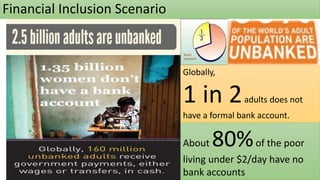

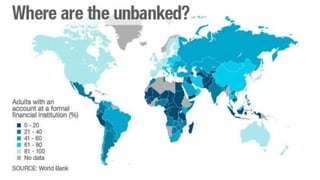

Financial inclusion provides access to formal financial services for disadvantaged groups and small businesses, promoting economic development. Globally, half of all adults lack bank accounts, including 80% of those living on under $2 per day. Without access to financing, small businesses and families must rely on informal mechanisms, hindering investment, employment, and growth. Financial inclusion can be expanded through initiatives like microfinance, mobile banking, and financial education, enabling people to invest, manage cash flow, and build resilience, lifting incomes and reducing poverty. Governments and organizations should promote financial inclusion programs that can generate employment and entrepreneurship.