The document proposes developing a 90-270 MW wind farm in Romania with an estimated cost of €450 million. The wind farm would be built on 400 hectares of leased land in the Oltenia region with average wind speeds of 7.2 m/s. The development is estimated to take 2 years with operational activity beginning in the third year, generating an estimated €42.1 million in annual revenue. The project is expected to have a return on investment of 21.9% and payback period of less than 7 years.

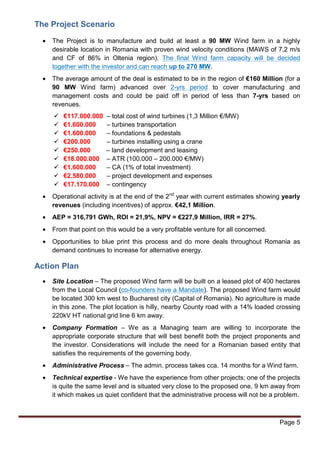

![Page 4

Horary

wind

speed

[m/s]

Hours %

Enercon

E-82 E3

[kW]

Power

[kW]

Siemens

SWT-3-101

[kW]

Power

[kW]

Enercon

E-126

[kW]

Power

[kW]

3,5 35 0.53 55 1925 50 1750 115 4025

4 44 0.67 82 3608 70 3080 175 7700

5 74 1.13 174 12876 165 12210 410 30340

6 135 2.06 321 43335 310 41850 760 102600

7 356 5.44 532 189392 500 178000 1250 445000

8 580 8.85 815 472700 790 458200 1900 1102000

9 586 8.95 1180 691480 1115 653390 2700 1582200

10 620 9.47 1580 979600 1510 936200 3750 2325000

11 645 9.85 1900 1225500 1850 1193250 4850 3128250

12 655 10 2200 1441000 2000 1310000 5750 3766250

13 525 8.02 2480 1302000 2420 1270500 6500 3412500

14 495 7.56 2700 1336500 2650 1311750 7000 3465000

15 384 5.86 2850 1094400 2830 1086720 7350 2822400

16 344 5.25 2950 1014800 3000 1032000 7500 2580000

17 296 4.52 3020 893920 3020 893920 7580 2243680

18 248 3.79 3020 748960 3020 748960 7580 1879840

19 185 2.82 3020 558700 3020 558700 7580 1402300

20 134 2.05 3020 404680 3020 404680 7580 1015720

21 115 1.76 3020 347300 3020 347300 7580 871700

22 65 0.99 3020 196300 3020 196300 7580 492700

23 17 0.26 3020 51340 3020 51340 7580 128860

24 12 0.18 3020 36240 3020 36240 7580 90960

TOTAL 6.550 100 13.046.556 12.726.340

32.899.025

Table 1: 3 Turbine Models Power calculations

Business Opportunity

The potential of Romania in wind energy is considered the highest in SEE. The Oltenia,

Moldova and Dobrogea provinces were considered the most appropriate areas for Wind farm

developments. Even if the wind is free, wind energy producers receive incentives (Green

Certificates) from the state besides the electricity retail price, because the investments are

very high. Through its progressive legislation, the government is creating one of Europe’s

friendliest environments for RE developers and is encouraging future investments in the wind

sector and not only. So, since 2004 green energy producers receive 1 Green Certificate for

each MWh of energy delivered into the system. In July 2010, the Romanian Parliament

amended the law 139/2010 giving more incentives to RE producers. Finally, in July 2011, the

European Commission had approved the law 139/2010. For instance, those in the wind

sector (where 80% of green energy investments will go), get 2 Green Certificates for 1

MWh until 2017 after that just single but it’s not the case anymore as ANRE notified on

overcompensation issue so, the Parliament amended the law GD 994/2013 in December

2013. Main changes regard the reduction of Green Certificates for wind from 2 to 1,5 took

place in January 1, 2014. These changes will be effective until January 1, 2018. After that,

other reduction of Green Certificates will take place from 2 to 1,75 for 1 MWh.](https://image.slidesharecdn.com/rwfpr90-141022135817-conversion-gate01/85/RWF-PR90-4-320.jpg)