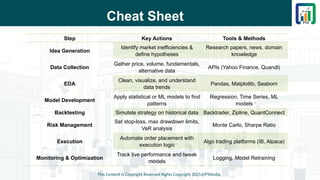

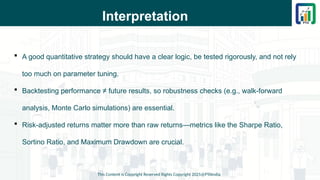

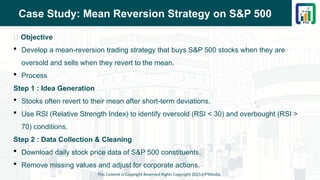

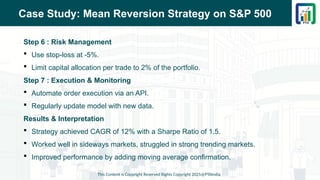

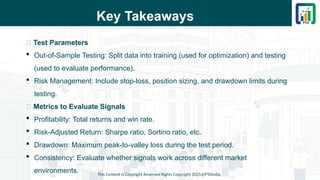

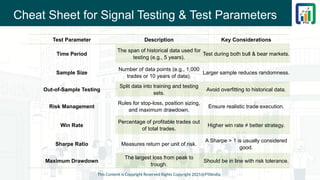

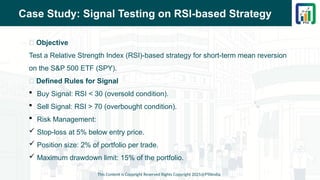

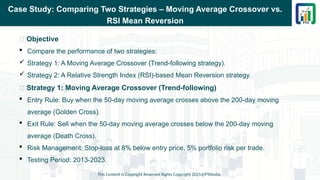

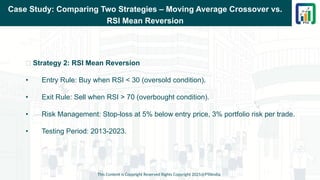

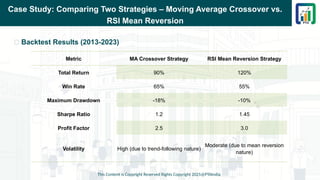

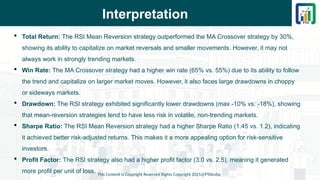

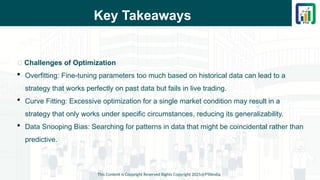

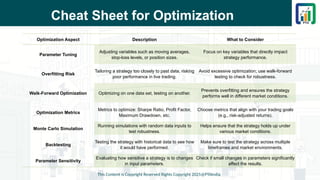

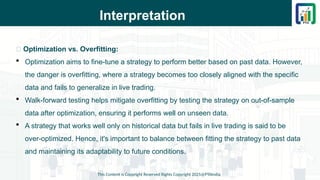

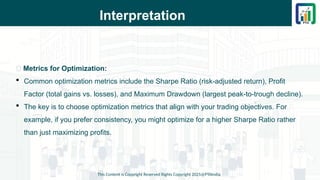

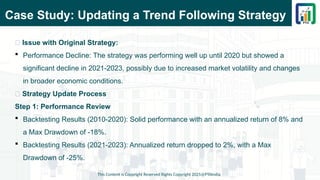

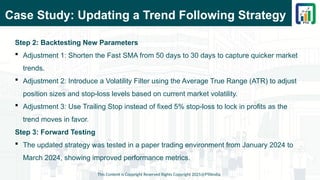

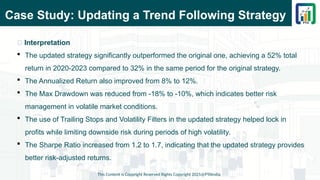

Section 12 - Chapter 2 - Applying Quantitative Techniques - Presented by Rohan Sharma - The CMT Coach - Chartered Market Technician CMT Level 2 Study Material - CMT Level 2 Chapter Wise Short Notes - CMT Level 2 Course Content - CMT Level 2 2025 Exam Syllabus Visit Site : www.learn.ptaindia.com and www.ptaindia.com