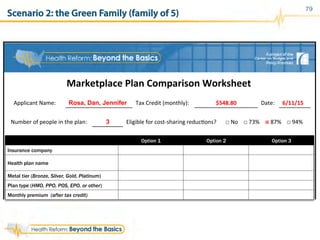

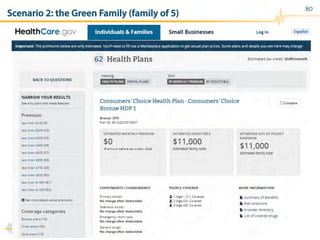

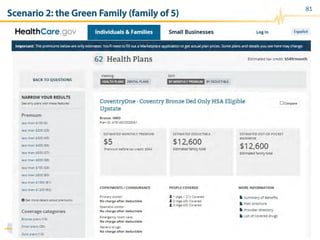

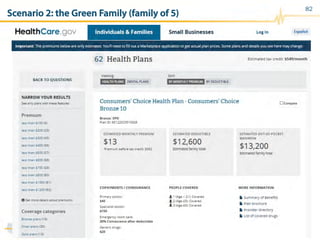

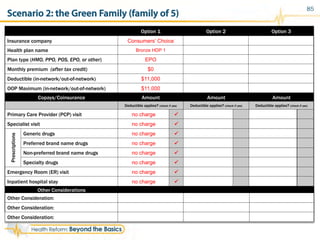

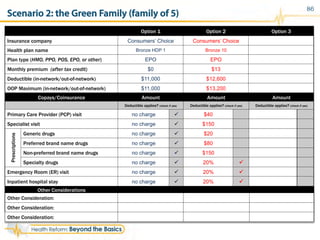

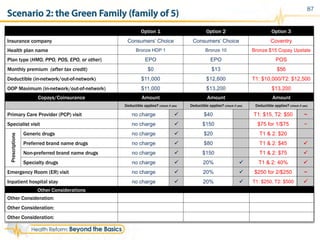

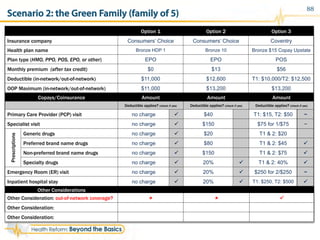

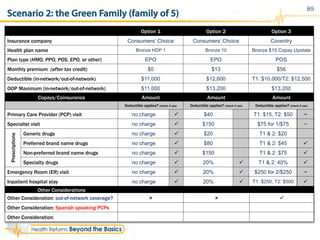

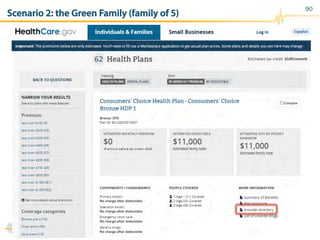

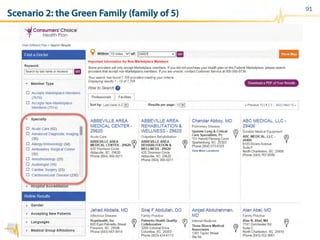

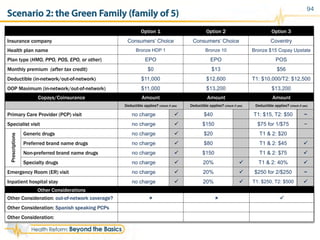

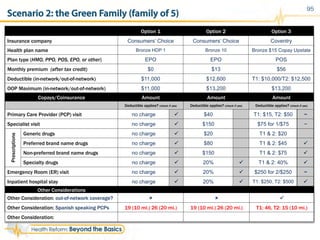

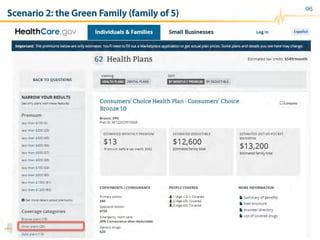

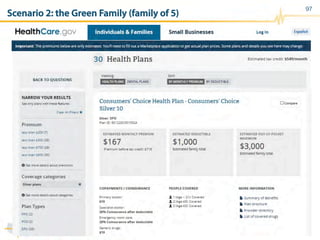

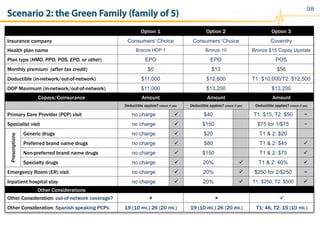

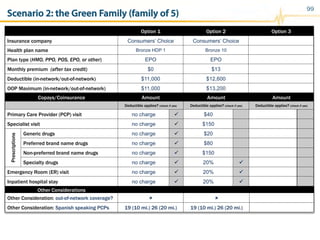

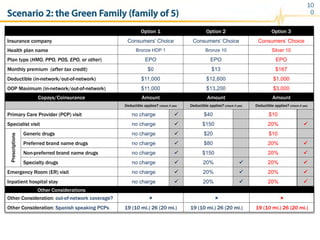

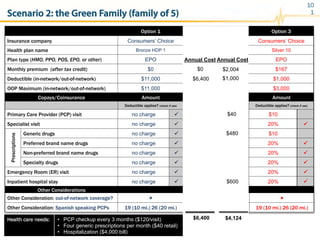

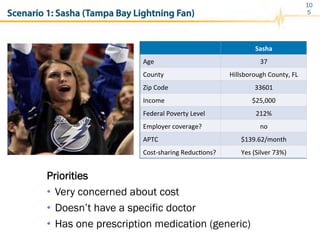

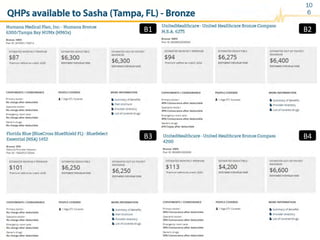

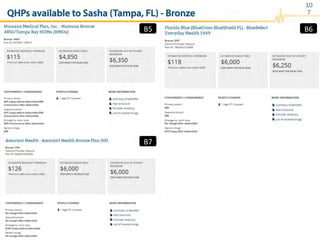

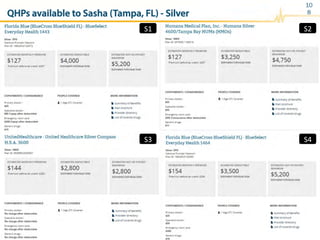

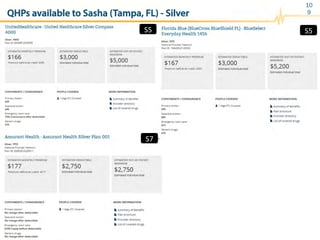

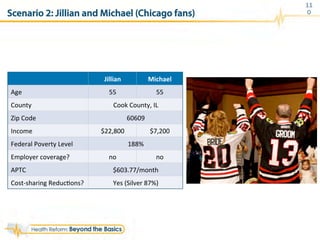

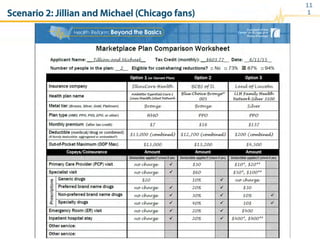

The document provides guidelines on assisting consumers in selecting health plans from the marketplace, detailing trends, plan elements, and comparisons of Qualified Health Plans (QHPs). It includes information on premiums, cost-sharing, benefits, and an interactive exercise for analyzing specific consumer scenarios. Additionally, it emphasizes the importance of understanding plan networks and the confusion around provider directories.