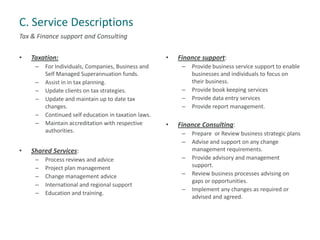

Schoenmaekers Pty Ltd provides strategic, financial, and tax solutions and support to individuals and businesses through a professional and personal approach. They aim to be a valued partner by providing services, support, solutions, and strategic initiatives related to management, finance, taxation, and change management. Leveraging 28 years of international and local expertise, Schoenmaekers works with customers to ensure their needs are met through an end-to-end solution either directly or through their global network of associates.