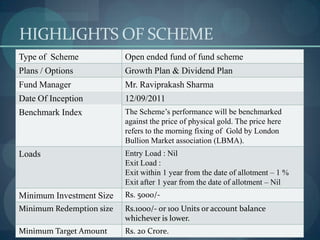

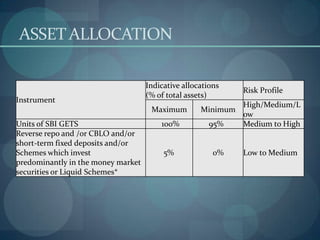

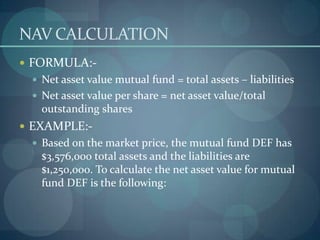

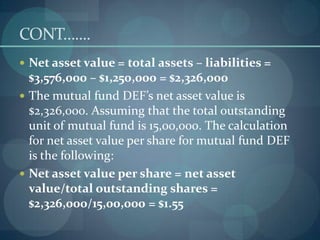

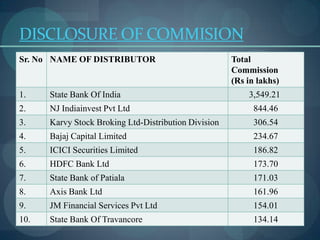

This document discusses SBI Gold Fund, a mutual fund scheme offered by SBI Mutual Fund. It provides an overview of the fund, including its objectives to track returns of SBI Gold Exchange Traded Fund, asset allocation of 95-100% in SBI GETS and 0-5% in money market instruments, and features like no requirement for a demat account, liquidity, and availability of systematic investment plans starting from Rs. 100 per month. The document also covers details like net asset value calculations, historical NAV data, and commissions disclosed to distributors for selling various SBI MF schemes.