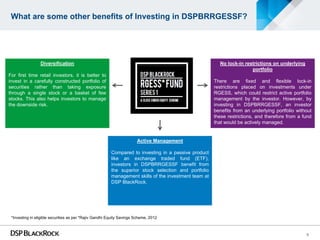

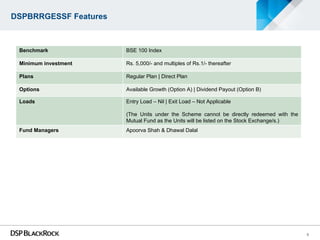

DSP BlackRock RGESS Fund – Series 1 (DSPBRRGESSF) is a close ended equity scheme that invests in stocks eligible under the Rajiv Gandhi Equity Savings Scheme, 2012 (RGESS) to provide tax benefits to new retail investors. The fund will invest 95-100% of its corpus in RGESS eligible securities including stocks in the CNX 100 and BSE 100 indices and public sector company stocks. It may also invest up to 5% in cash and money market instruments. The fund offers growth and dividend payout options with no entry or exit loads.