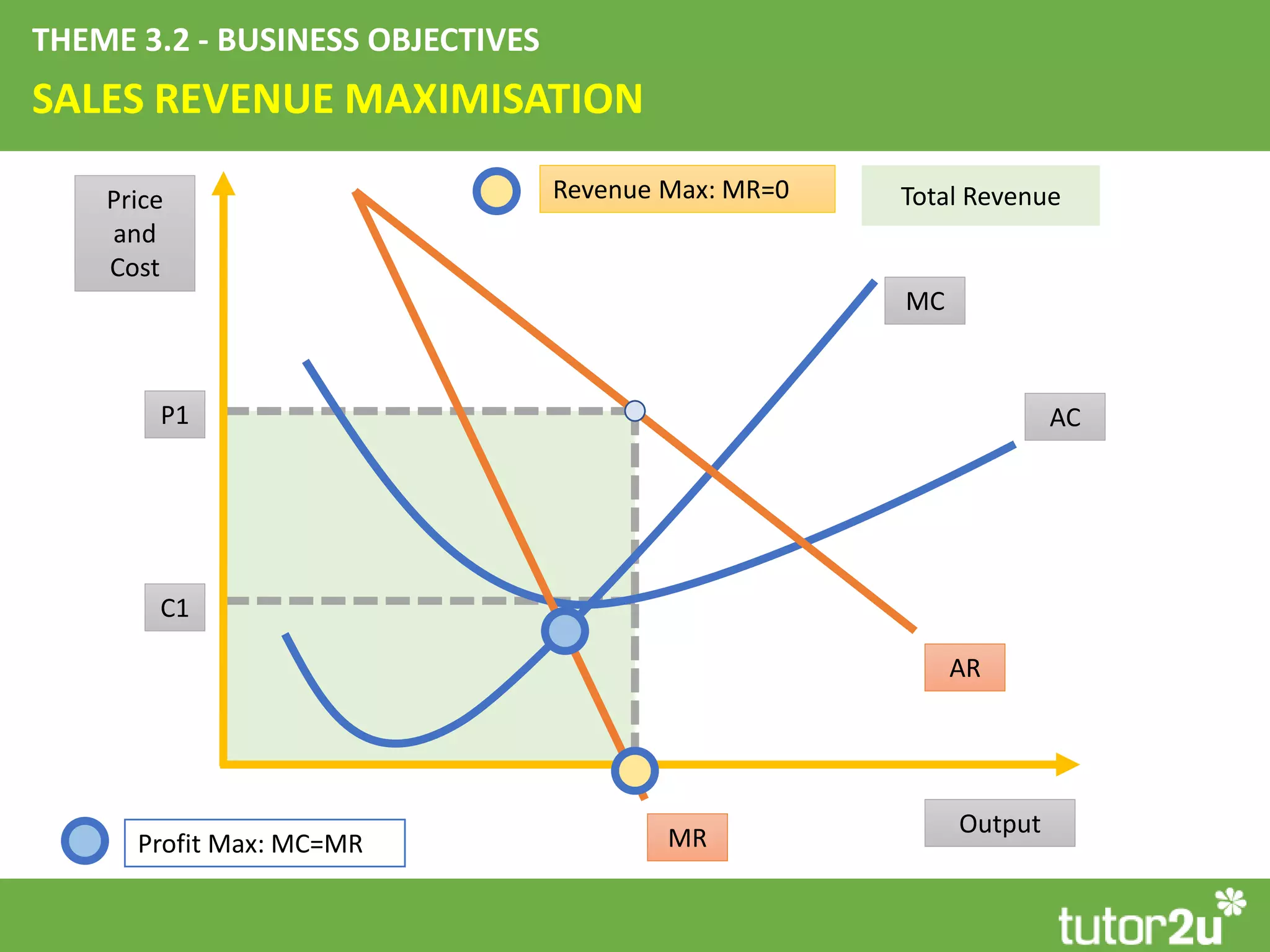

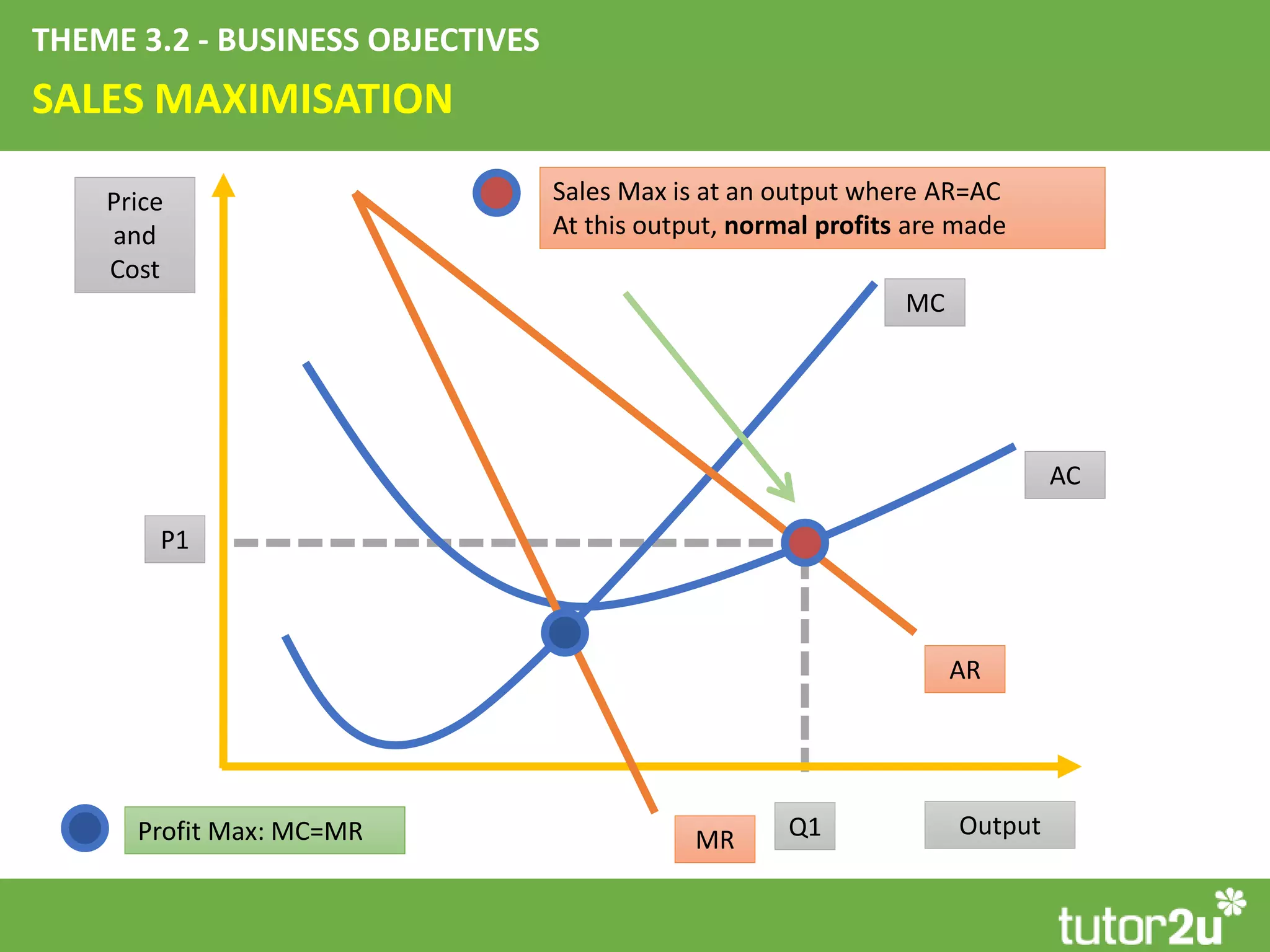

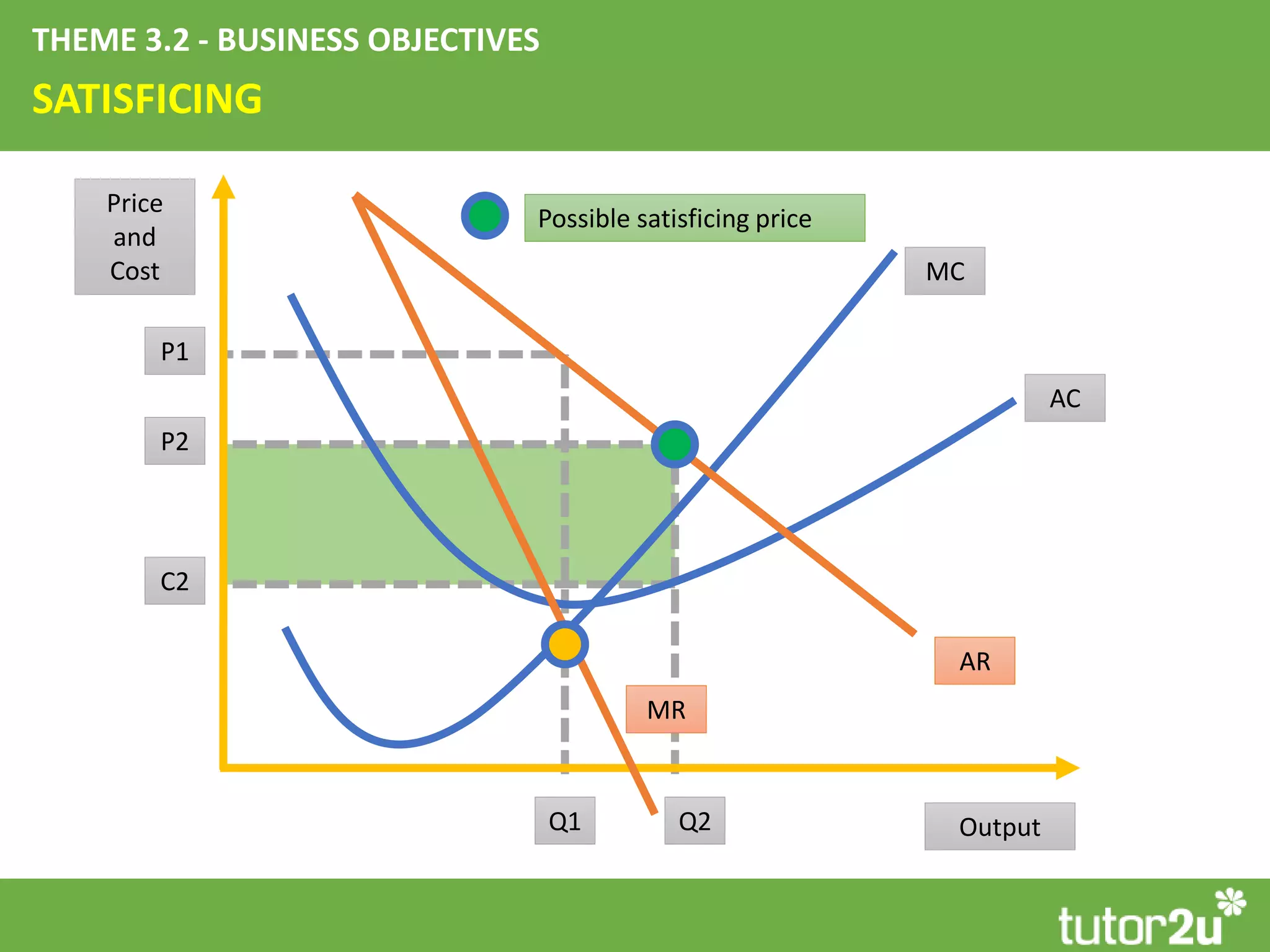

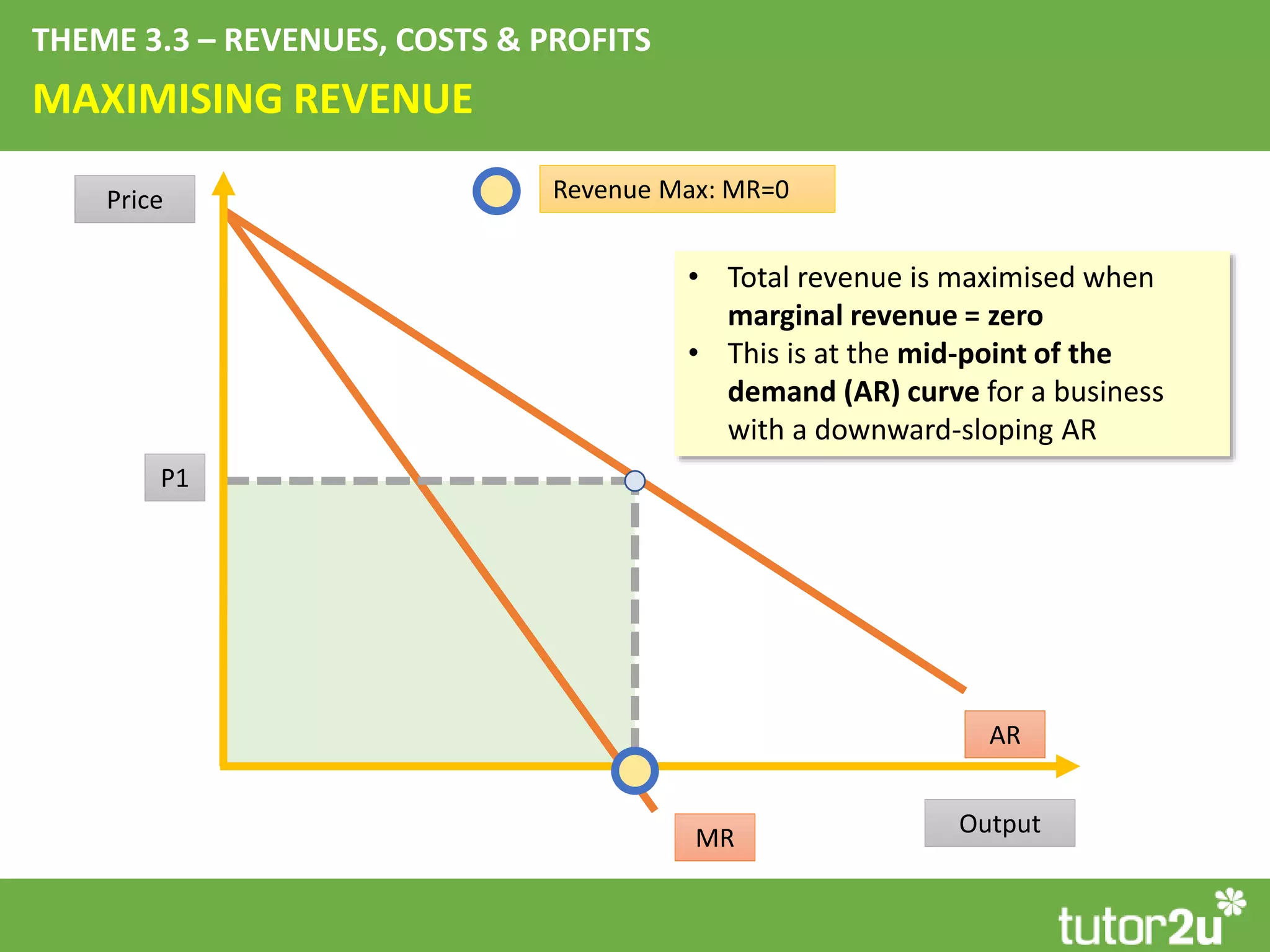

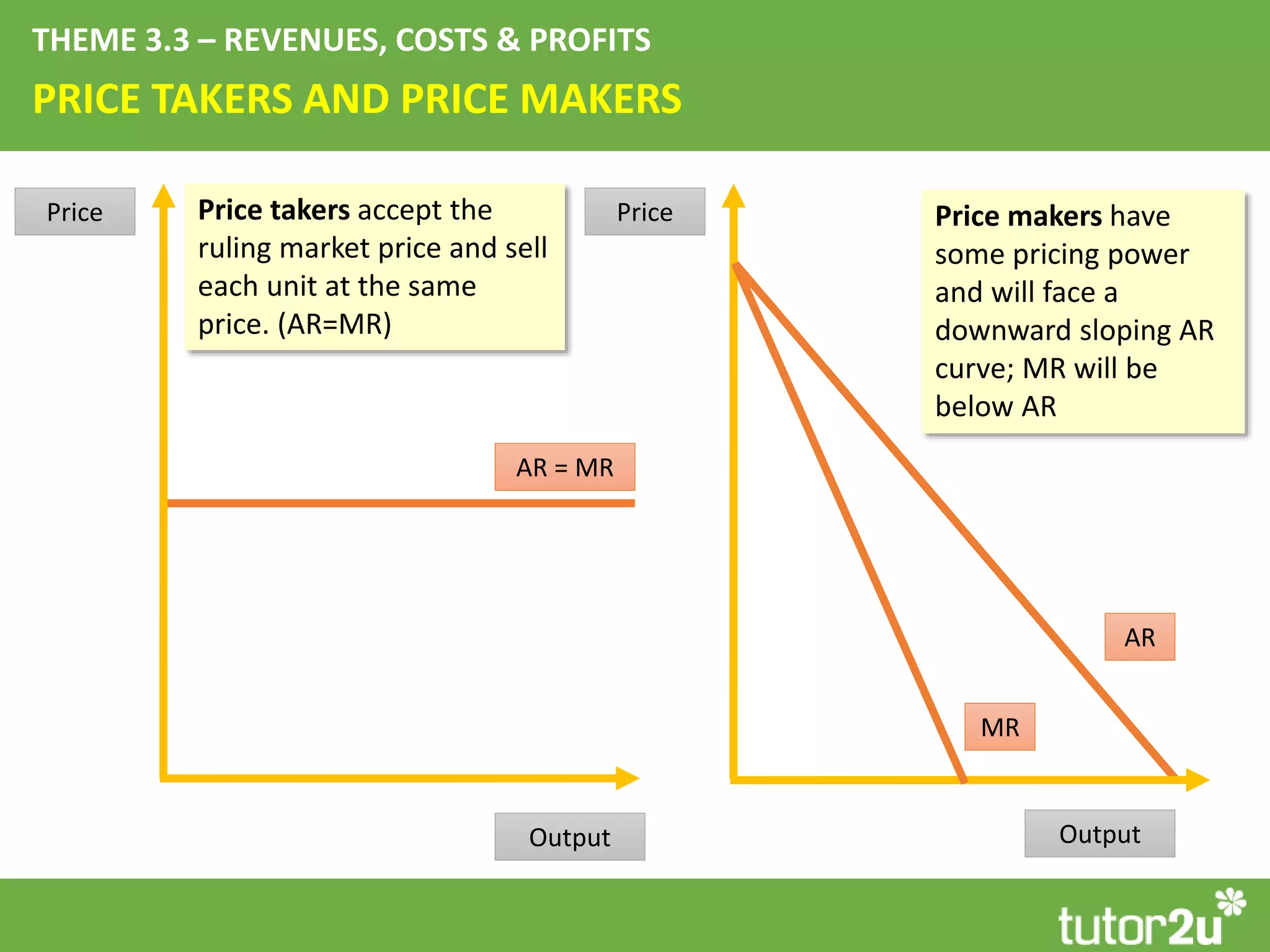

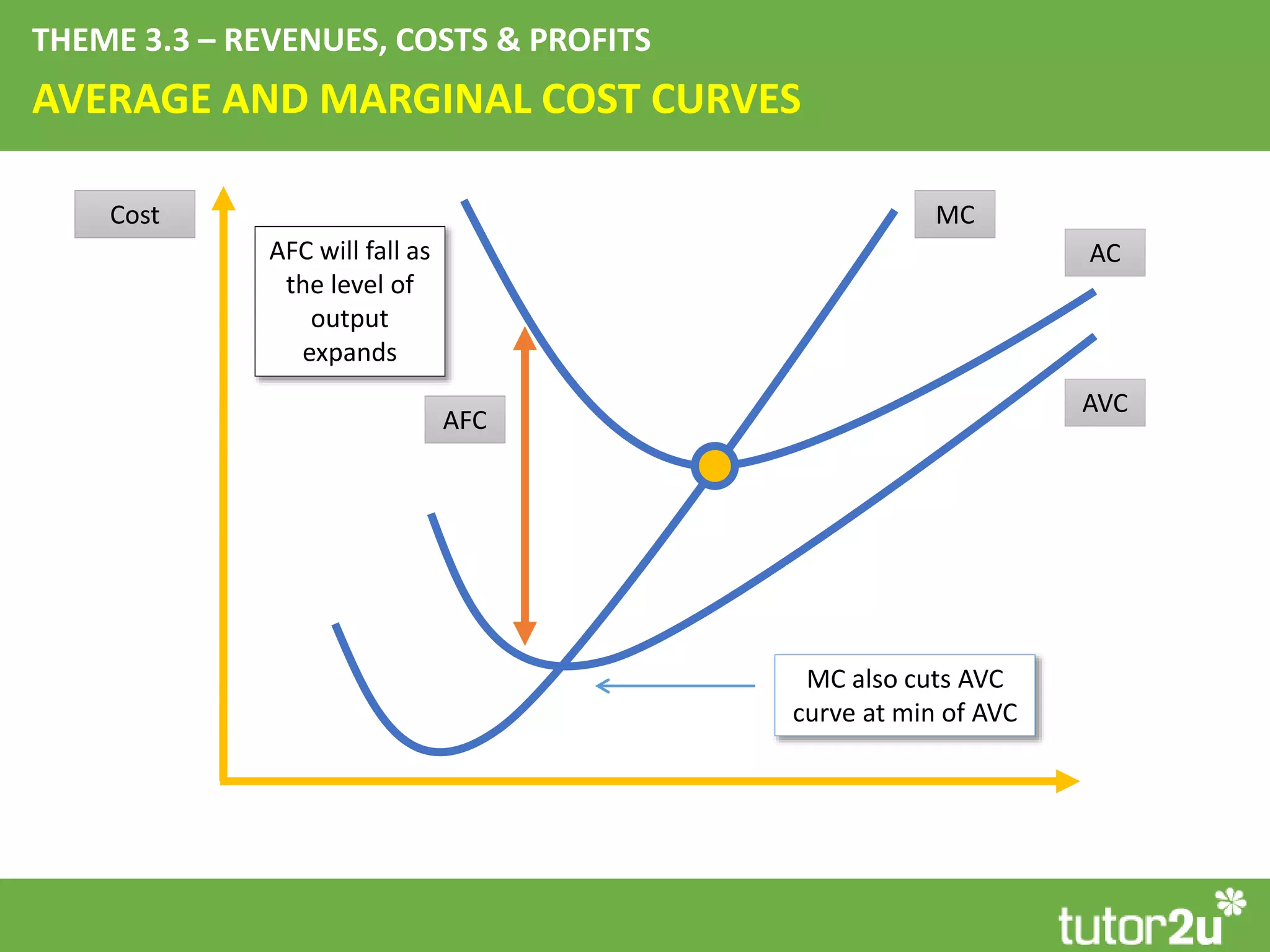

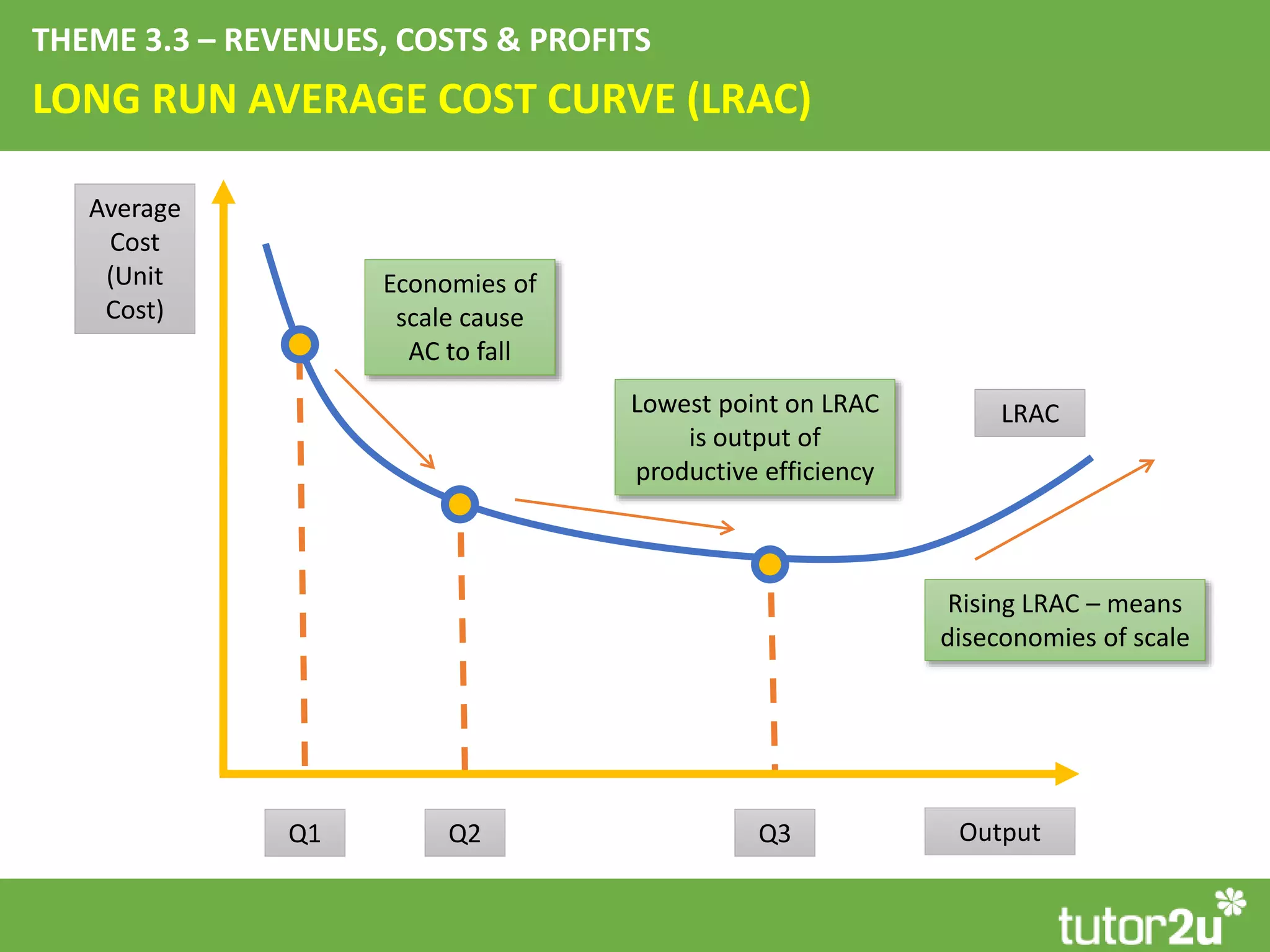

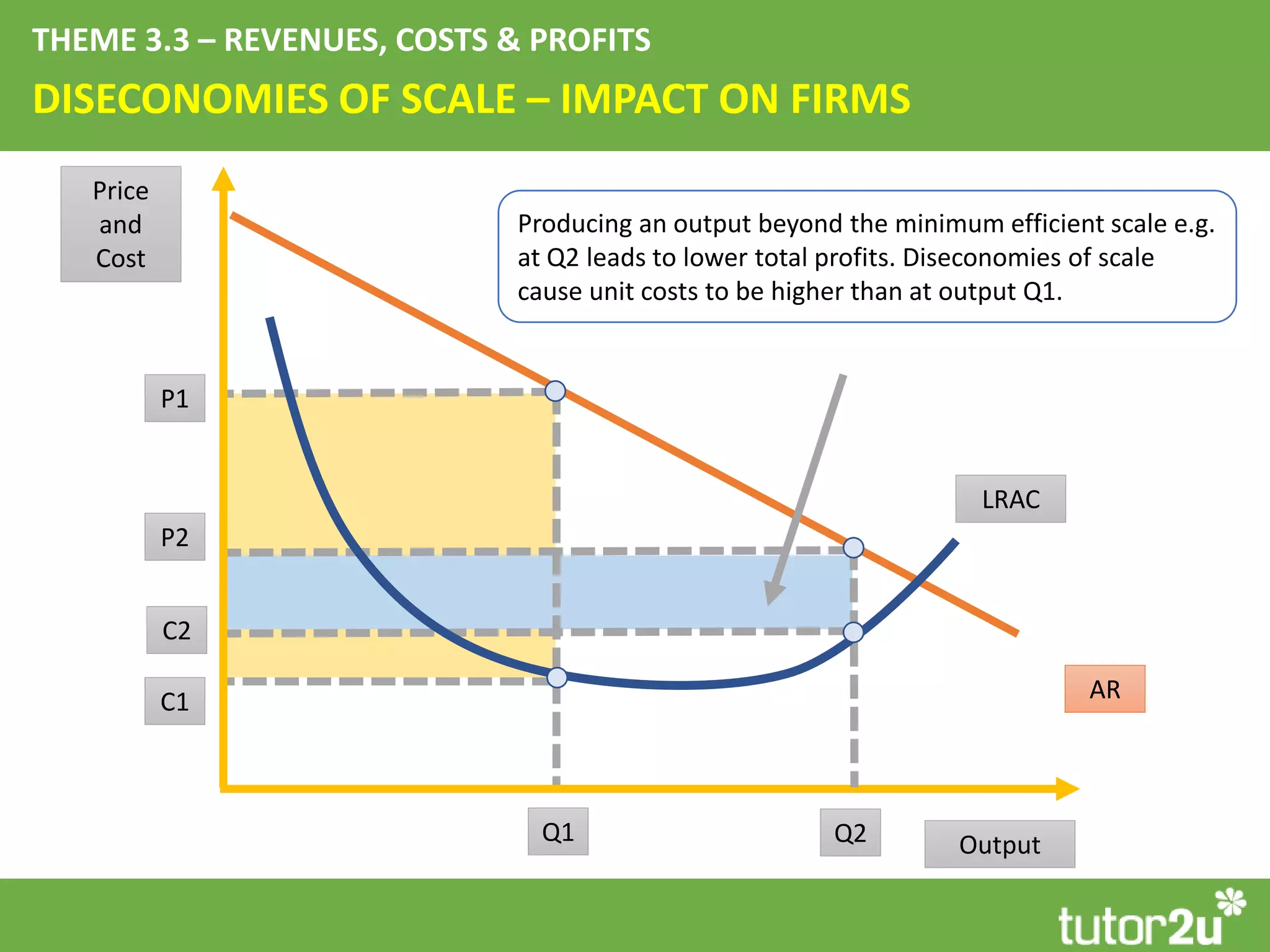

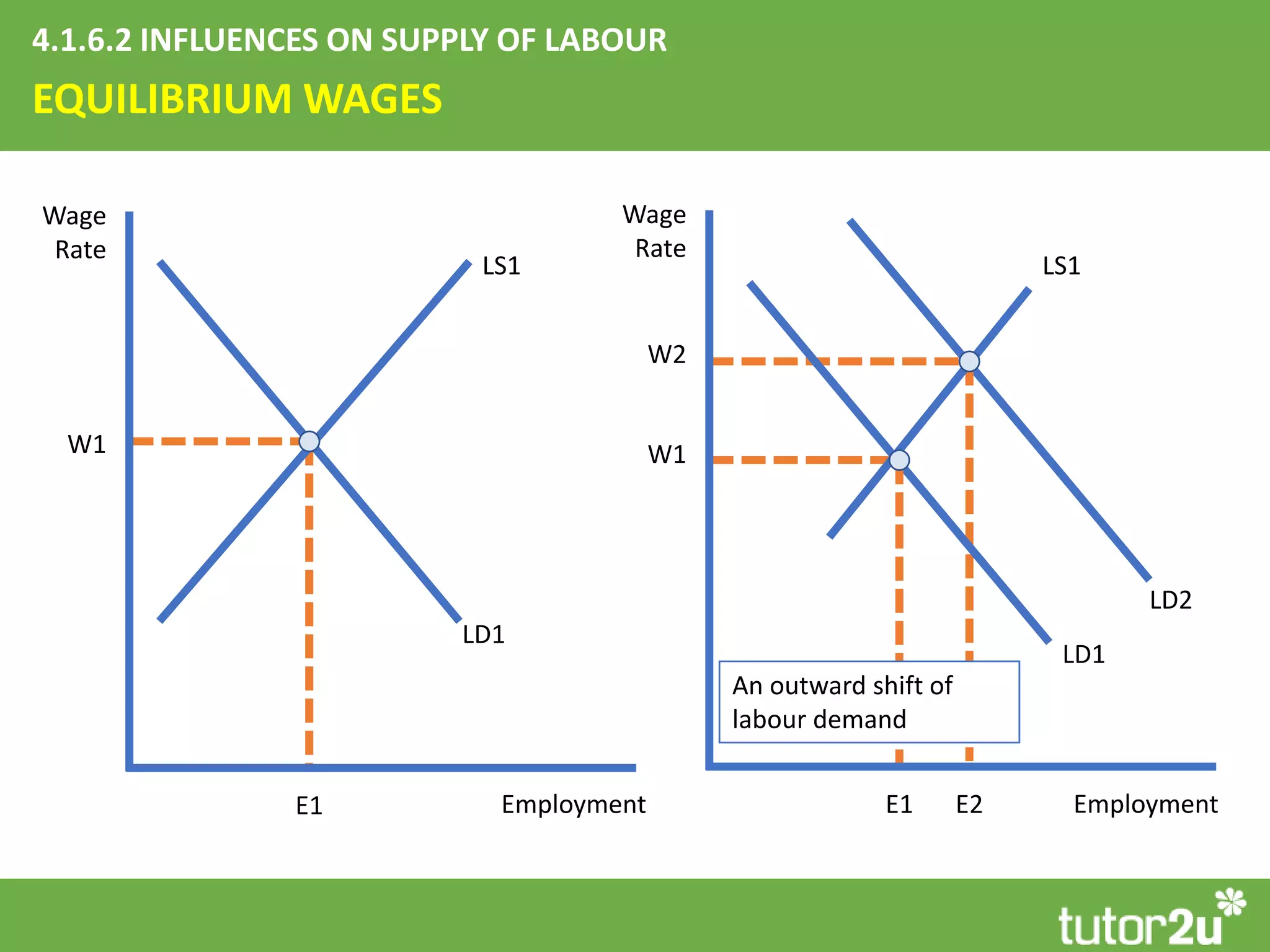

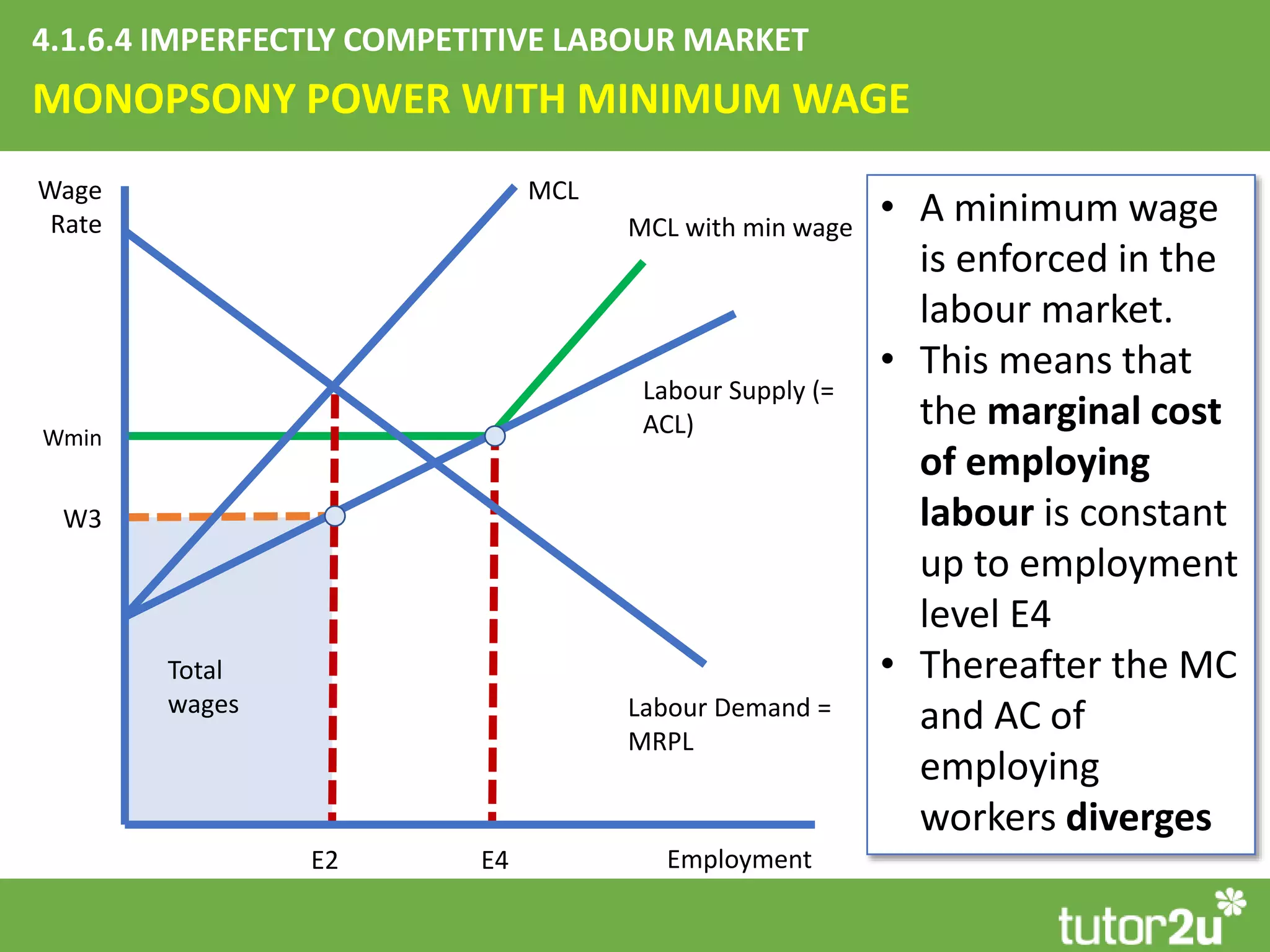

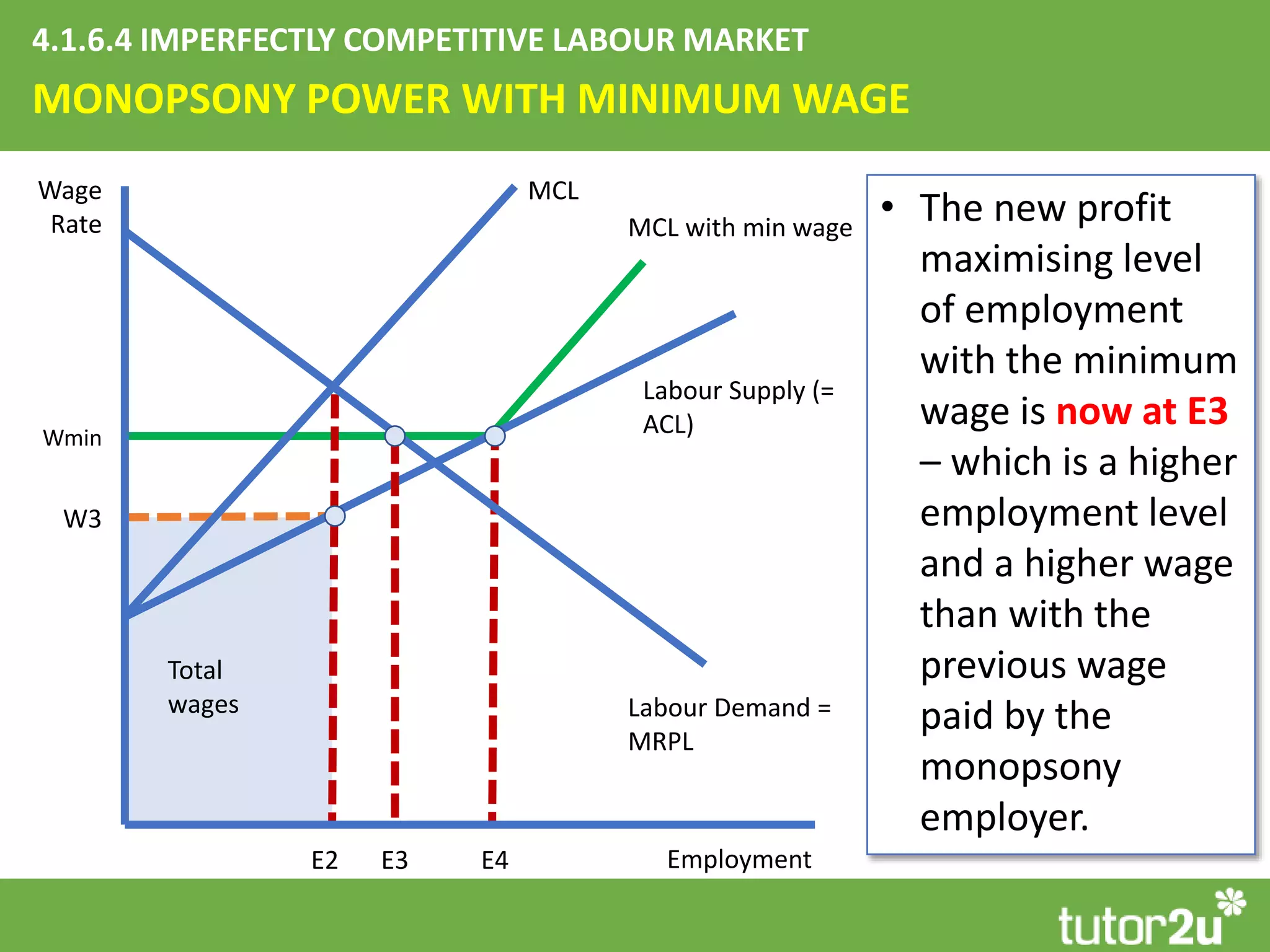

The document outlines key economic concepts relevant to Year 2 Microeconomics, detailing various business objectives, market structures, and the effects of government intervention. It covers revenue maximization, cost analysis, allocative efficiency, labor demand and supply elasticity, monopsony employer dynamics, and income distribution as illustrated by the Lorenz curve. Additionally, it discusses concepts such as perfect competition, monopolistic competition, and the implications of trade unions in wage determination.