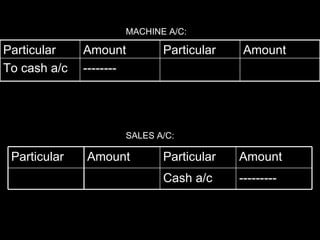

The document summarizes accounting transactions for a new sandwich outlet business. It includes [1] starting the business with capital of Rs. 40,000, [2] purchasing assets like furniture and machinery, [3] paying rent and buying ingredients, and [4] making sales of Rs. 2,000 from 20 sandwiches. The accounting entries are made in the books to record increasing assets by debiting cash and crediting capital on starting the business, debiting vending machine and crediting creditors for the purchase, and debiting cash and crediting sales for revenues earned. Ledger accounts are also shown for the transactions.