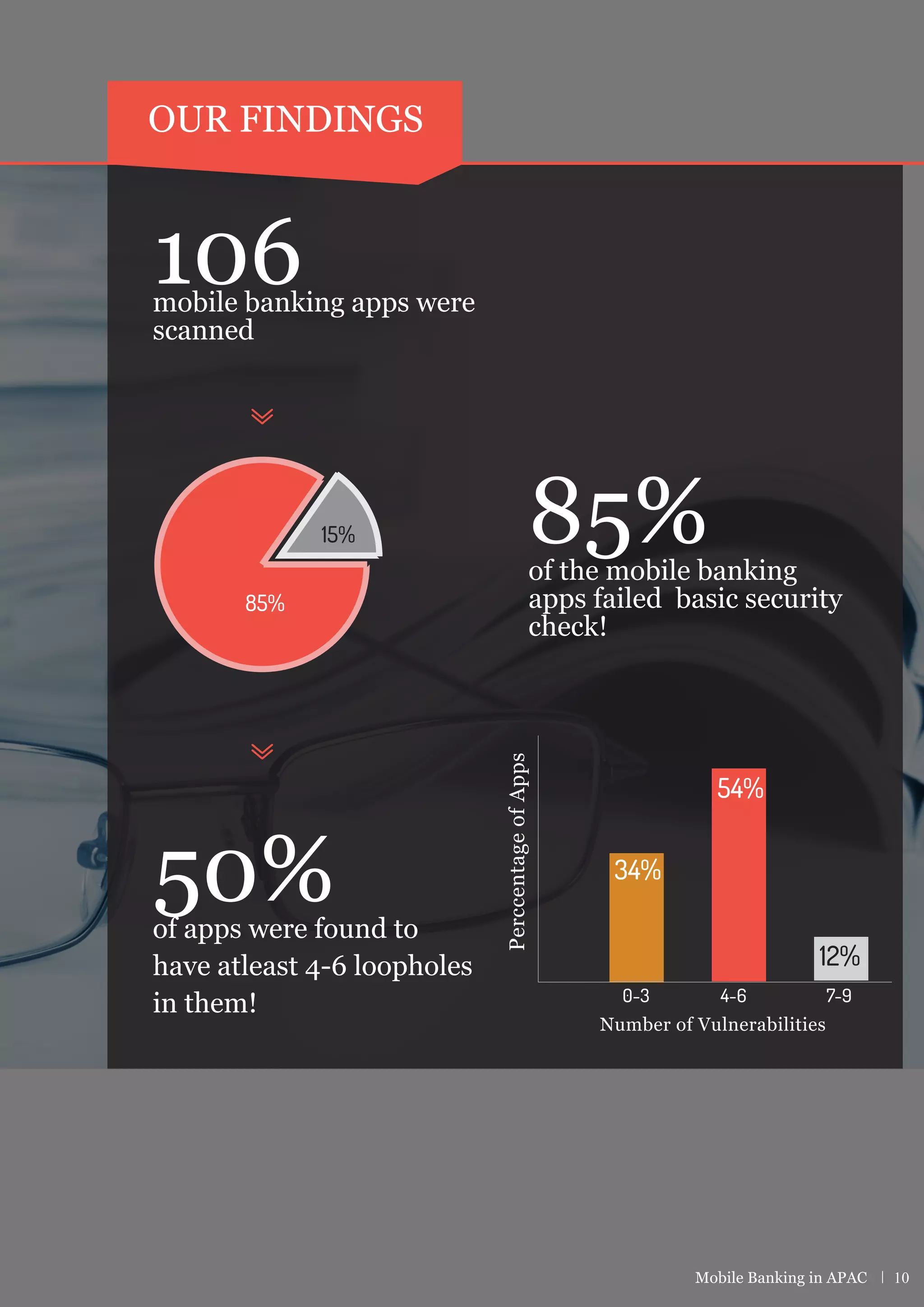

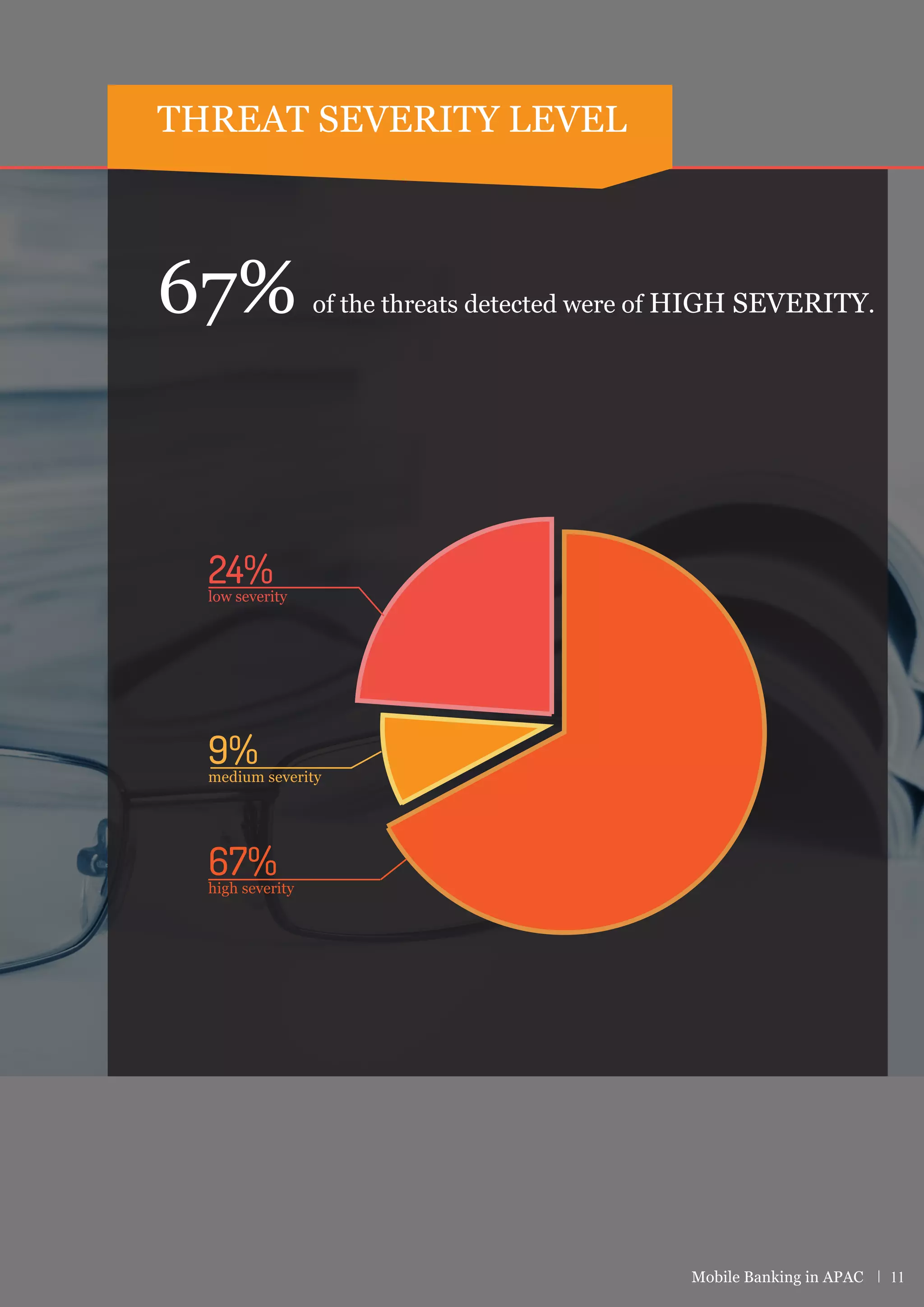

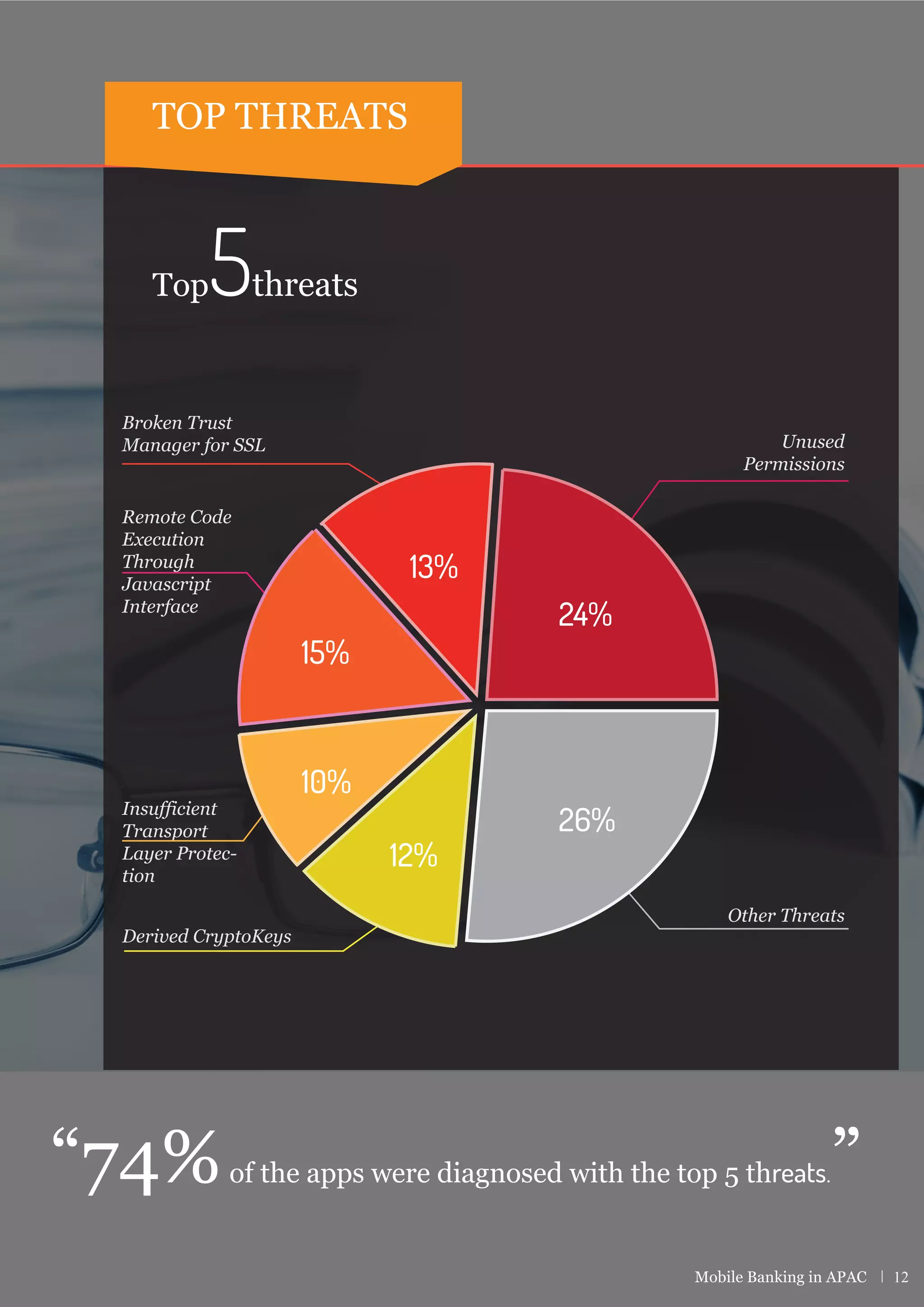

The report analyzes the security of mobile banking apps across the Asia-Pacific region, revealing that 85% of the examined 106 apps failed basic security checks, with over 50% exhibiting multiple vulnerabilities. The findings highlight a growing concern for banks as they innovate and adopt mobile technologies, emphasizing the need for enhanced security measures to protect against evolving threats. The study underscores the importance of balancing innovation with robust security protocols to ensure customer satisfaction and trust in digital banking.