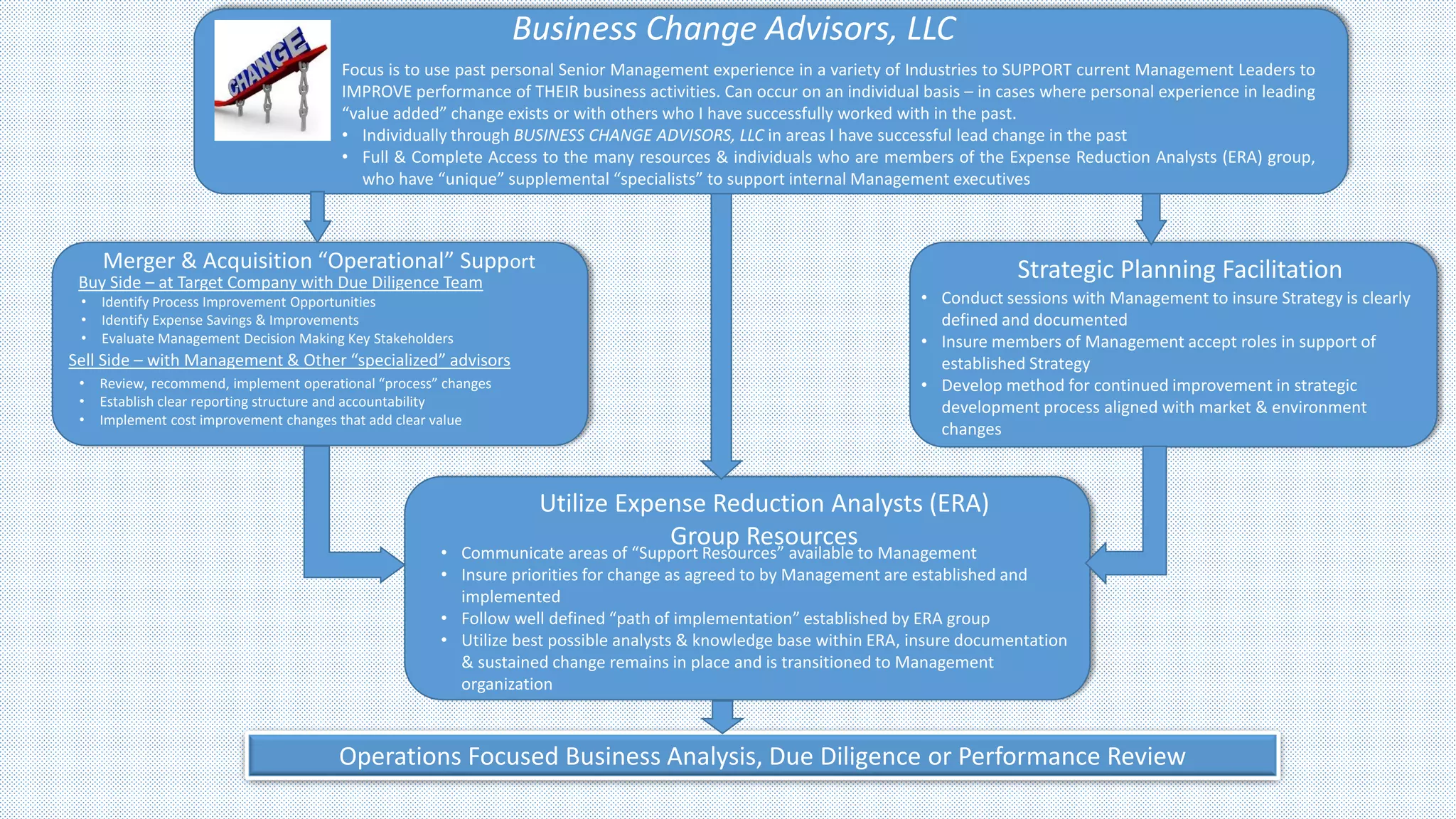

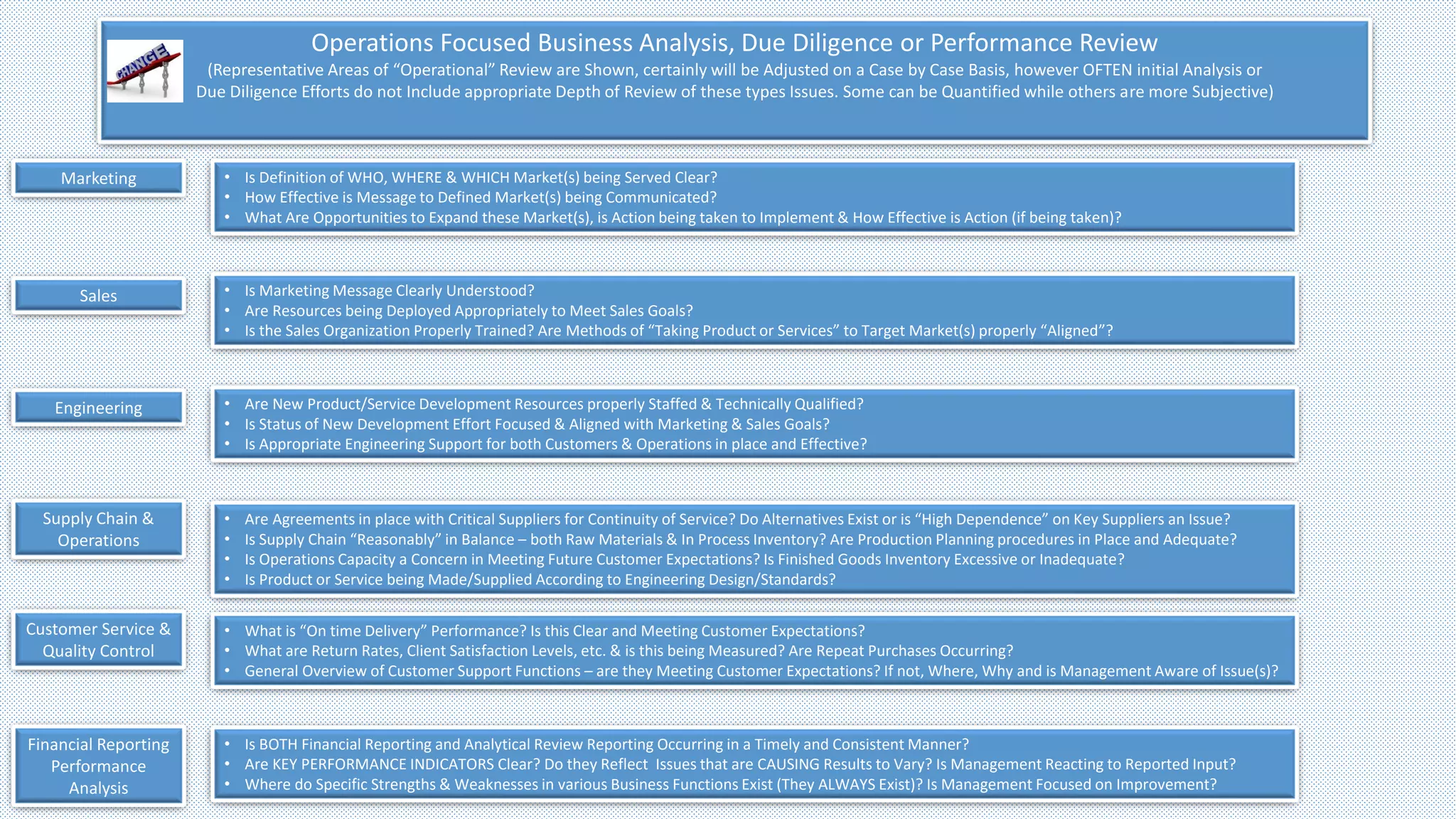

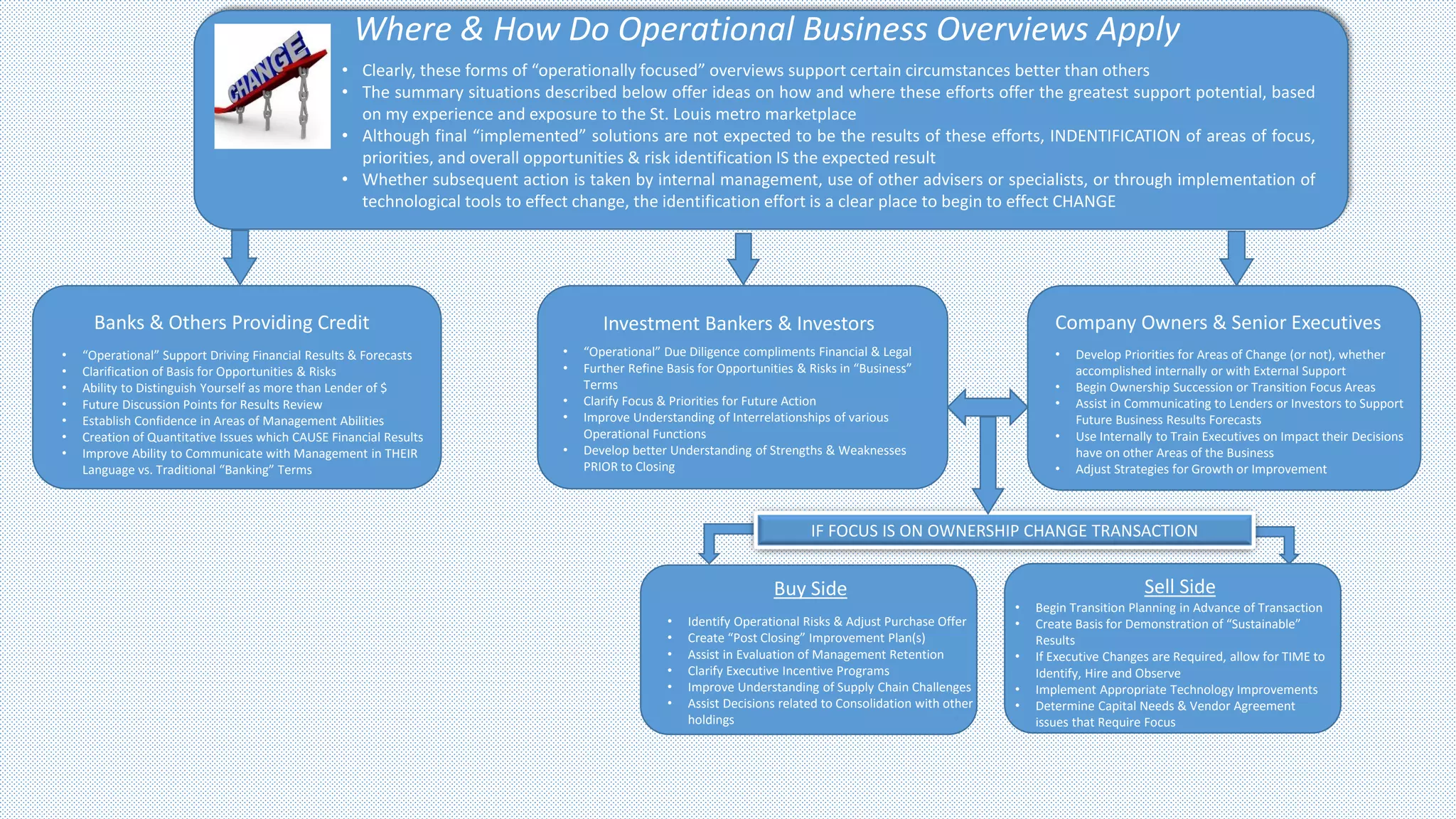

Business Change Advisors provides senior management consulting services to support business improvement. They utilize past experience leading change across industries to help clients improve performance. Services include operational assessments, strategic planning, expense reduction strategies, and merger/acquisition support. The goal is to identify specific opportunities to strengthen areas like marketing, sales, supply chain management, and financial reporting.