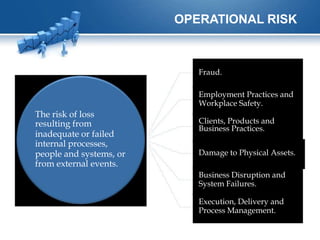

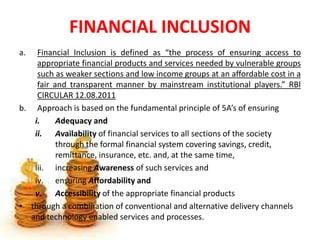

This document discusses risk management for financial inclusion with reference to banks. It covers operational risk, credit risk, and how effective risk management is important for success. Operational risks include fraud, workplace safety issues, and business disruptions. Credit risk relates to uncertainty in a counterparty's ability to meet obligations. Financial inclusion aims to ensure access to appropriate financial products and services for vulnerable groups through the formal financial system, focusing on awareness, affordability, accessibility, and availability. Barriers to past financial inclusion efforts included lack of technology, illiteracy, insufficient reach, and not having a viable business model to serve poorer populations. Effective risk management is key to overcoming these barriers and achieving financial inclusion goals.