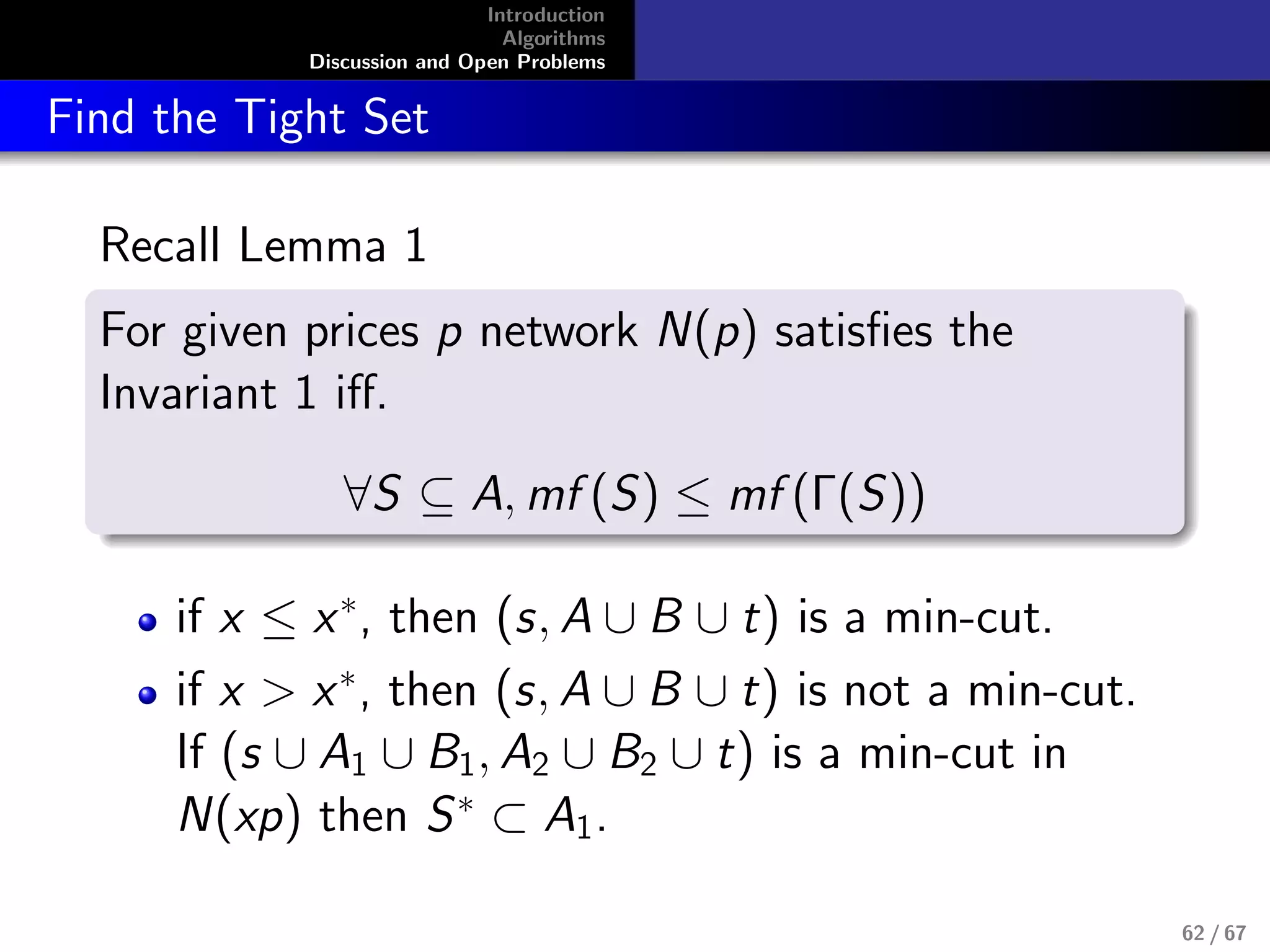

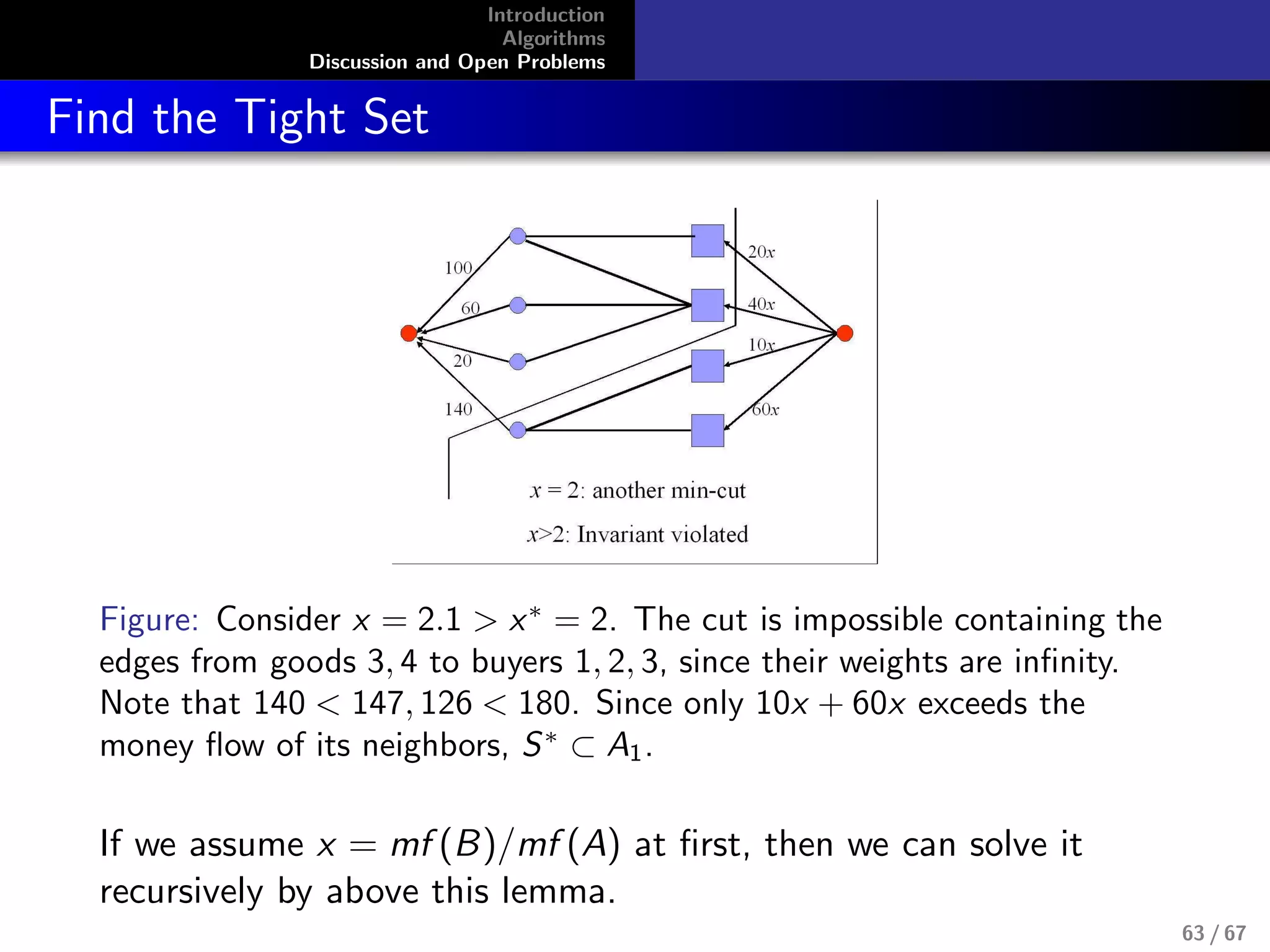

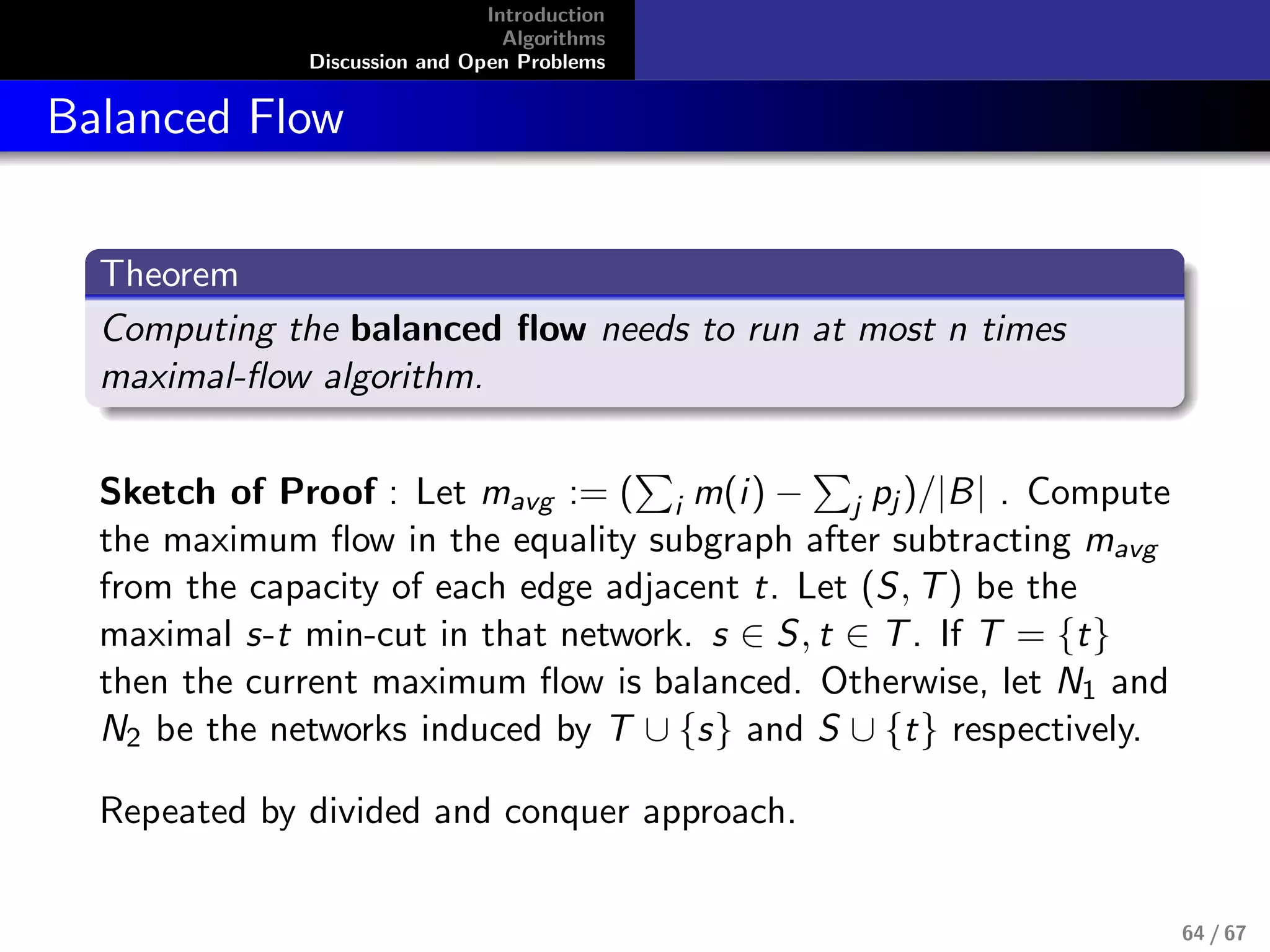

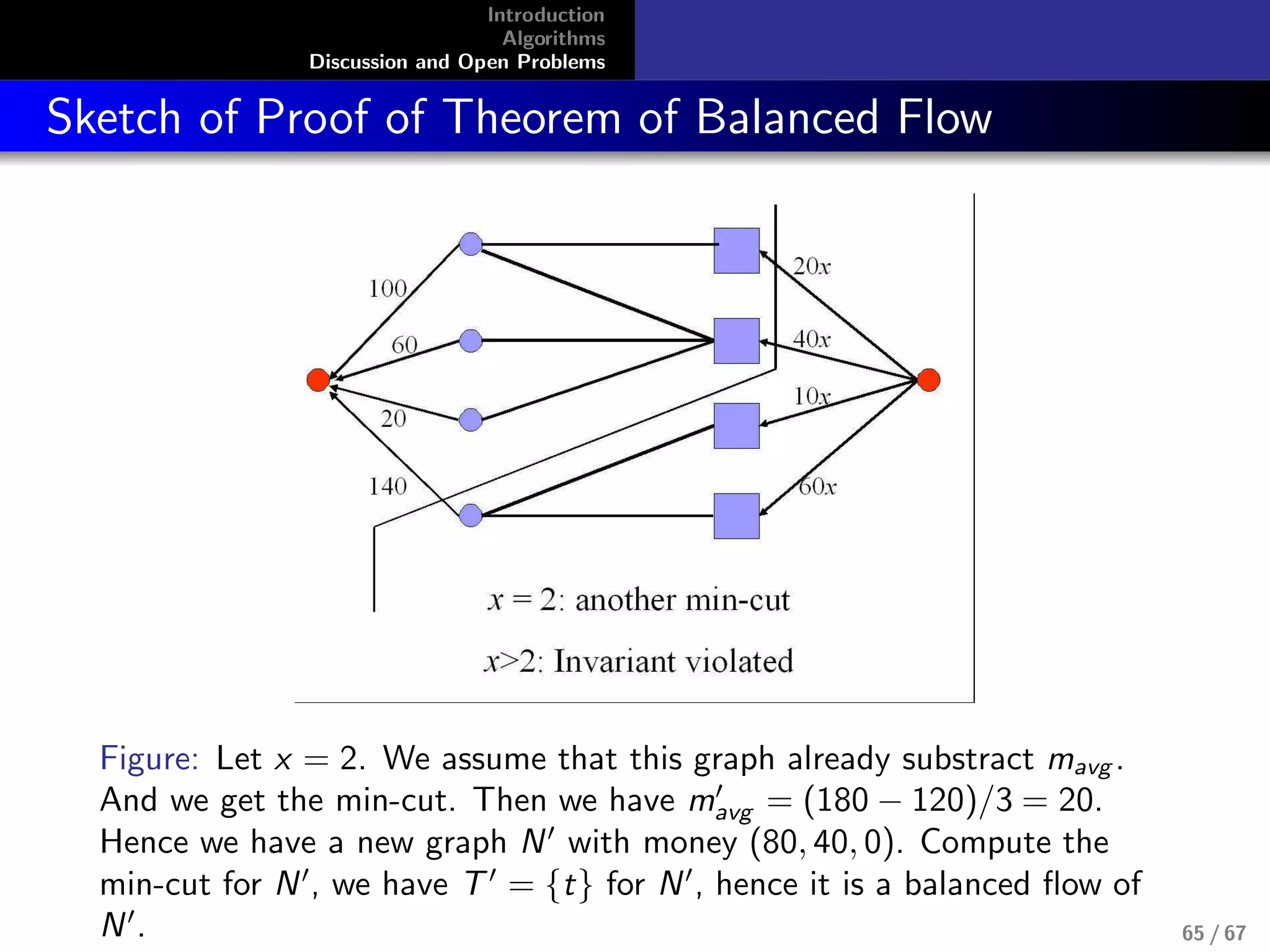

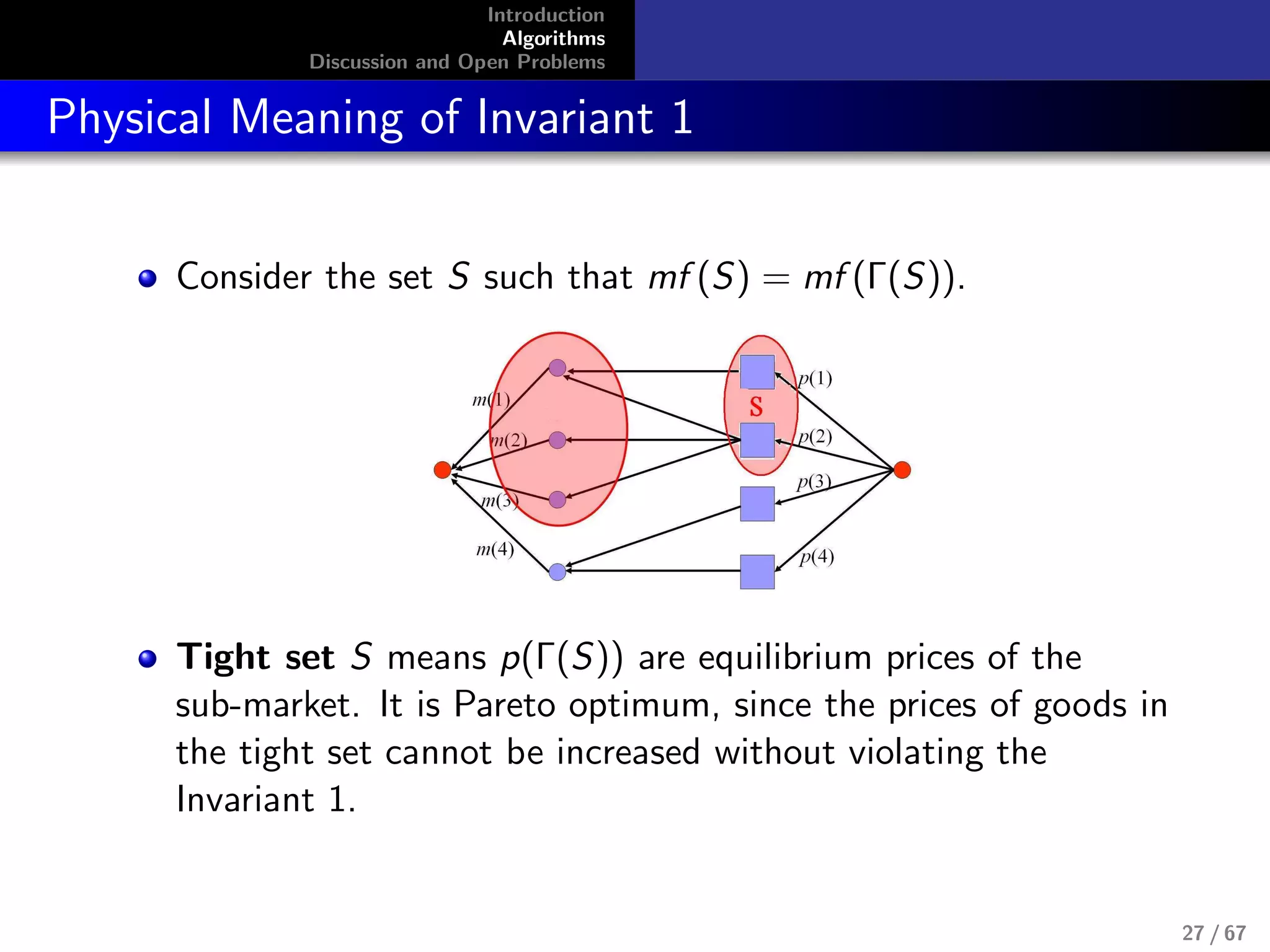

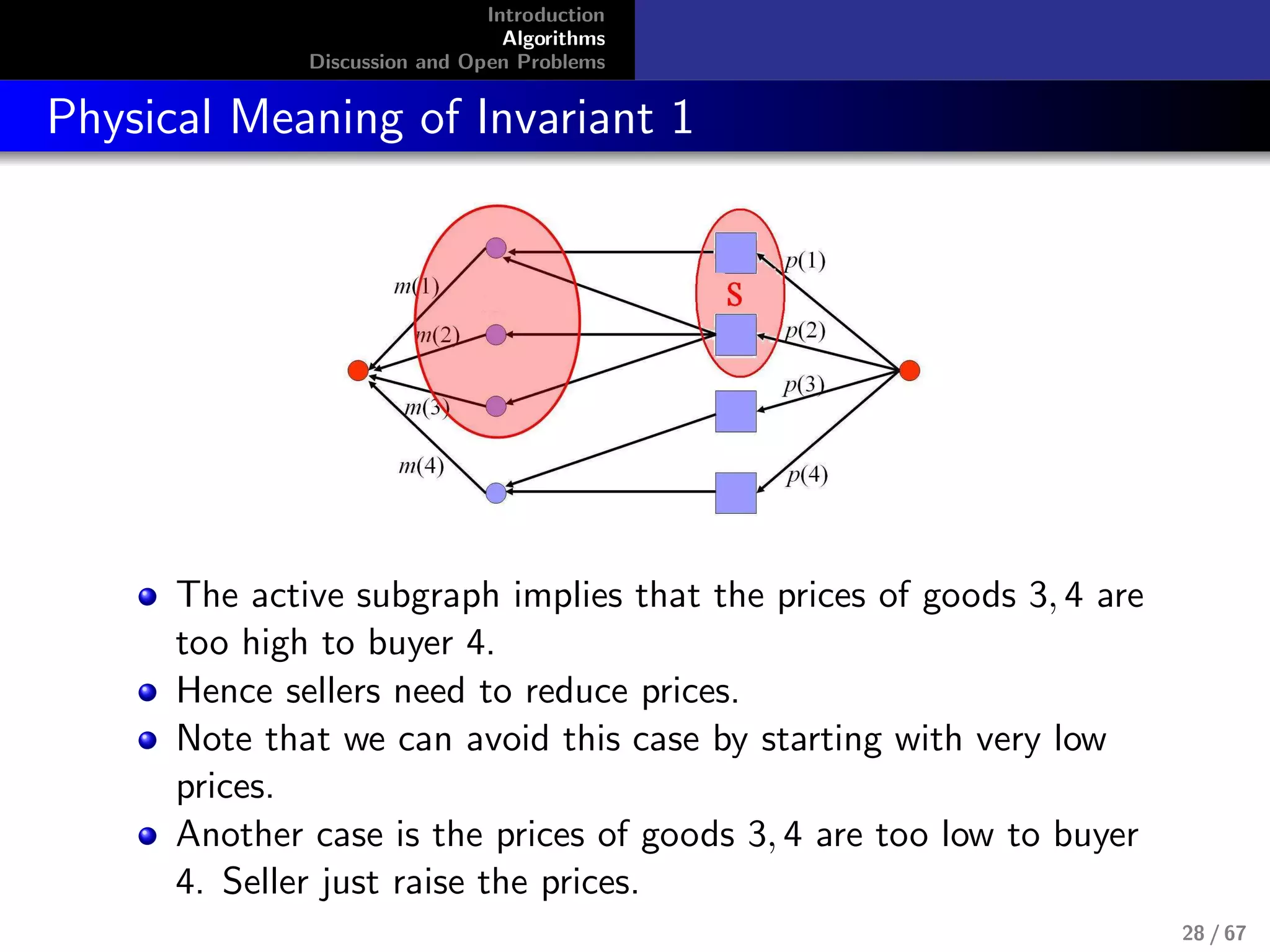

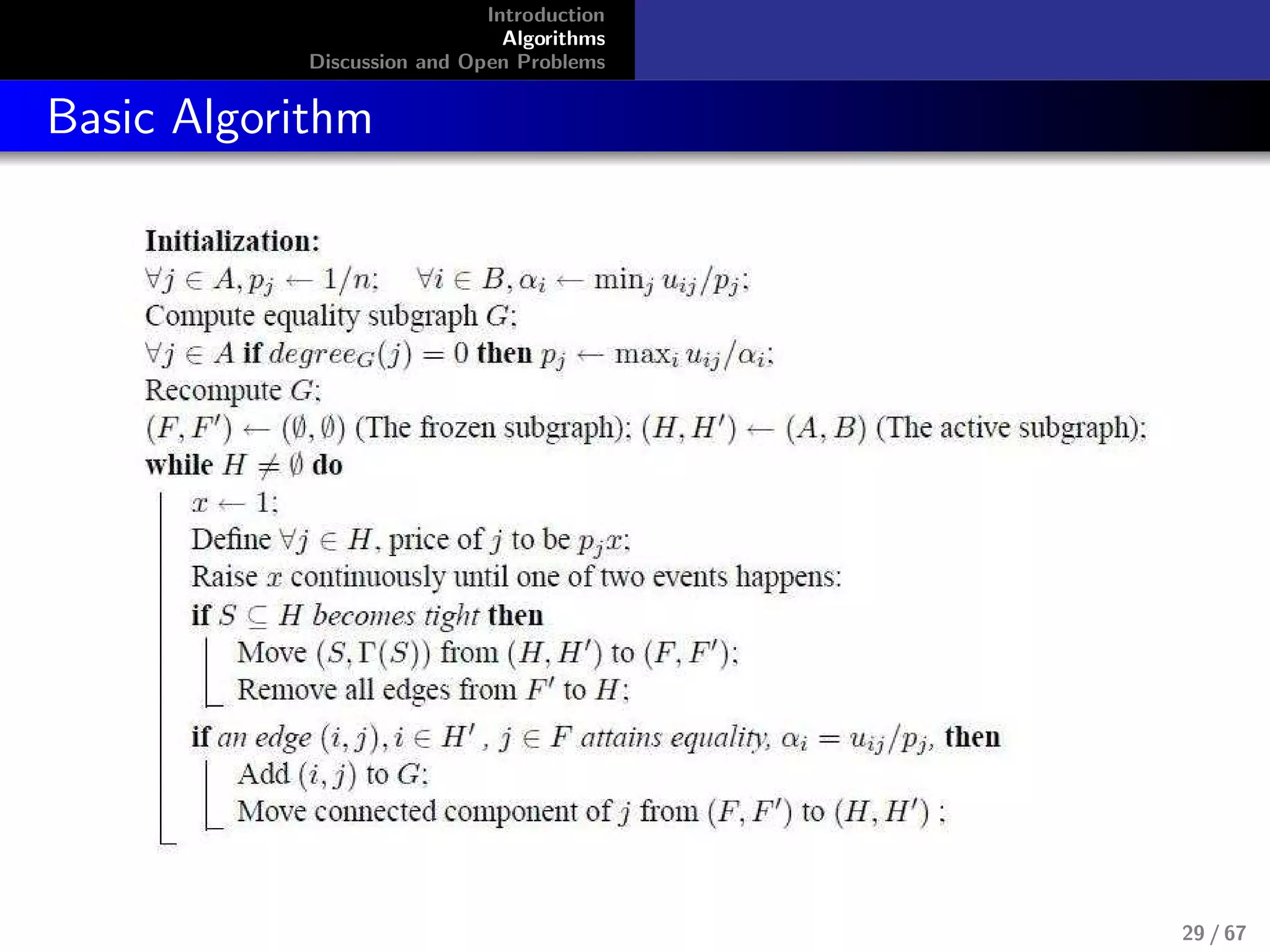

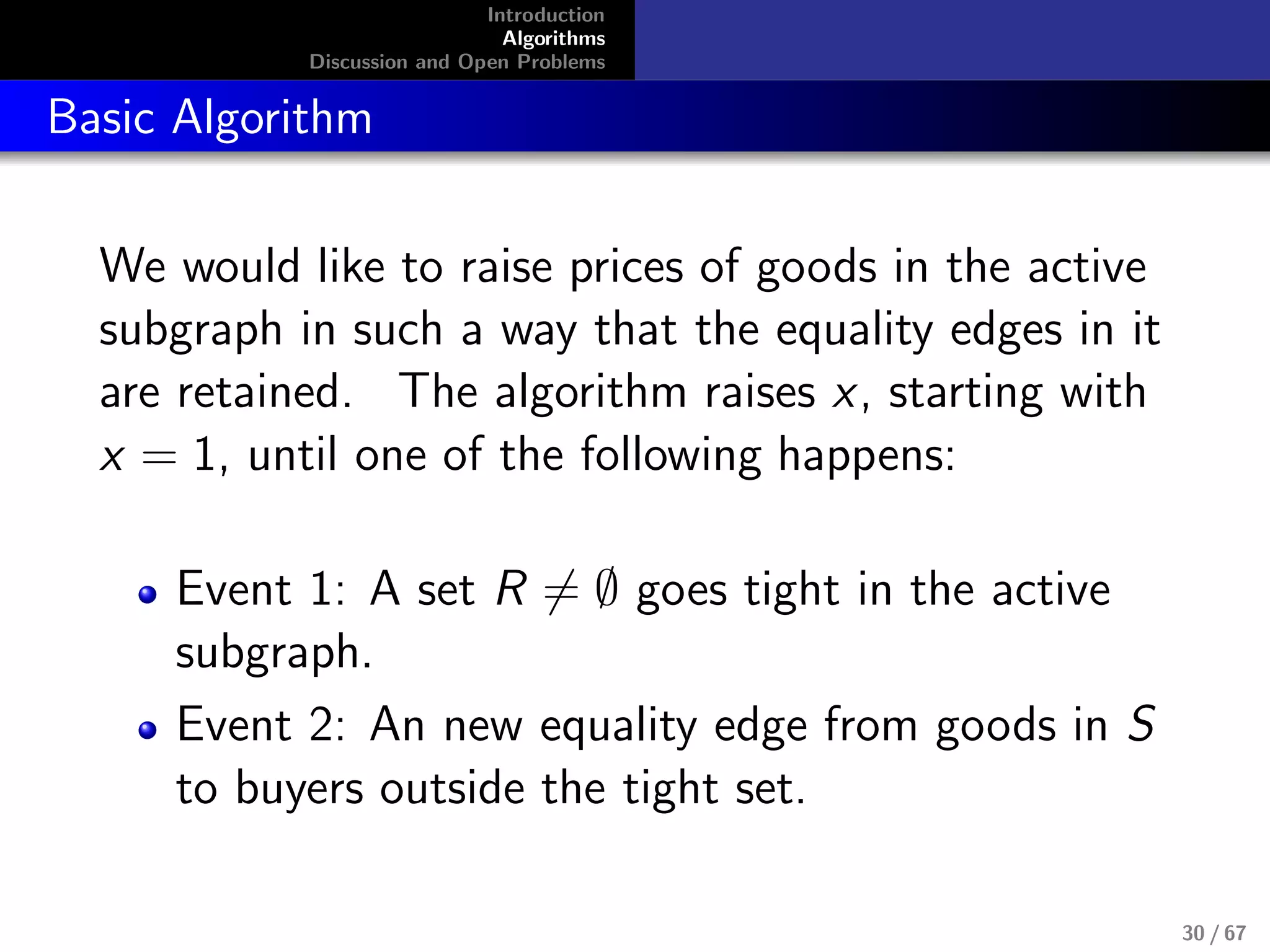

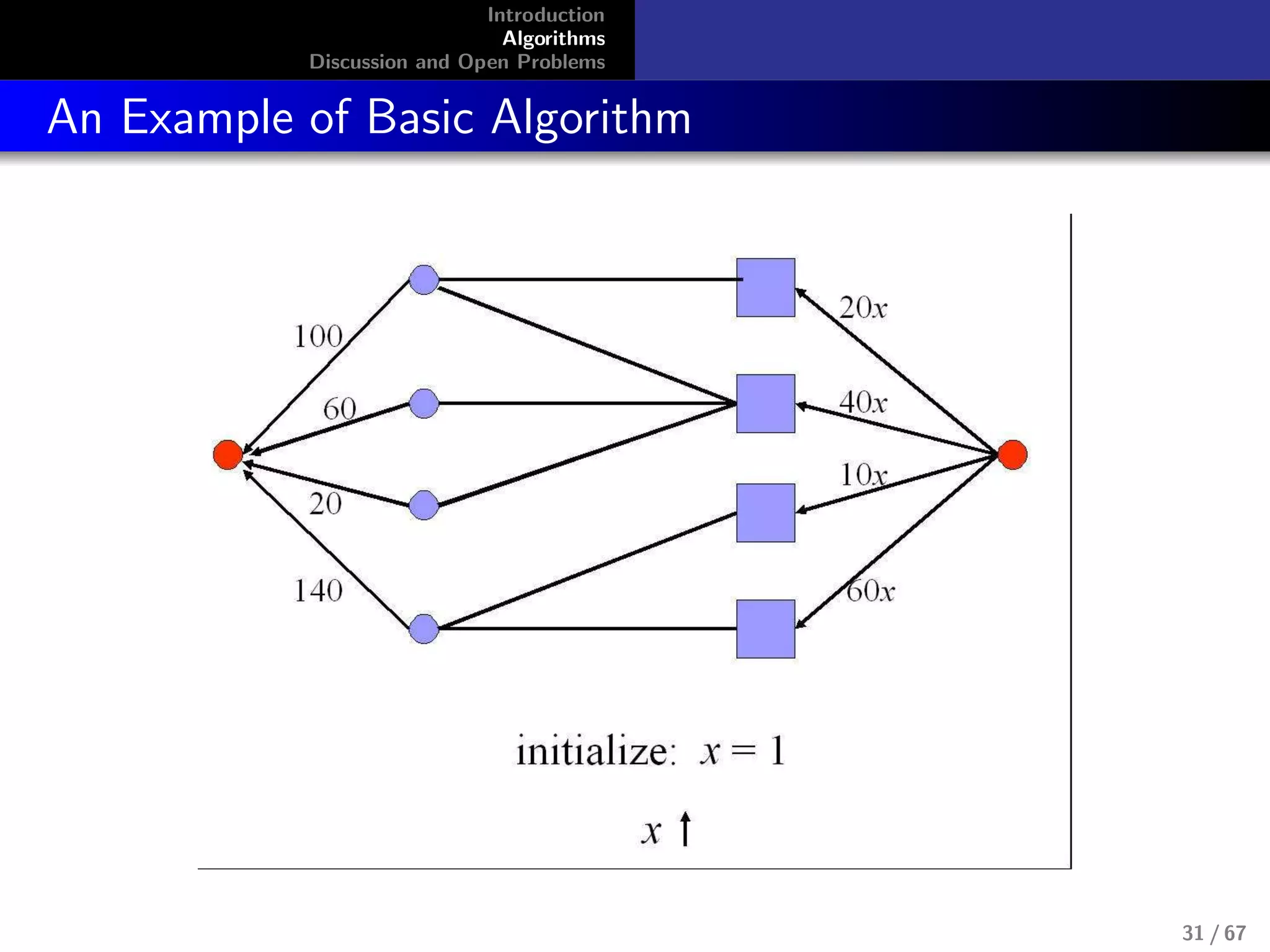

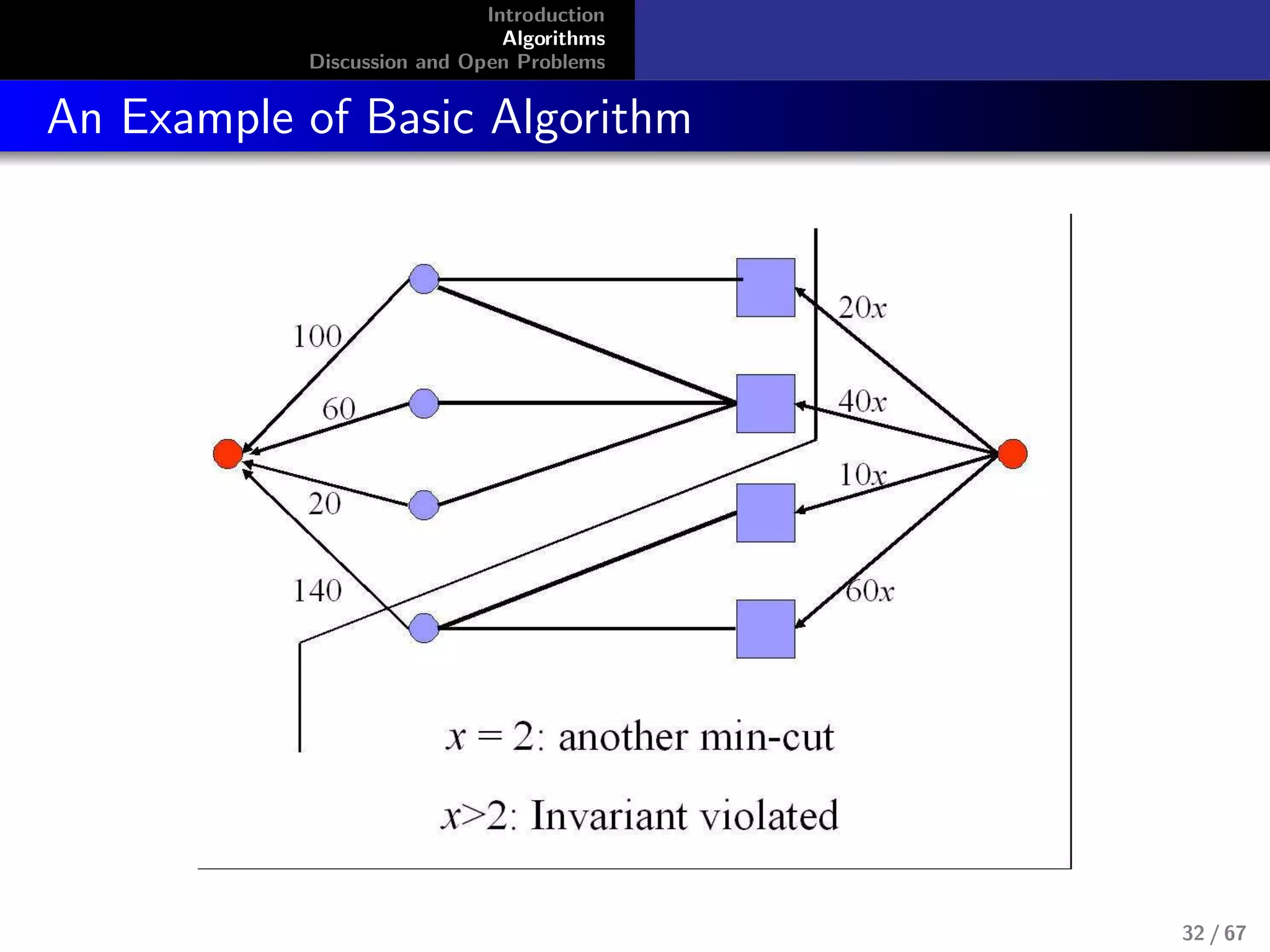

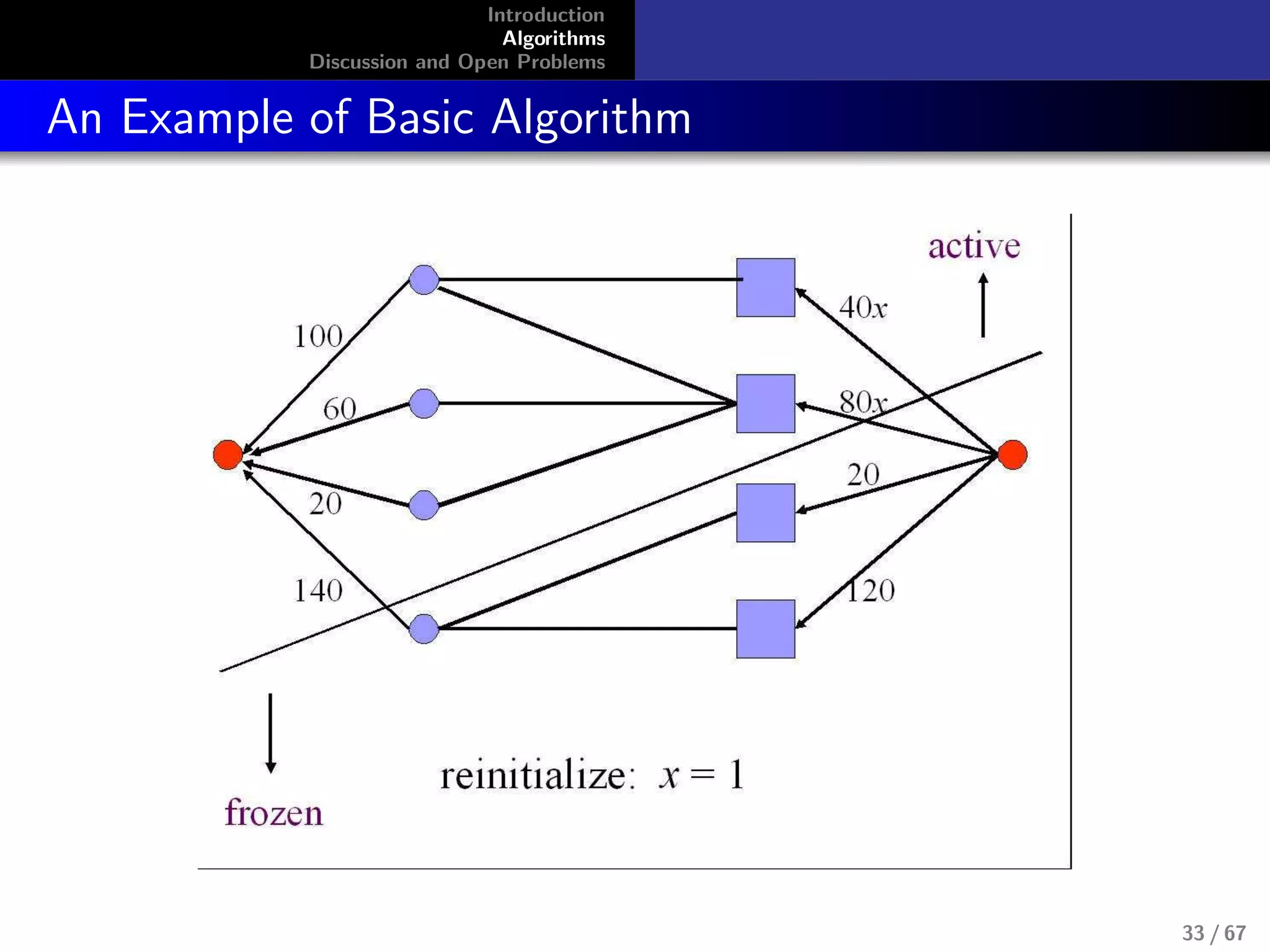

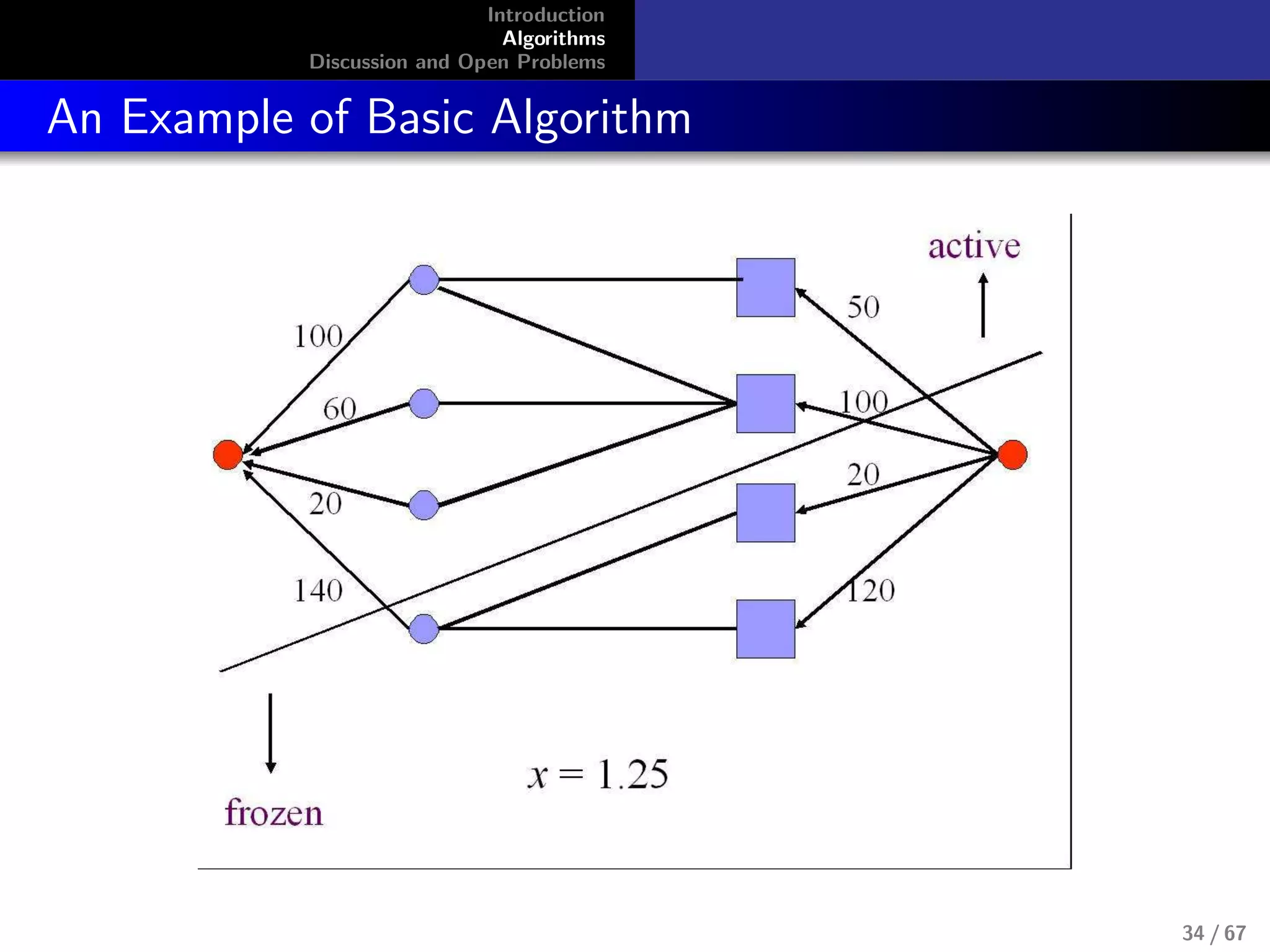

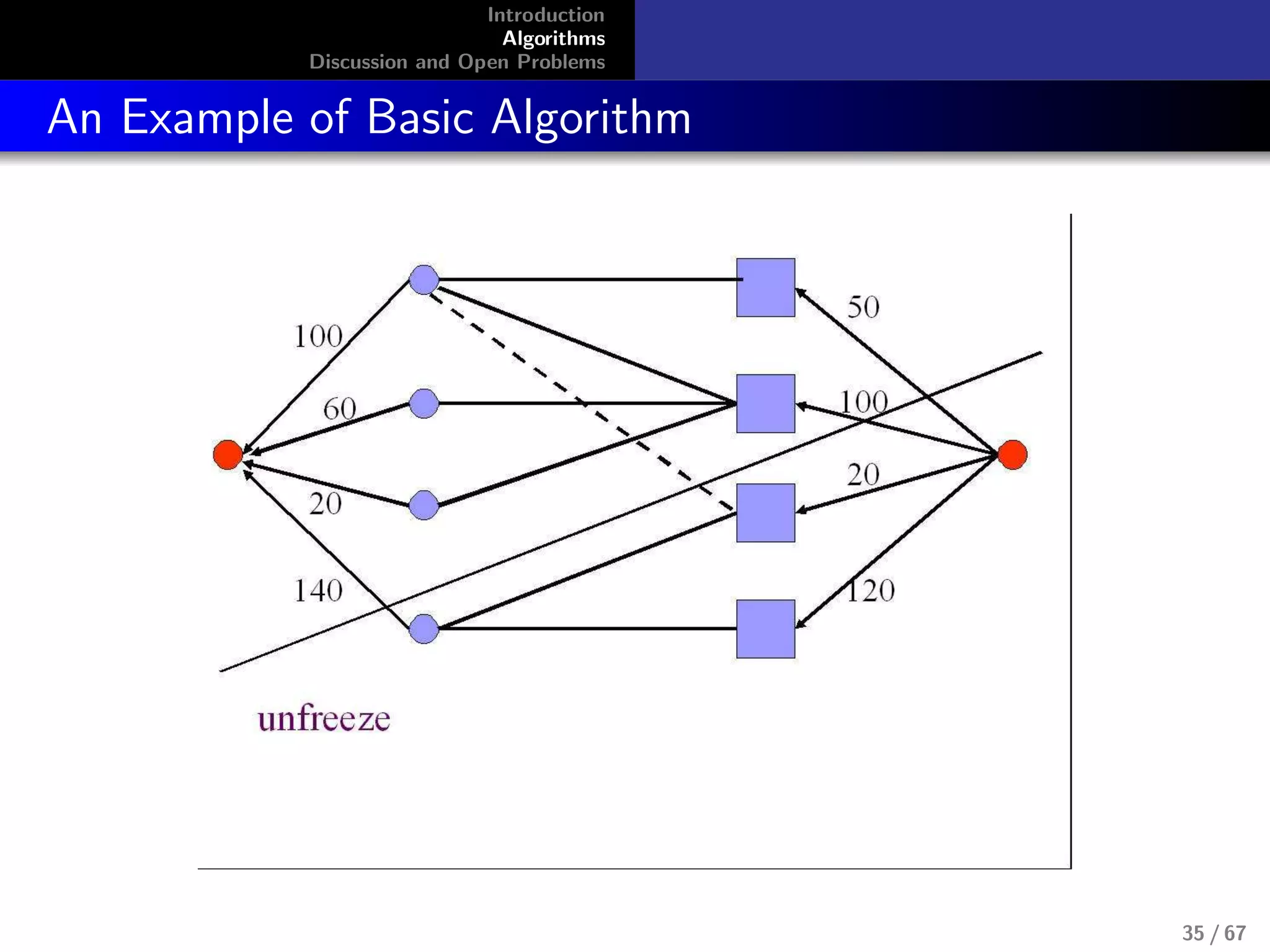

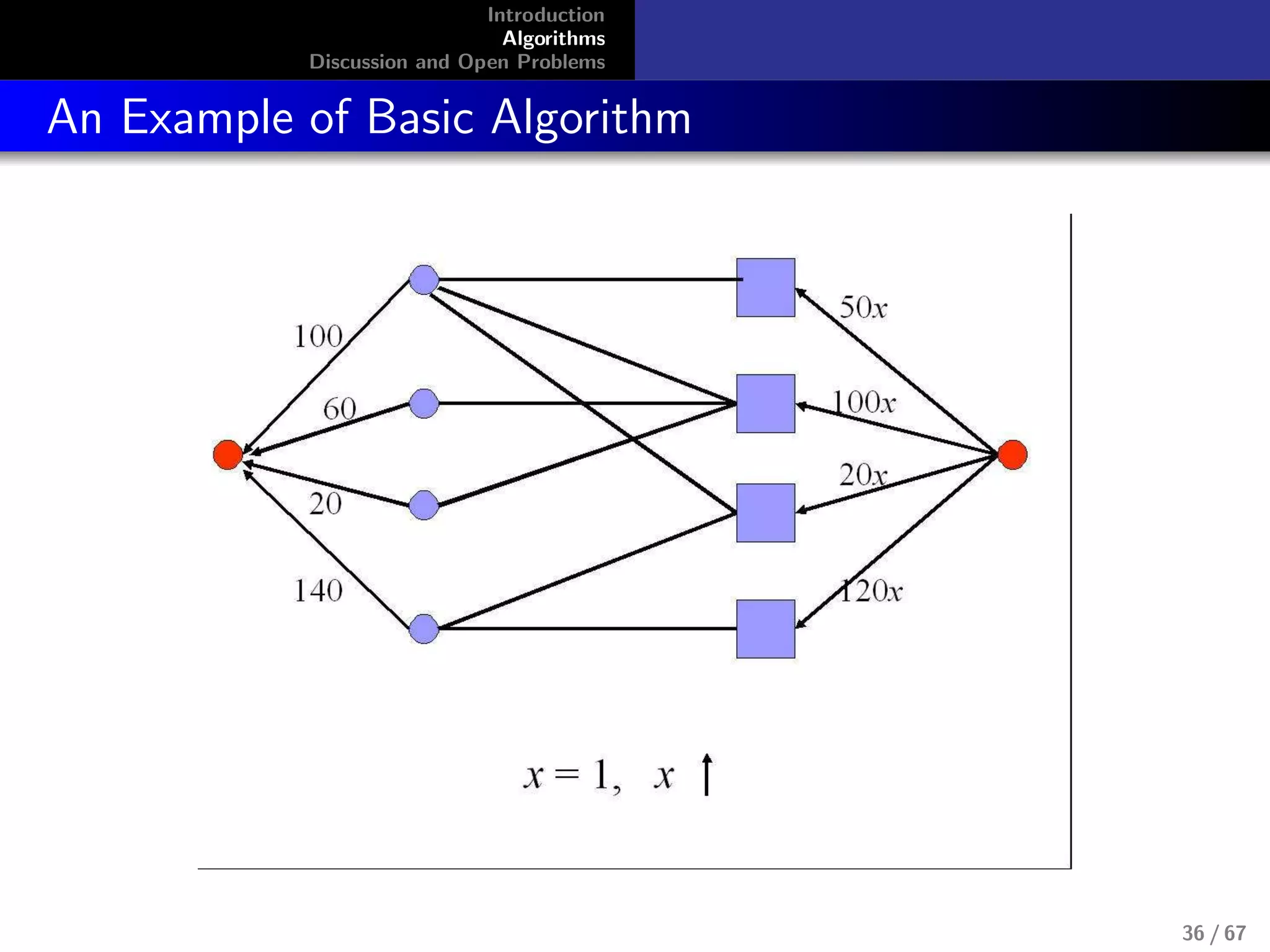

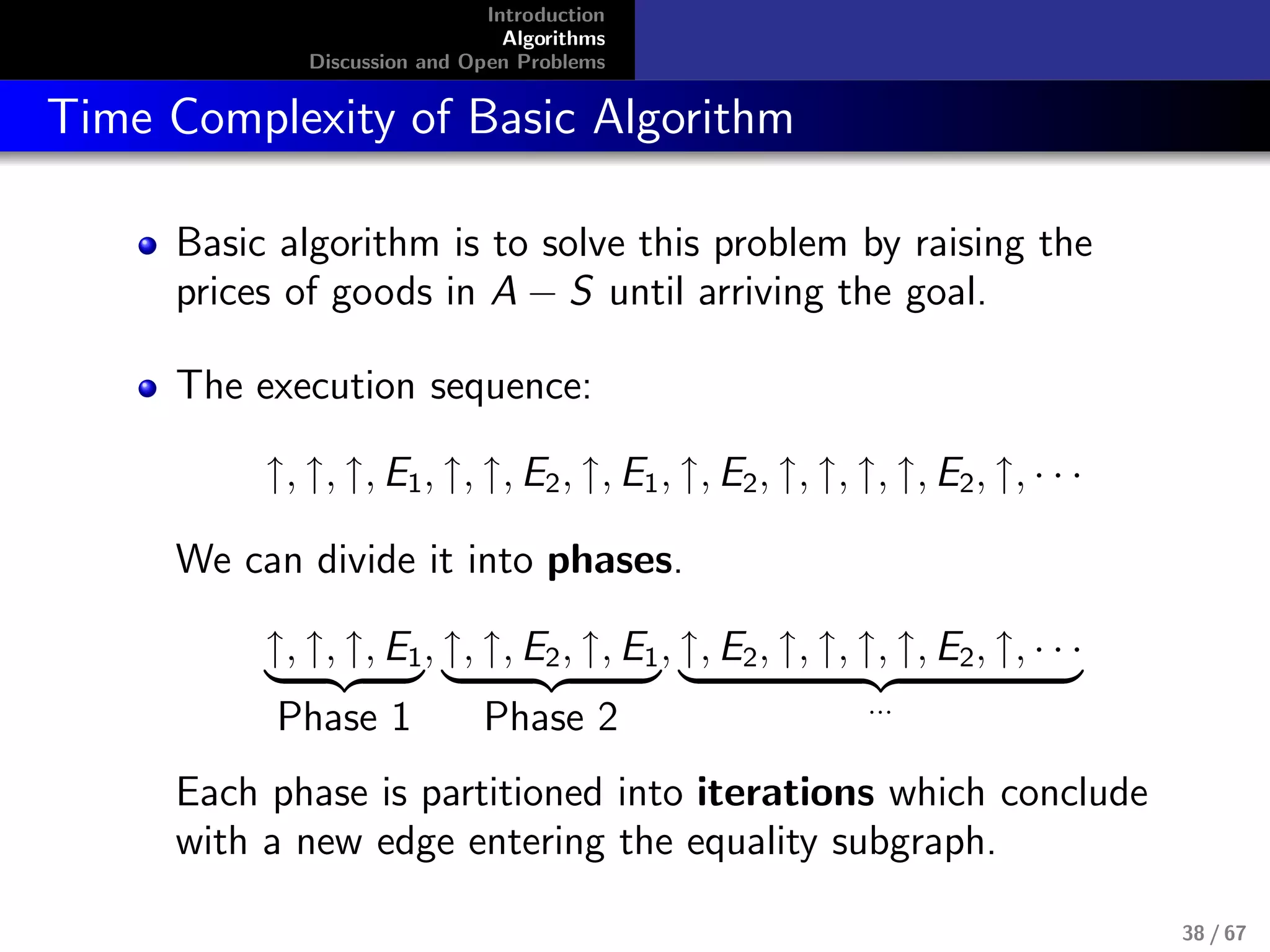

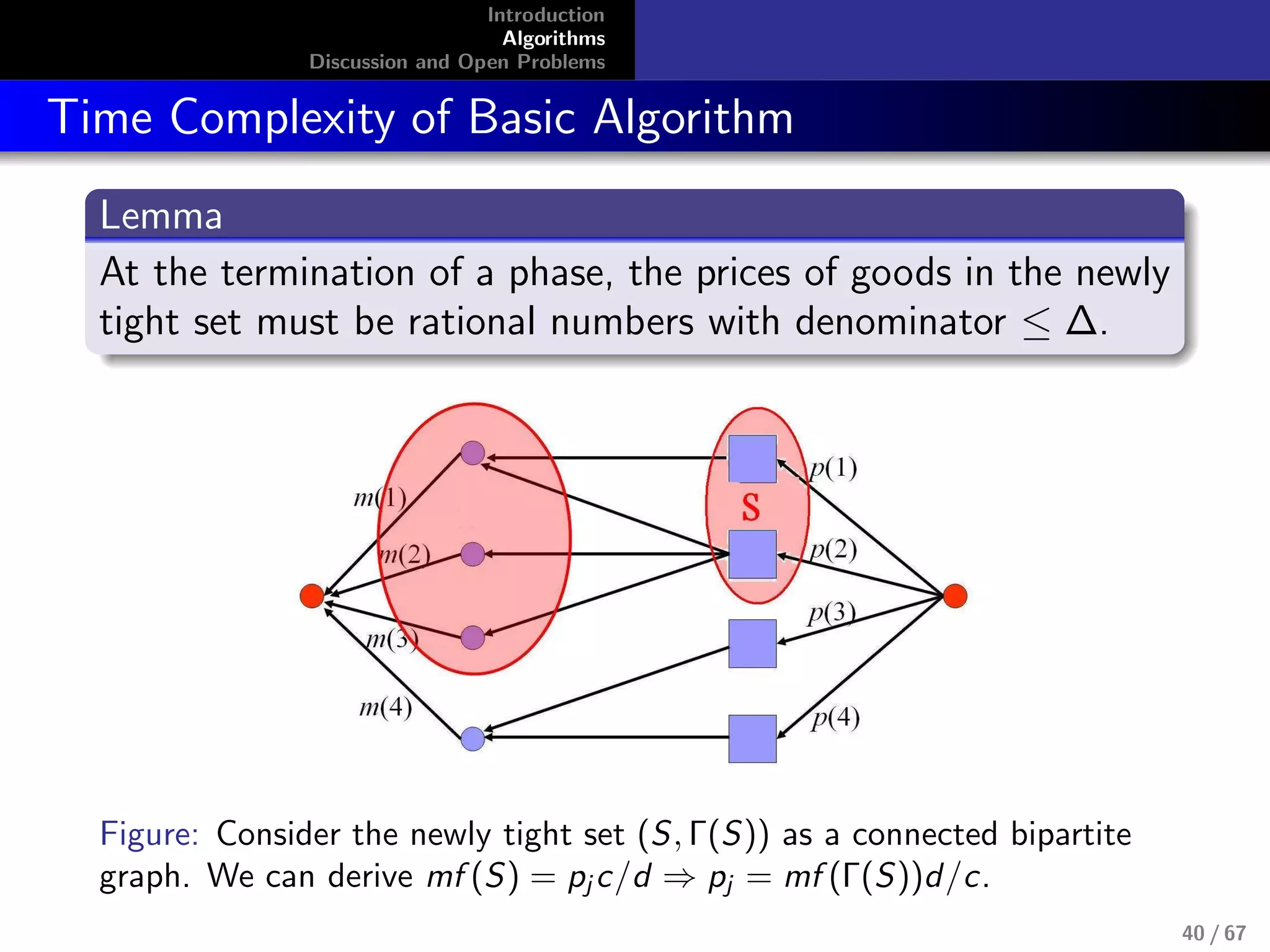

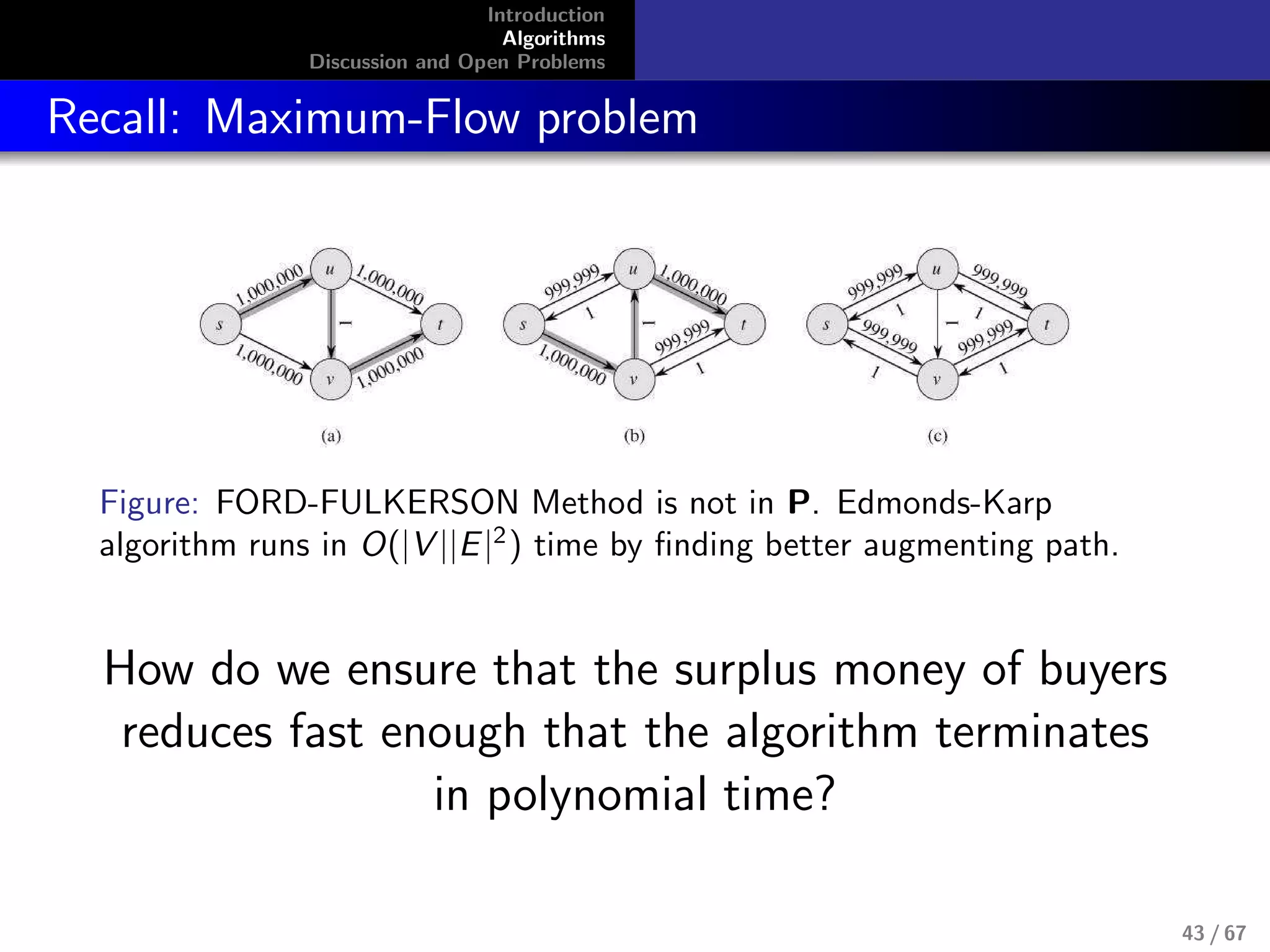

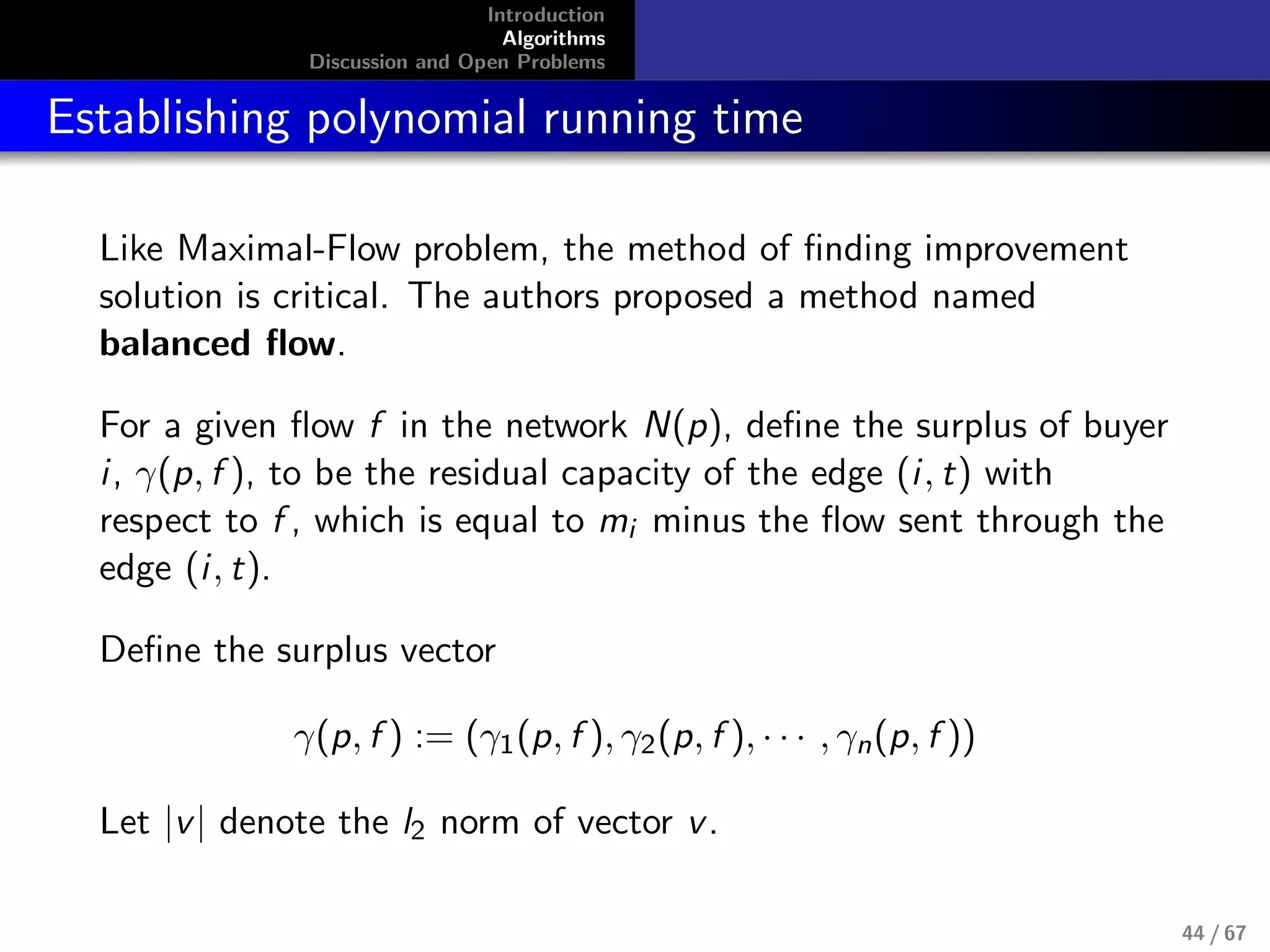

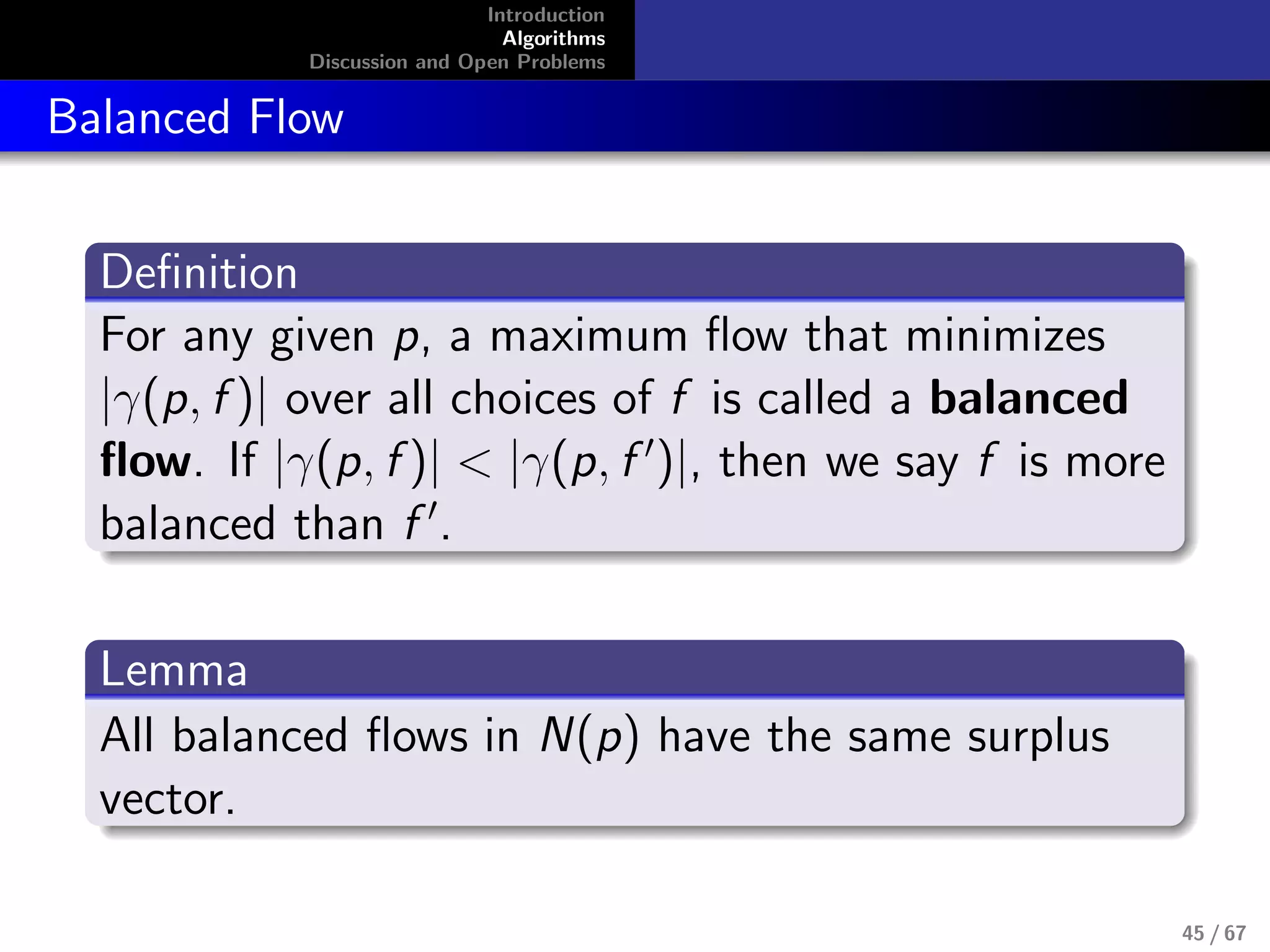

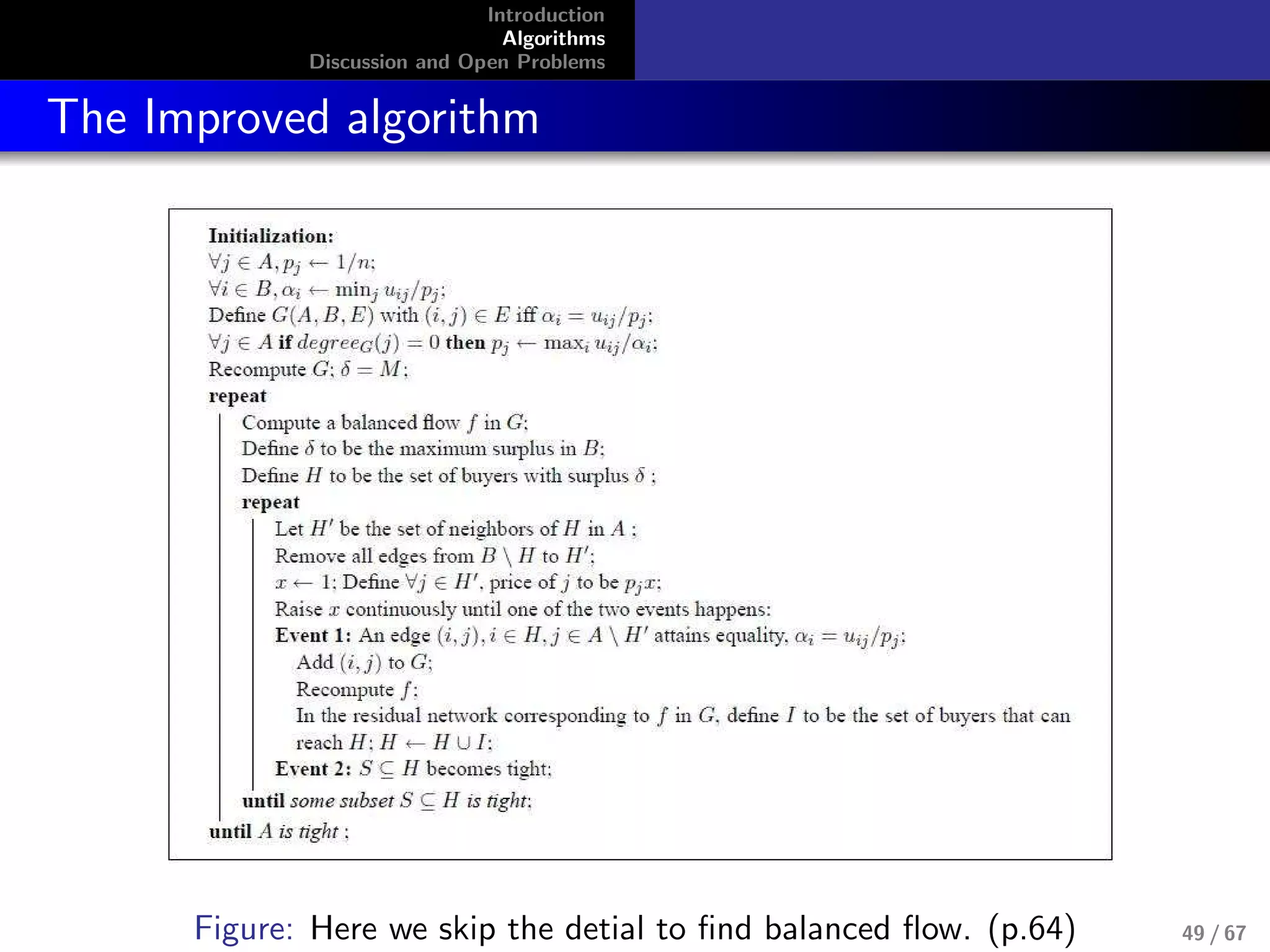

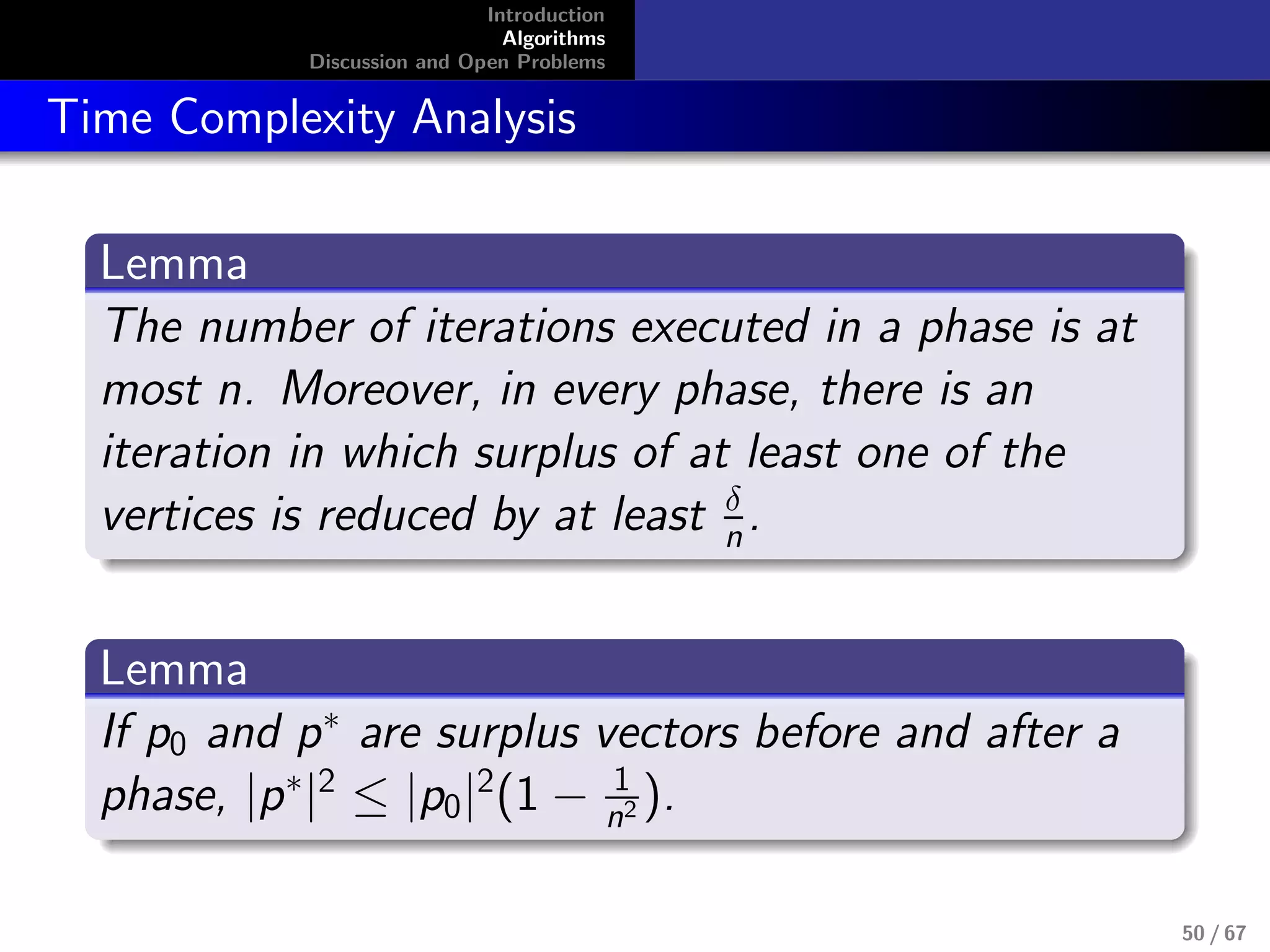

The document discusses algorithms for computing market equilibria in economic models. It introduces Fisher's model and the Arrow-Debreu model of markets. It describes how competitive equilibria and Pareto efficiency arise in these models under certain assumptions. The document then presents an algorithm based on a primal-dual approach that computes market clearing prices for Fisher's linear model in polynomial time by incrementally raising prices until surplus is eliminated.

![Introduction

Algorithms

Discussion and Open Problems

Materials

Vijay V. Vazirani, chapter 5, Algorithmic Game Theory,

Cambridge University Press, 2008.[5]

Devanur, et al., Market Equilibrium via a Primal-Dual-Type

Algorithm, FOCS’02, 389-395.[1]

Devanur, et al., Market equilibrium via a primal–dual

algorithm for a convex program, J. ACM, 2008, v. 55,

pp.1-18[2]

2 / 67](https://image.slidesharecdn.com/slides-090326043049-phpapp01-150607173359-lva1-app6891/75/Introduction-to-Algorithmic-aspect-of-Market-Equlibra-2-2048.jpg)

![Introduction

Algorithms

Discussion and Open Problems

Combinatorial Algorithm for Fisher’s Model

No LP’s known for capturing equilibrium

allocations for Fisher’s model, although this

model doesn’t require integer constraints.

max

i

ui , s.t.,

j

pj xi,j ≤ mi , ui =

j

ui,jxi,j

Devanur, Papadimitriou, Saberi, and Vazirani,

2002[1]

Use primal-dual schema. It is highly successful algorithm

design technique from exact and approximation algorithms

11 / 67](https://image.slidesharecdn.com/slides-090326043049-phpapp01-150607173359-lva1-app6891/75/Introduction-to-Algorithmic-aspect-of-Market-Equlibra-11-2048.jpg)

![Introduction

Algorithms

Discussion and Open Problems

Arrow-Debreu model: An Auction-Based Algorithm

Jain proved that Arrow-Debreu’s Model with Linear Utility

Functions is in P at 2007[4], however it is based on ellipsoid

algorithm. And ellipsoid algorithm is slow in practice.

Garg et al. [3] proposed an auction-based PTAS for the linear

case of the Arrow-Debreu model.

52 / 67](https://image.slidesharecdn.com/slides-090326043049-phpapp01-150607173359-lva1-app6891/75/Introduction-to-Algorithmic-aspect-of-Market-Equlibra-52-2048.jpg)

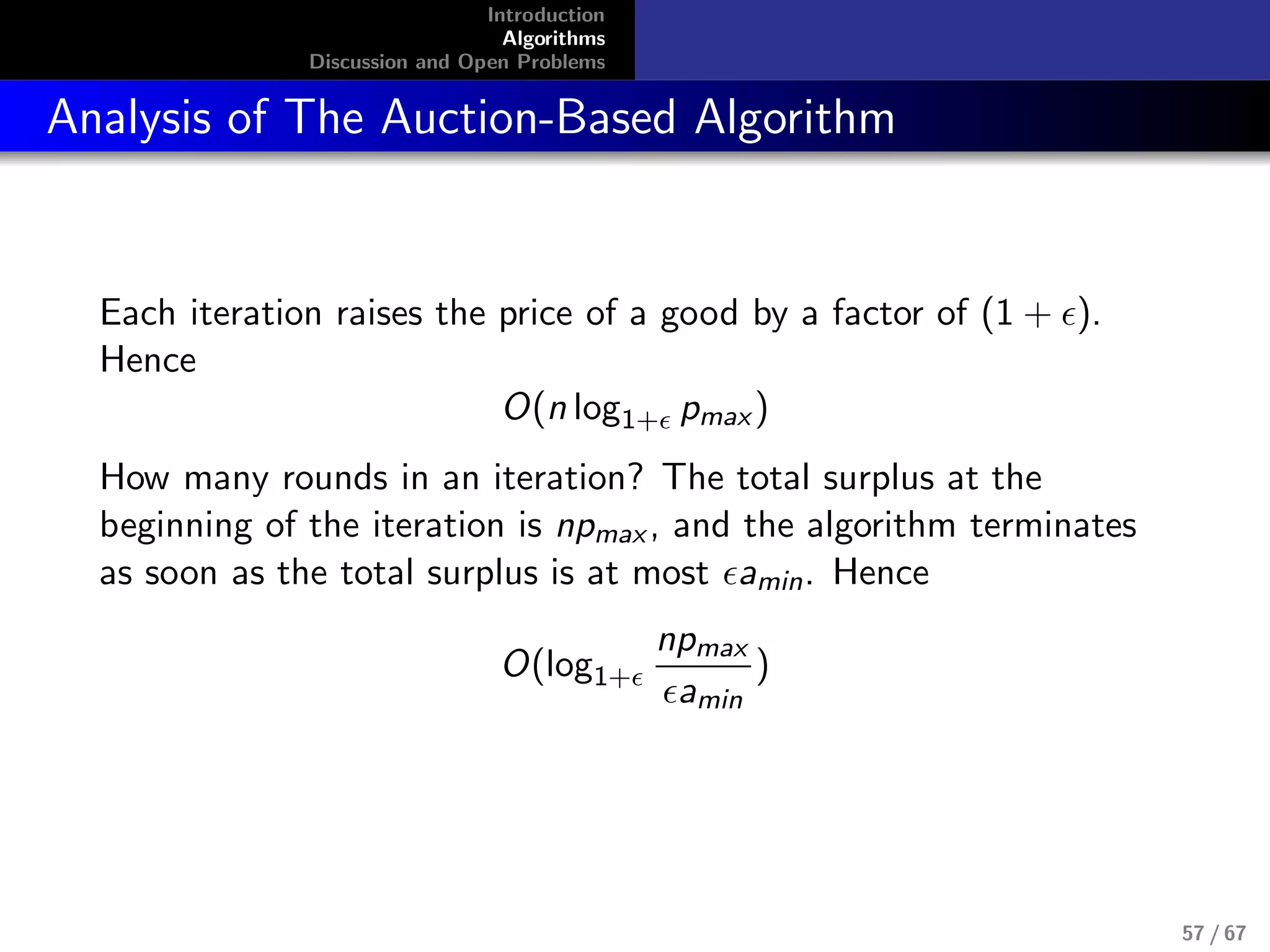

![Introduction

Algorithms

Discussion and Open Problems

An Auction-Based Algorithm[3]

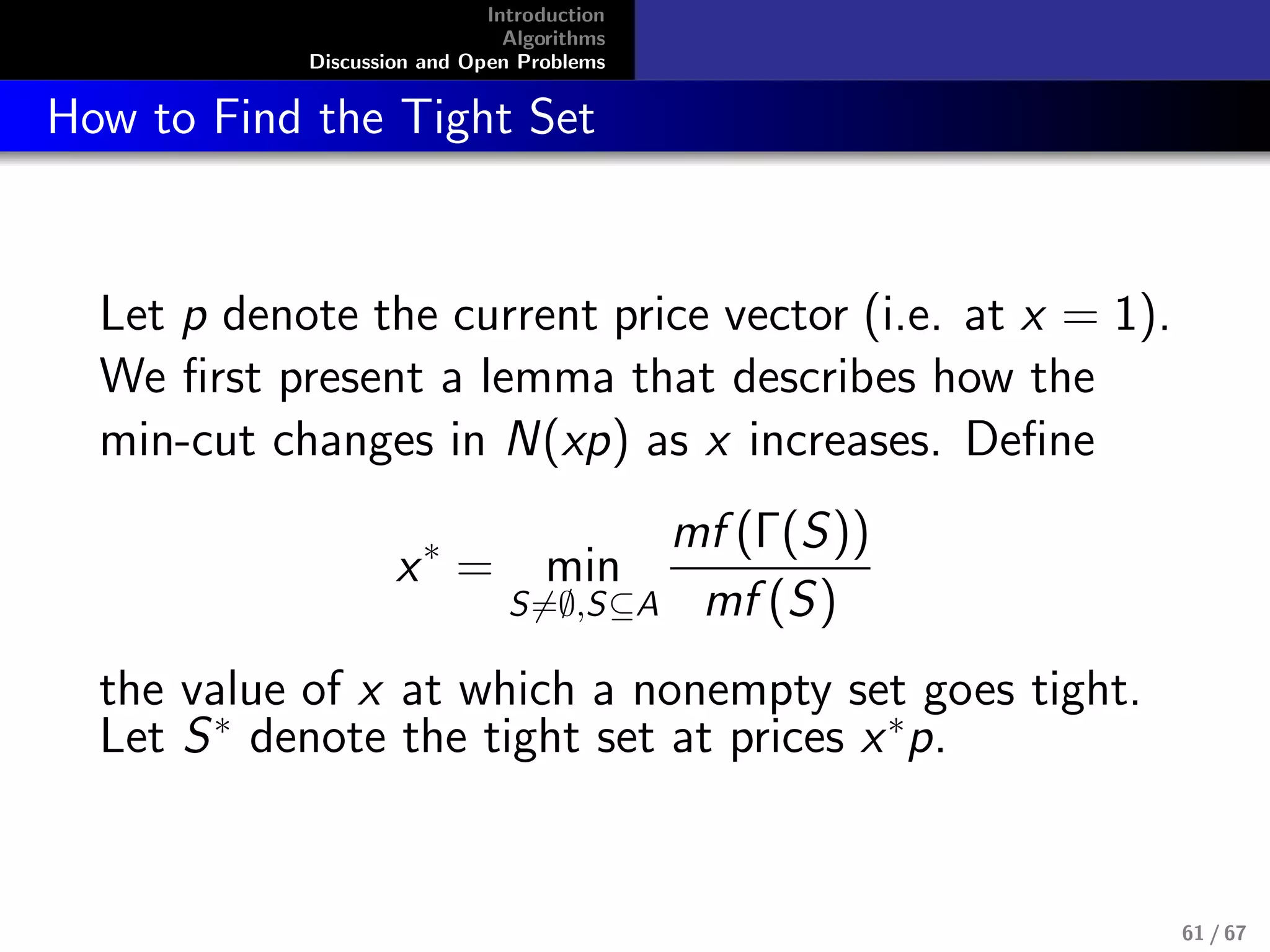

1 Initializes the price of each good to be unit, computes the

worth of the initial endowment of each agent, and gives this

money to each agent. All goods are initially fully unsold.

2 LOOP UNTIL (the surplus of the traders becomes sufficiently

small, i.e., amin, or all the goods are assigned.)1

2.1 LOOP UNTIL (no agent has surplus money)

2.1.1 Agent i outbid to buy her optimal good j as many as possible,

i.e., at price (1 + )pj .

2.1.2 If agent i has all good j, update the worth of agents with

price (1 + )pj . And Jump to [2].

1

amin means the minimum amount of initial endowments which a agent has.

53 / 67](https://image.slidesharecdn.com/slides-090326043049-phpapp01-150607173359-lva1-app6891/75/Introduction-to-Algorithmic-aspect-of-Market-Equlibra-53-2048.jpg)