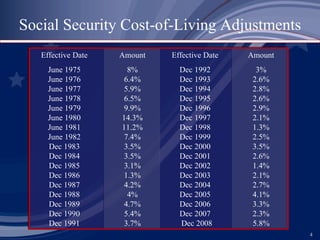

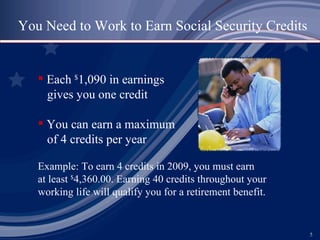

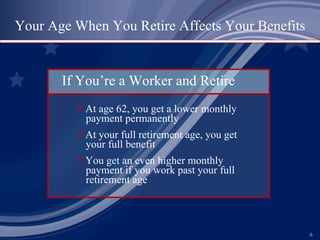

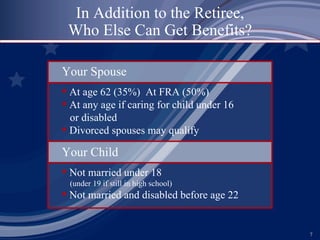

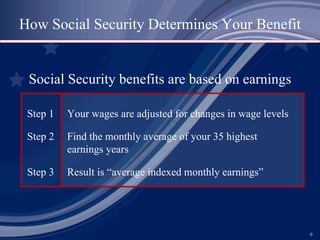

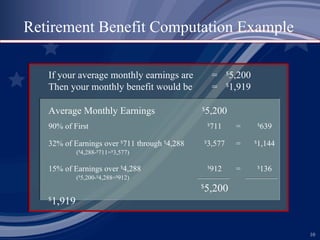

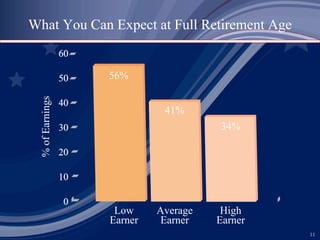

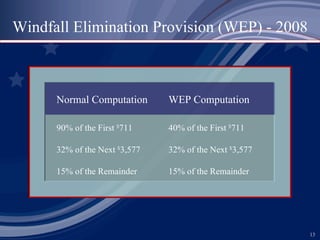

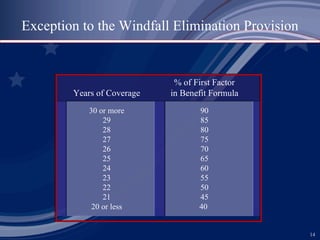

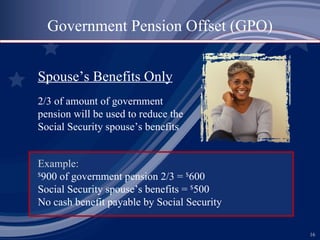

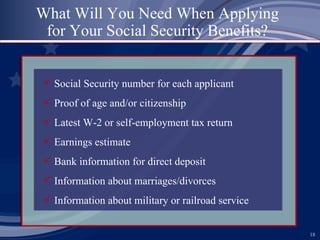

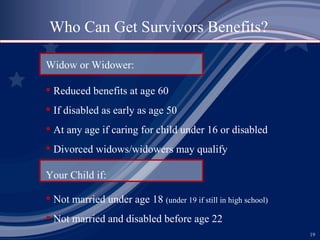

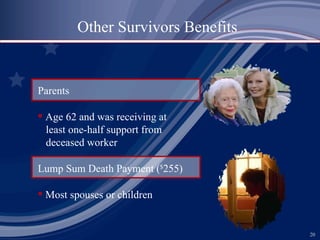

This document provides information about Social Security benefits in the United States, including retirement benefits, cost of living adjustments, eligibility requirements, benefit calculations, Medicare coverage, and planning for retirement. Key details include how Social Security benefits are calculated based on earnings history, the full retirement age increasing to 67, spousal and child benefits, survivors benefits, and Medicare enrollment periods.