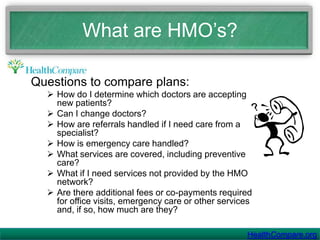

Most Americans receive health insurance through employers or family members, but losing a job may lead to loss of coverage. Managed care plans, such as HMOs and PPOs, offer differing levels of provider flexibility and costs, while short-term major medical insurance provides temporary coverage. Healthcompare is an online platform that facilitates researching and comparing various health insurance options from numerous carriers.