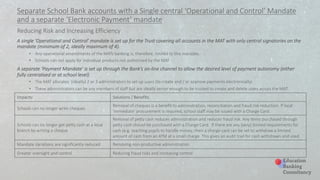

The document discusses different banking models for multi-academy trusts (MATs), including having individual bank accounts for each school with their own signatories, having a single bank account for the trust, and having separate school bank accounts with a centralized operational mandate and separate payment mandate in order to reduce risks like fraud while increasing efficiency. It analyzes the risks and inefficiencies of different structures and provides solutions and benefits of models with more centralized control over banking.