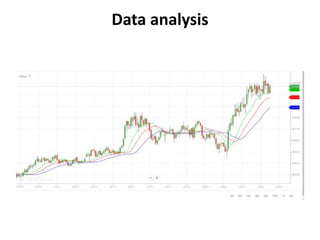

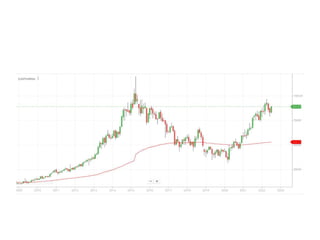

The document analyzes price fluctuations and market trends in Indian pharma stocks using technical analysis tools like the Alligator, Ehler Fisher Model, VWAP, MACD, and Super Trend indicators. It finds that stocks like Cipla showed an uptrend from 2010-2015 and potential uptrend in 2022, while Sun Pharma showed an uptrend in 2010-2015 but downturns in later periods. The analysis suggests choosing indicators based on market conditions and trader comfort levels to help identify optimal times to enter and exit positions in these pharma stocks.