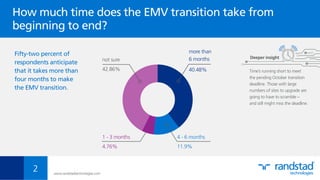

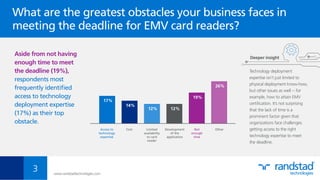

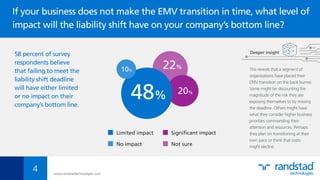

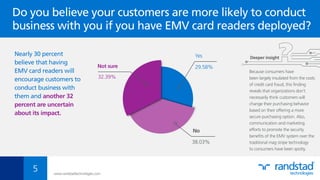

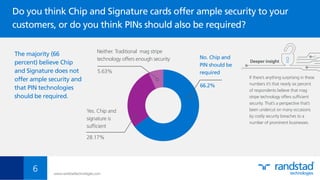

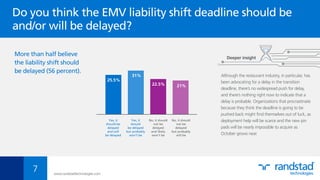

The survey found that while 58% of respondents reported actively preparing for the EMV transition deadline in October, 42% had either not taken steps or were unsure about preparations. The top obstacles cited were lack of time (19%) and access to deployment expertise (17%). Additionally, 66% of respondents believed that chip and signature technology did not offer sufficient security compared to chip and PIN. Over half of respondents thought the liability shift deadline should be delayed, though delay appears unlikely. In conclusion, the survey revealed that many businesses may miss the deadline due to delays in preparation and lack of expertise as the deadline approaches.