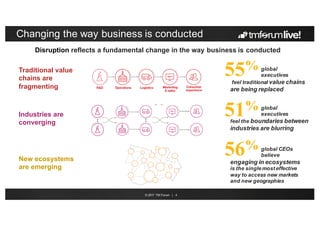

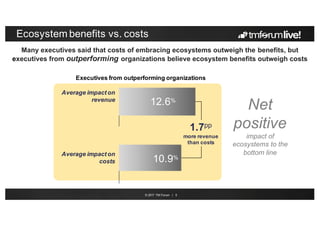

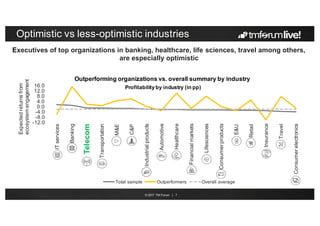

The document discusses the growing importance of digital platforms and ecosystems for businesses. It notes that 90% of executives believe ecosystems will change their organizations, and over half of global executives feel traditional value chains are being replaced by ecosystems. The document also discusses the value of APIs for expanding business opportunities and revenues, though telecom executives still need to improve in deploying APIs. Finally, it notes that while CSPs have an opportunity to become platform providers due to existing trust and security capabilities, they also face significant risks to privacy and security from criminal threats if digital trust is broken.

![© 2017 TM Forum | 8

Expected and unexpected ecosystem gains

Businesses embrace ecosystems because they

anticipate benefits from participation and

engagement

But the innovation unleashed through

ecosystems can also produce new

opportunities that may not have even been

considered in their absence

Benefits from ecosystems can therefore be

magnified – what we call dynamic (unexpected)

innovation

Ecosystems yield planned and unexpected

gains1

An edge of unexpected gains over expected

gains (revenues)

Production

Possibility Frontier

Output 2

Output1

Source [1]: Production Possibility Frontier http://www.tutor2u.net/economics/reference/production-possibility-frontier

Ecosystems create opportunities unattainable in their absence](https://image.slidesharecdn.com/digitaltrustandtheapieconomy-170517054833/85/Digital-trust-and-the-api-economy-8-320.jpg)