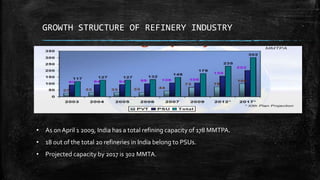

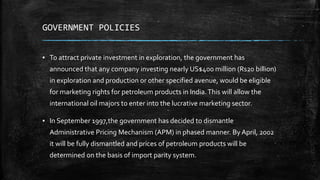

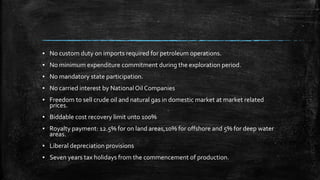

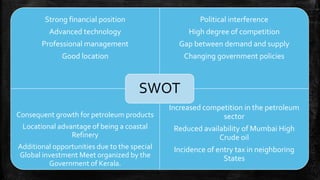

The Indian refinery industry has grown significantly over time. Refining capacity has increased from 62 MMTPA in 1998 to 215 MMTPA currently. Major challenges include crude oil sourcing, improving margins, and addressing environmental issues. The government has implemented policies to attract private investment and dismantle administrative pricing. Key players in the industry include Reliance, BPCL, HPCL, and Essar Oil. The industry is oligopolistic in nature.