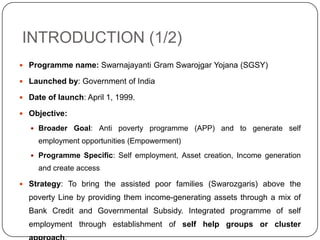

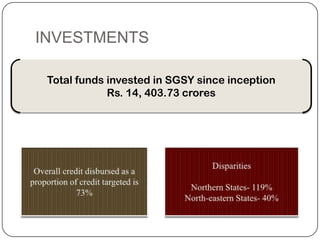

The document summarizes the Swarnajayanti Gram Swarojgar Yojana (SGSY), a self-employment program launched by the Government of India. The key points are:

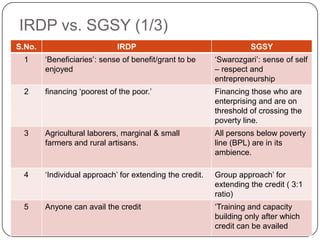

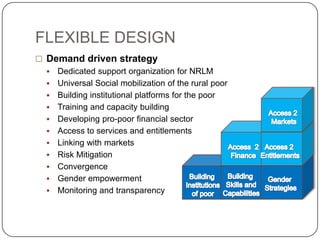

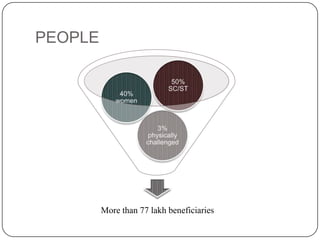

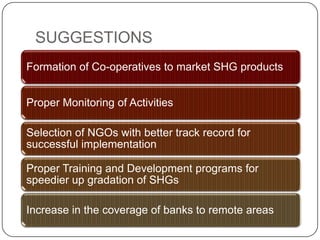

1) SGSY aims to bring families living below the poverty line above it by providing income-generating assets through bank credit and government subsidies.

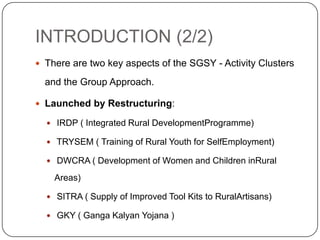

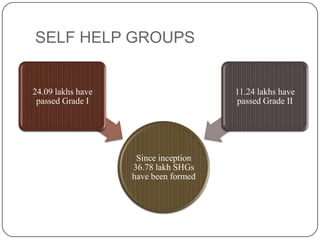

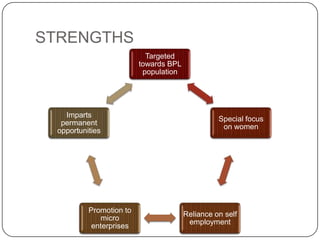

2) It focuses on a group approach and forming self-help groups, as well as identifying clusters of economic activities.

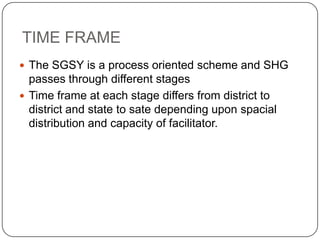

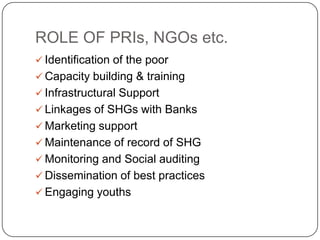

3) Implementation involves organizing the rural poor into self-help groups, providing training and assets, and linking groups to credit and marketing support.