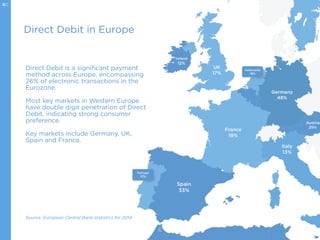

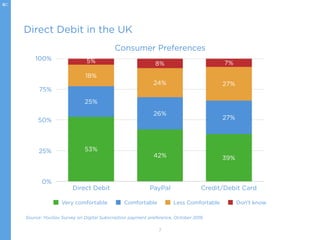

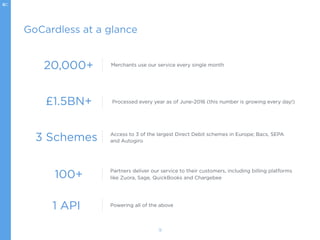

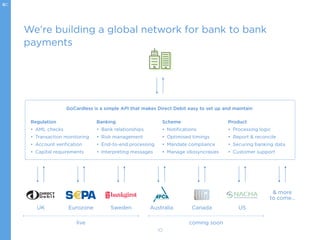

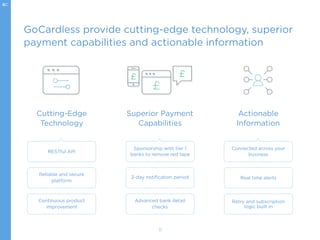

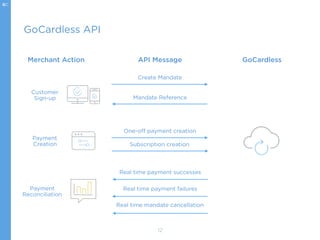

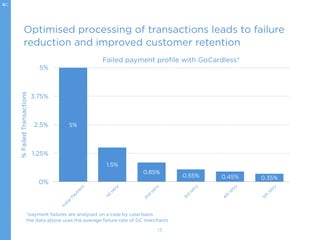

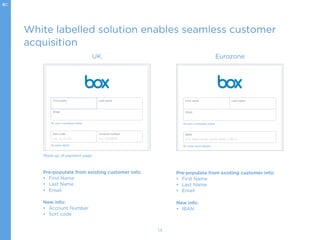

The document explains the advantages of using direct debit as a payment method, highlighting its cost-effectiveness, low failure rates, and consumer preferences in Europe, particularly in the UK, Germany, and France. GoCardless offers a simple API for setting up direct debits with automation and compliance, thus enhancing cash flow and customer retention. Direct debit accounts for 26% of electronic transactions in the eurozone, demonstrating its significance and acceptance across various markets.