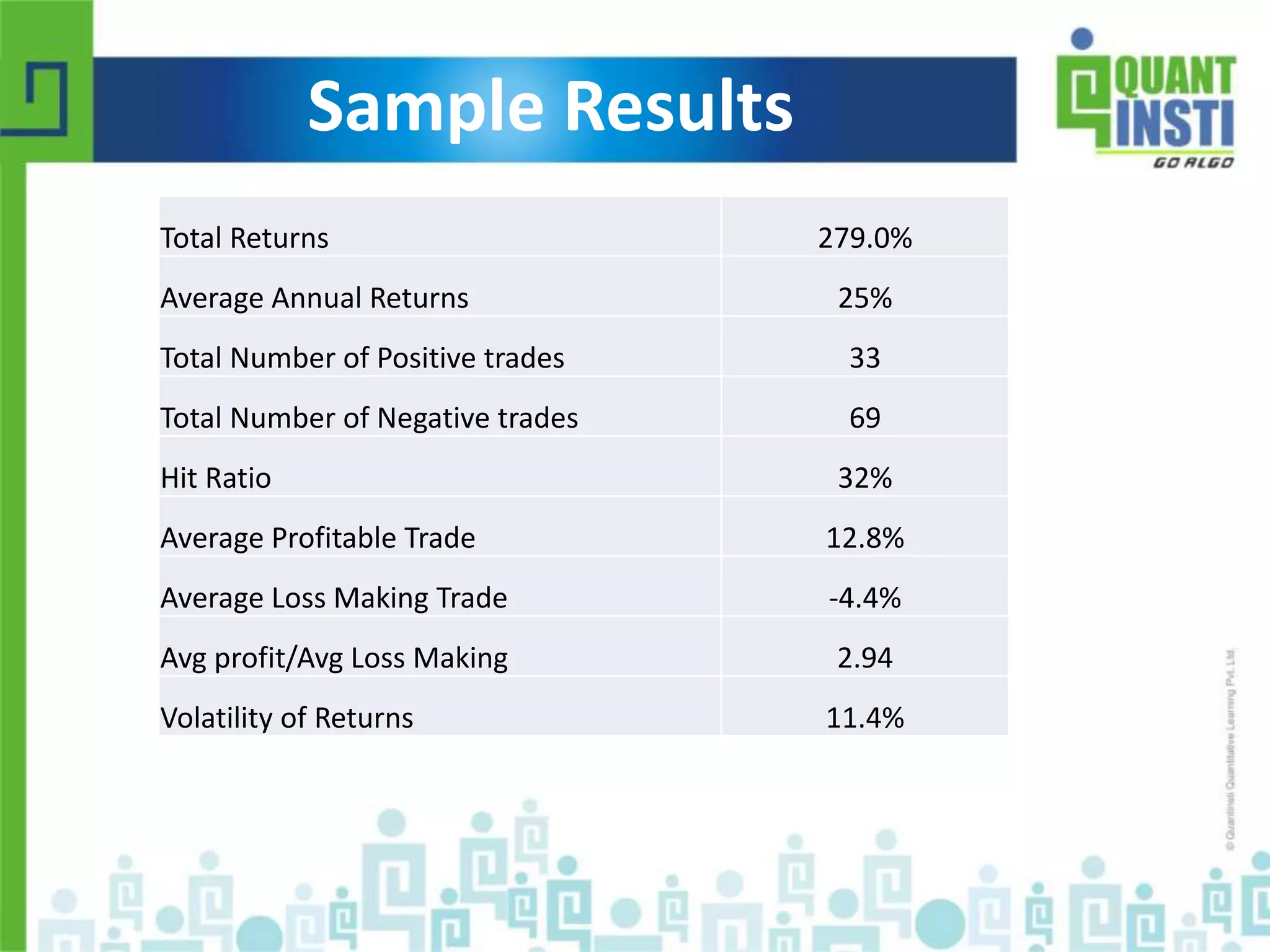

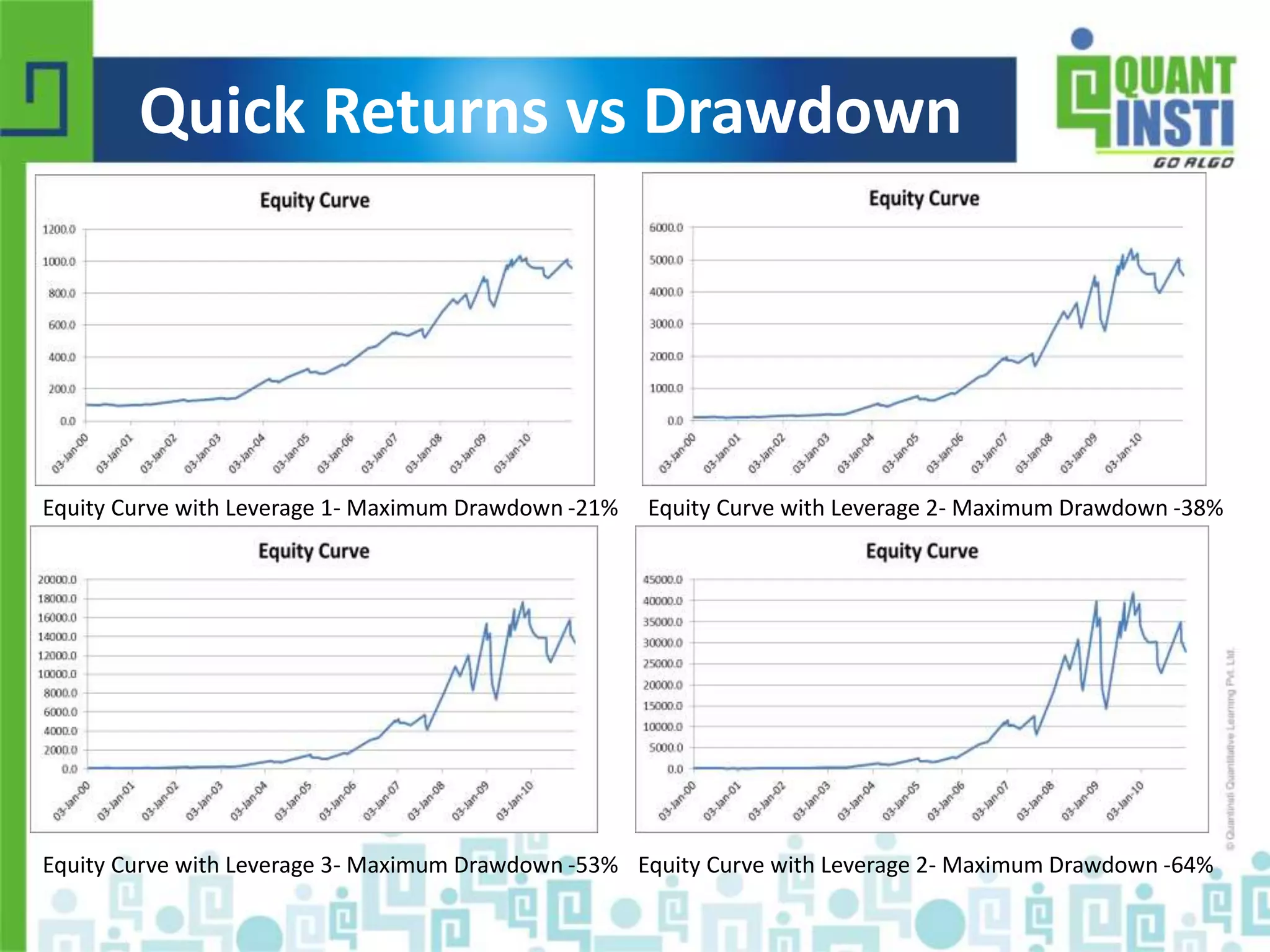

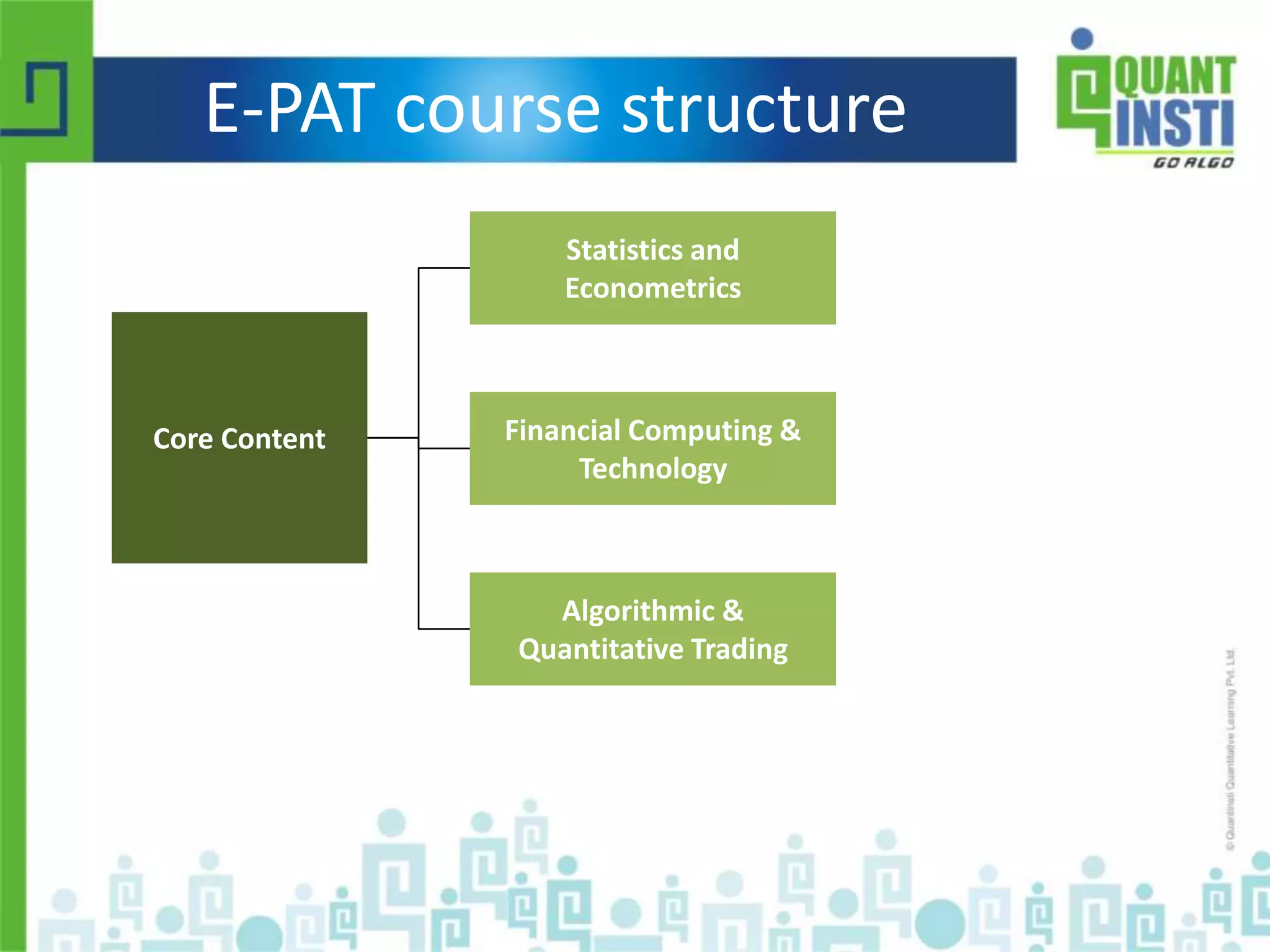

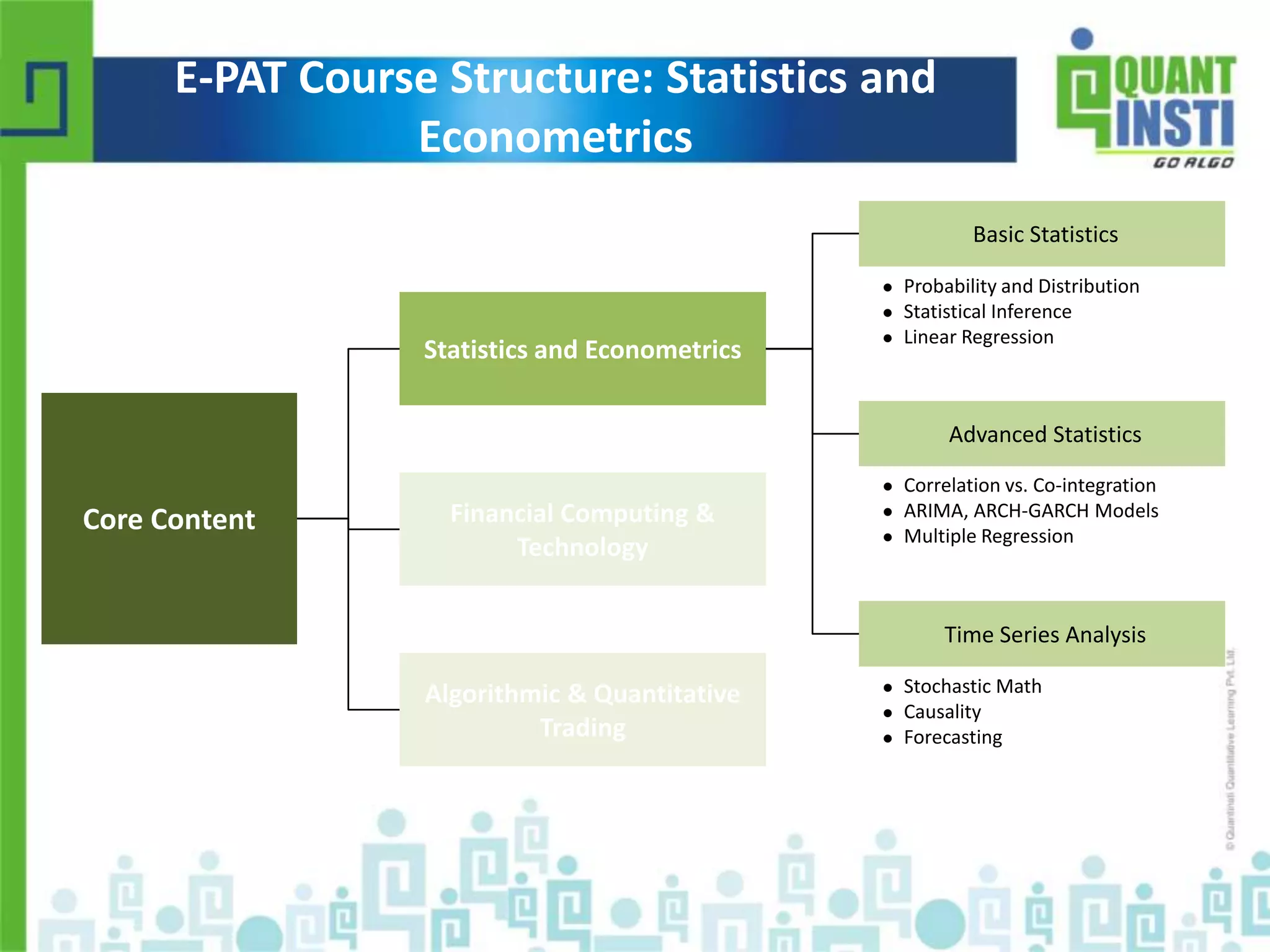

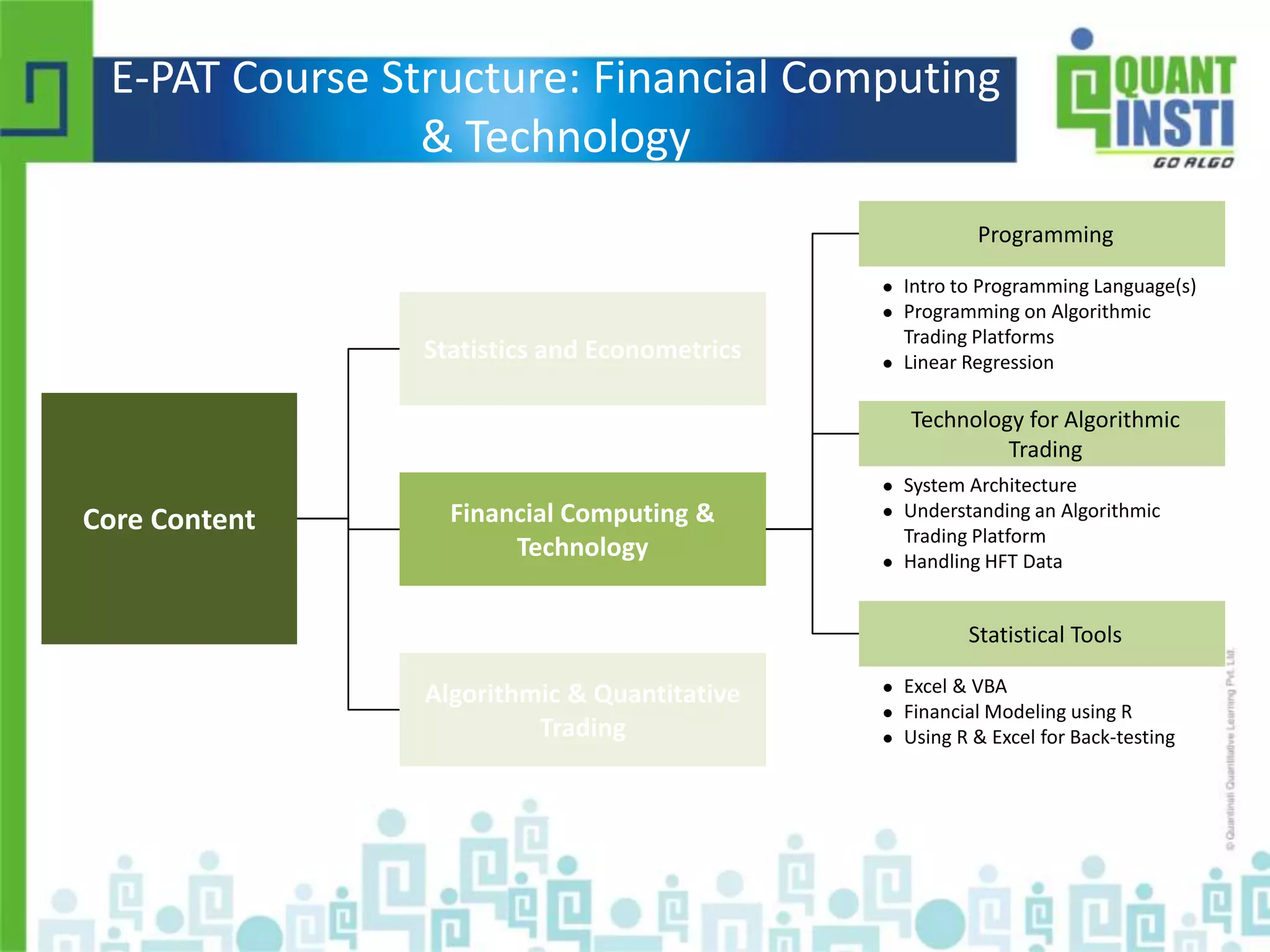

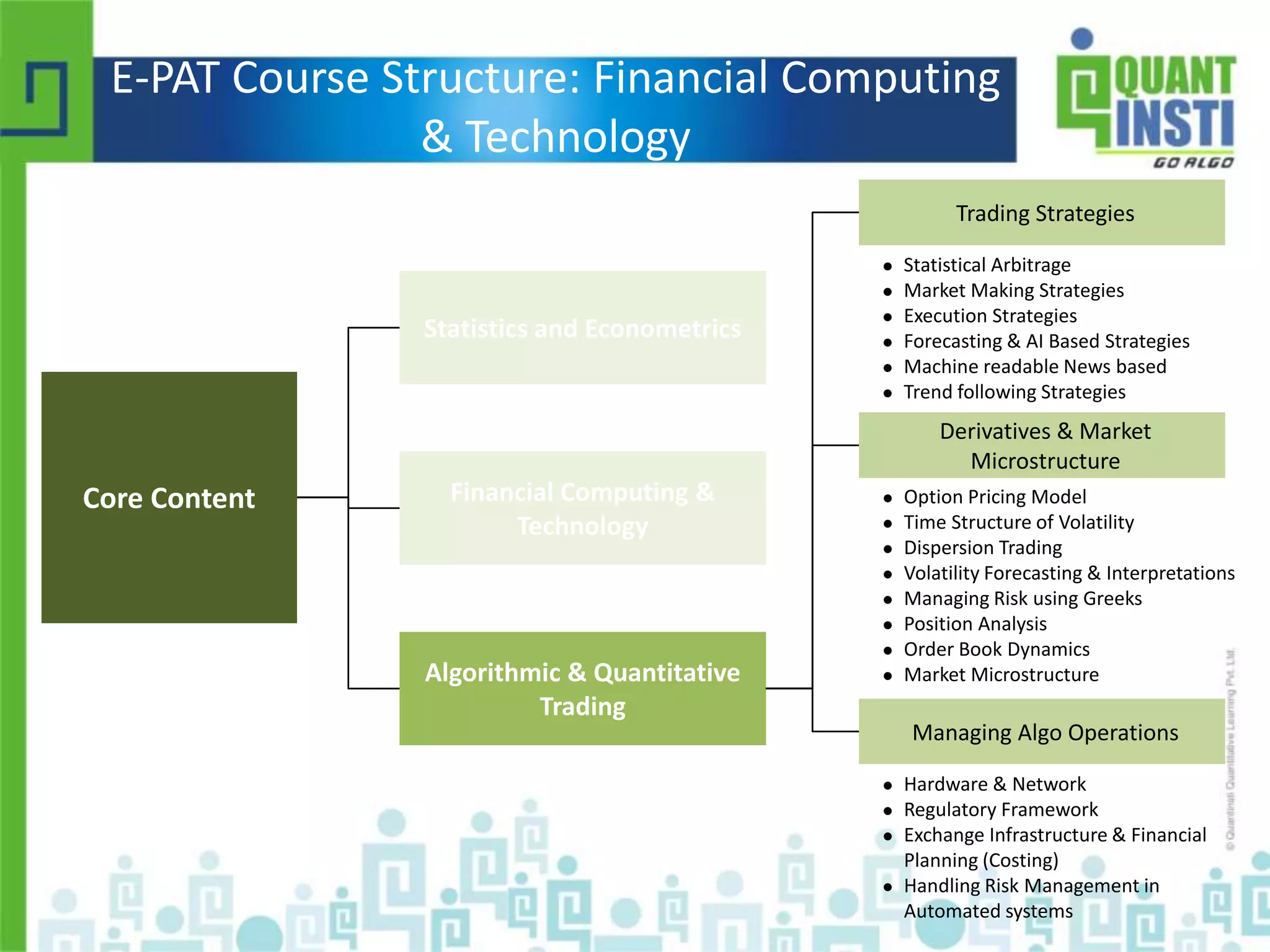

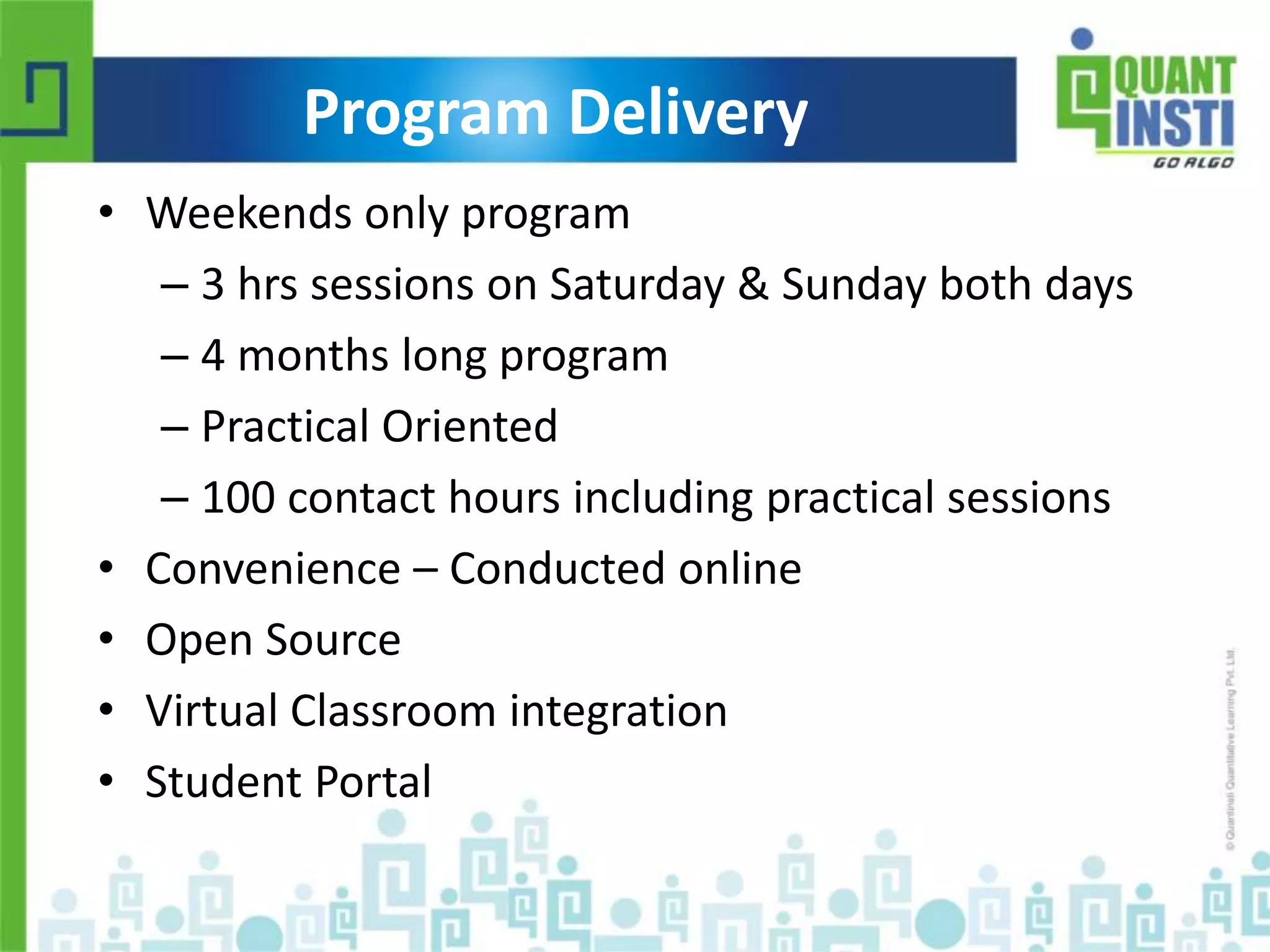

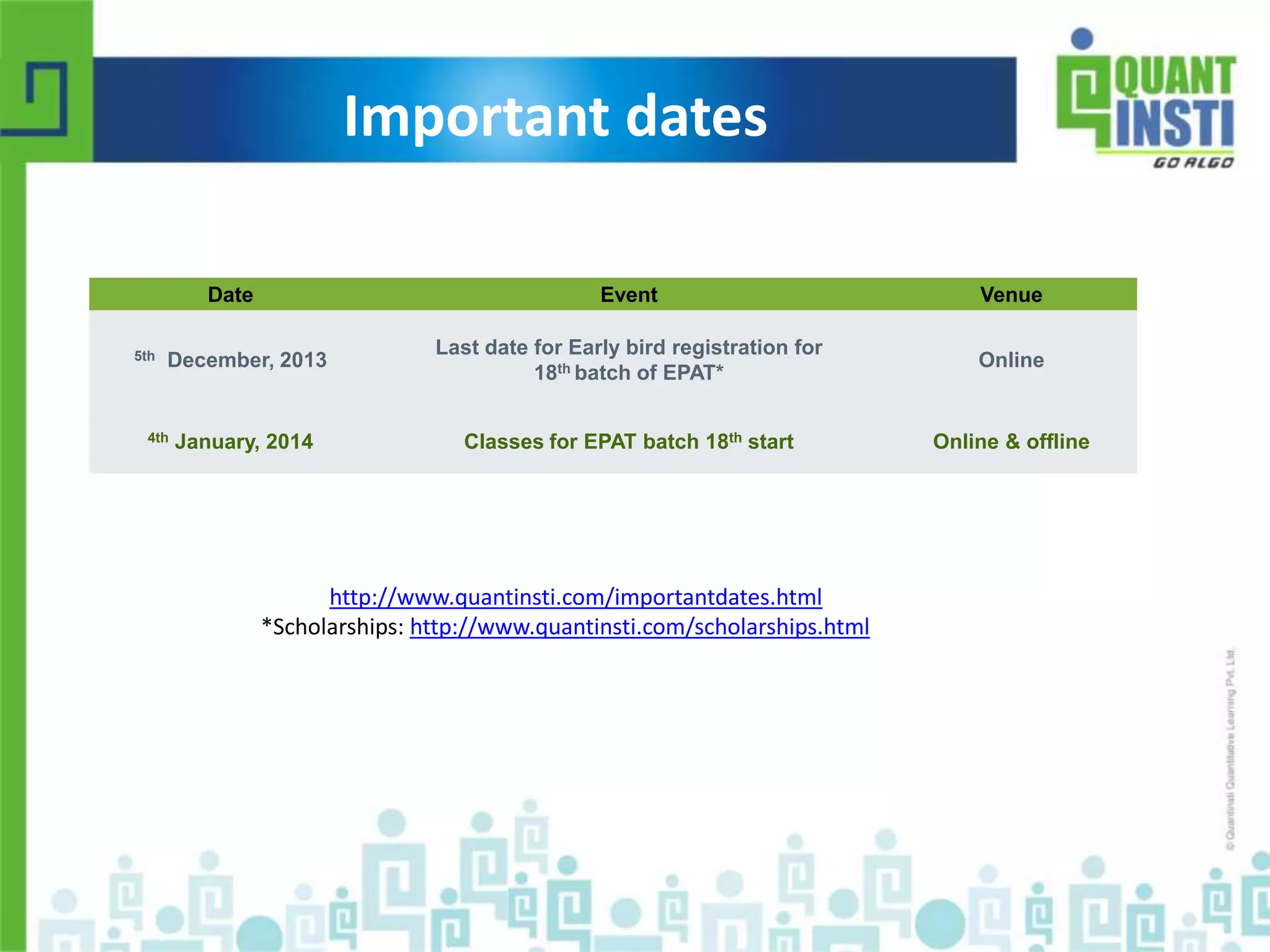

The document outlines the process of designing and implementing trading strategies, emphasizing the importance of hypothesis formulation, back-testing, and optimization. It discusses various trading strategies, the significance of risk assessment, and provides sample results for a trading strategy based on moving averages. Additionally, it offers details about a structured course on algorithmic and quantitative trading, including course content and delivery methods.