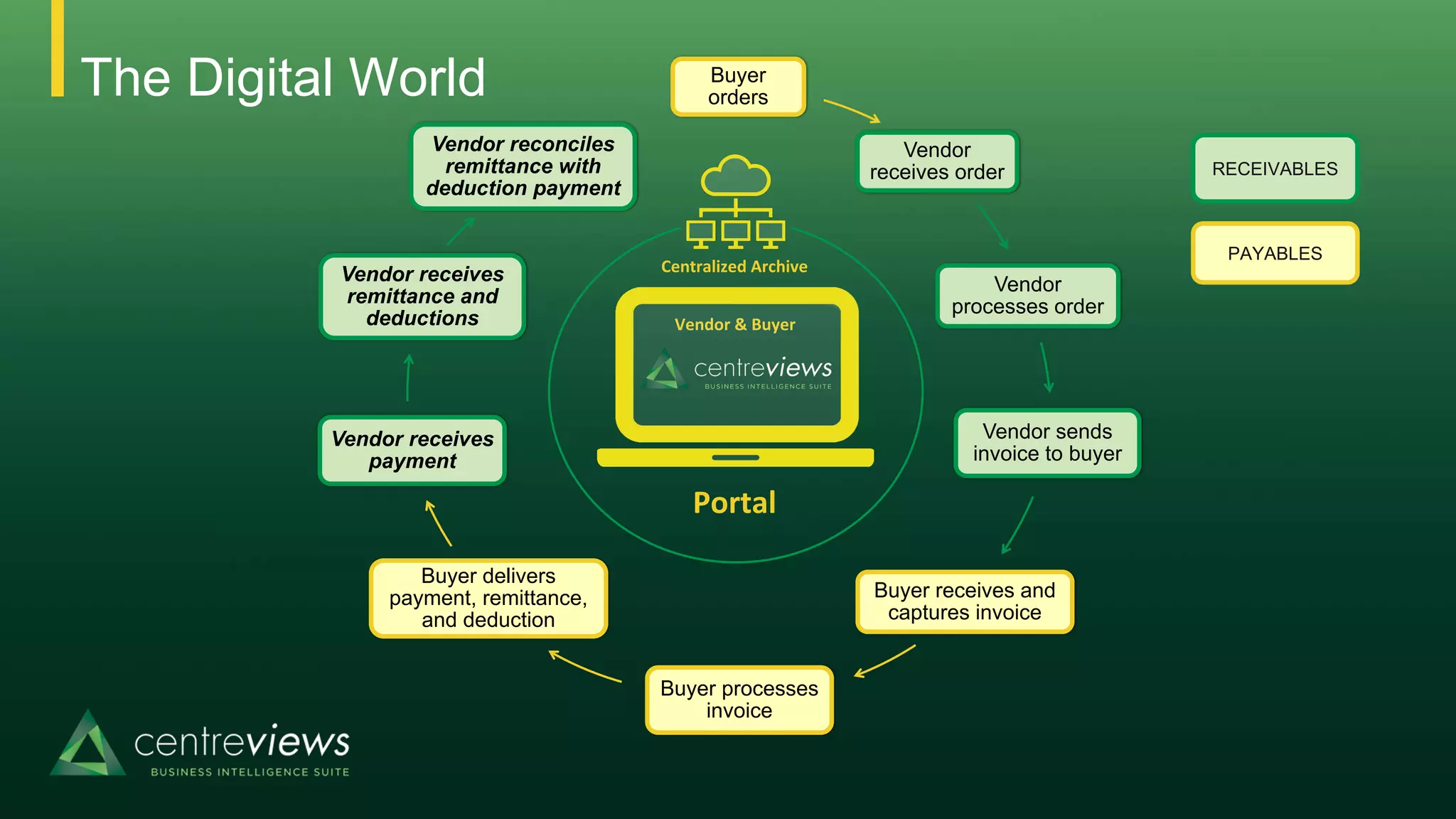

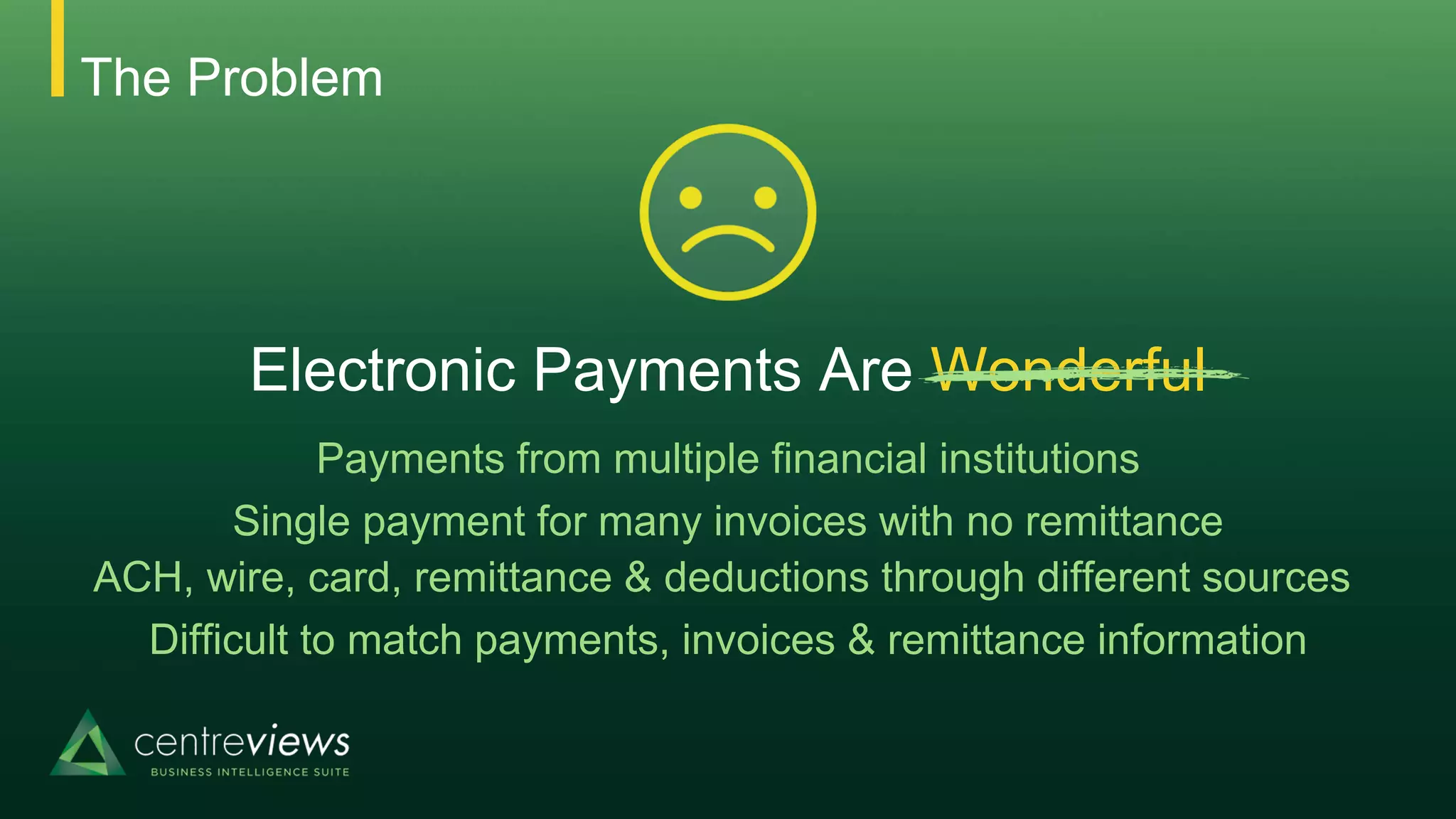

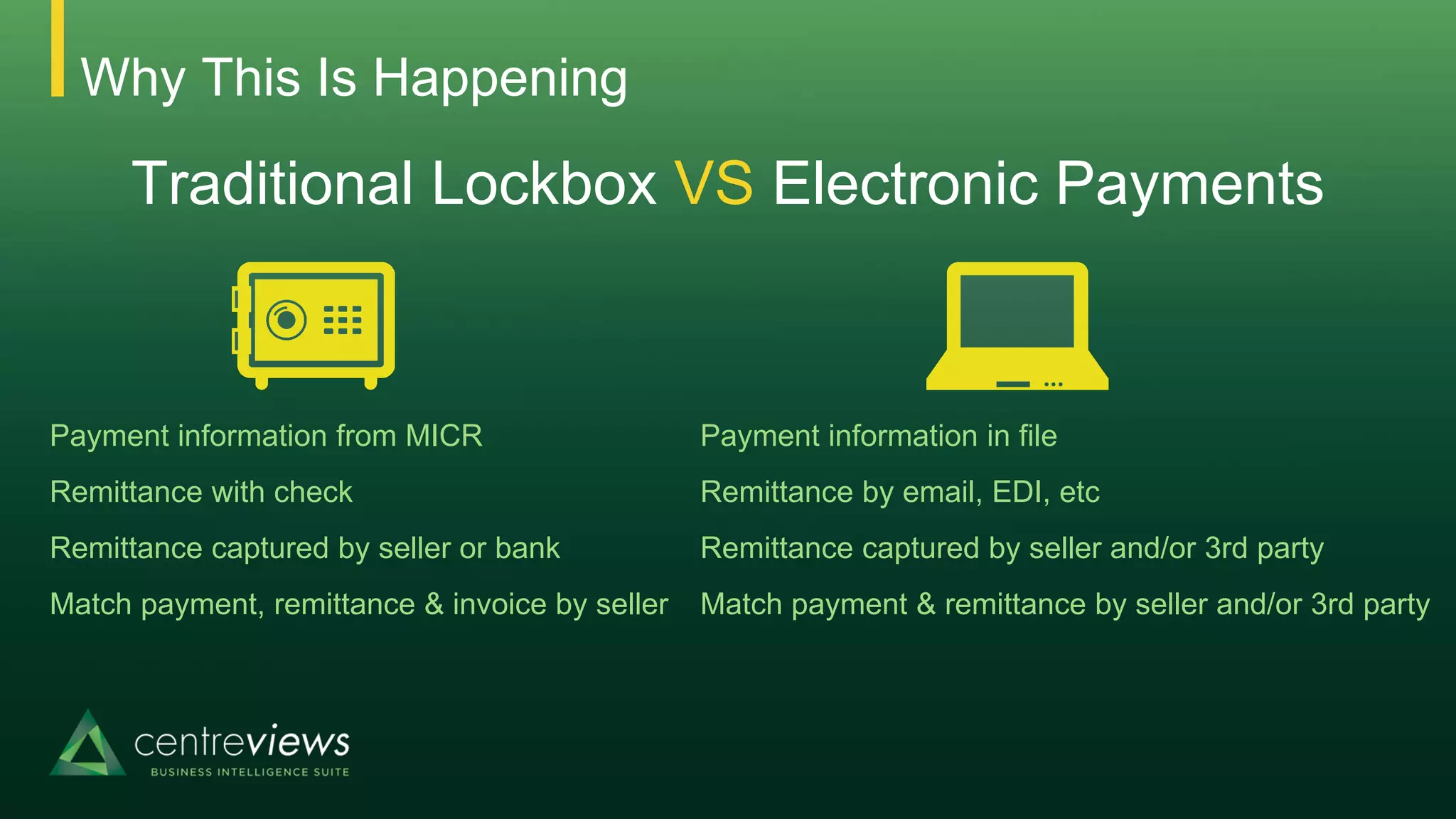

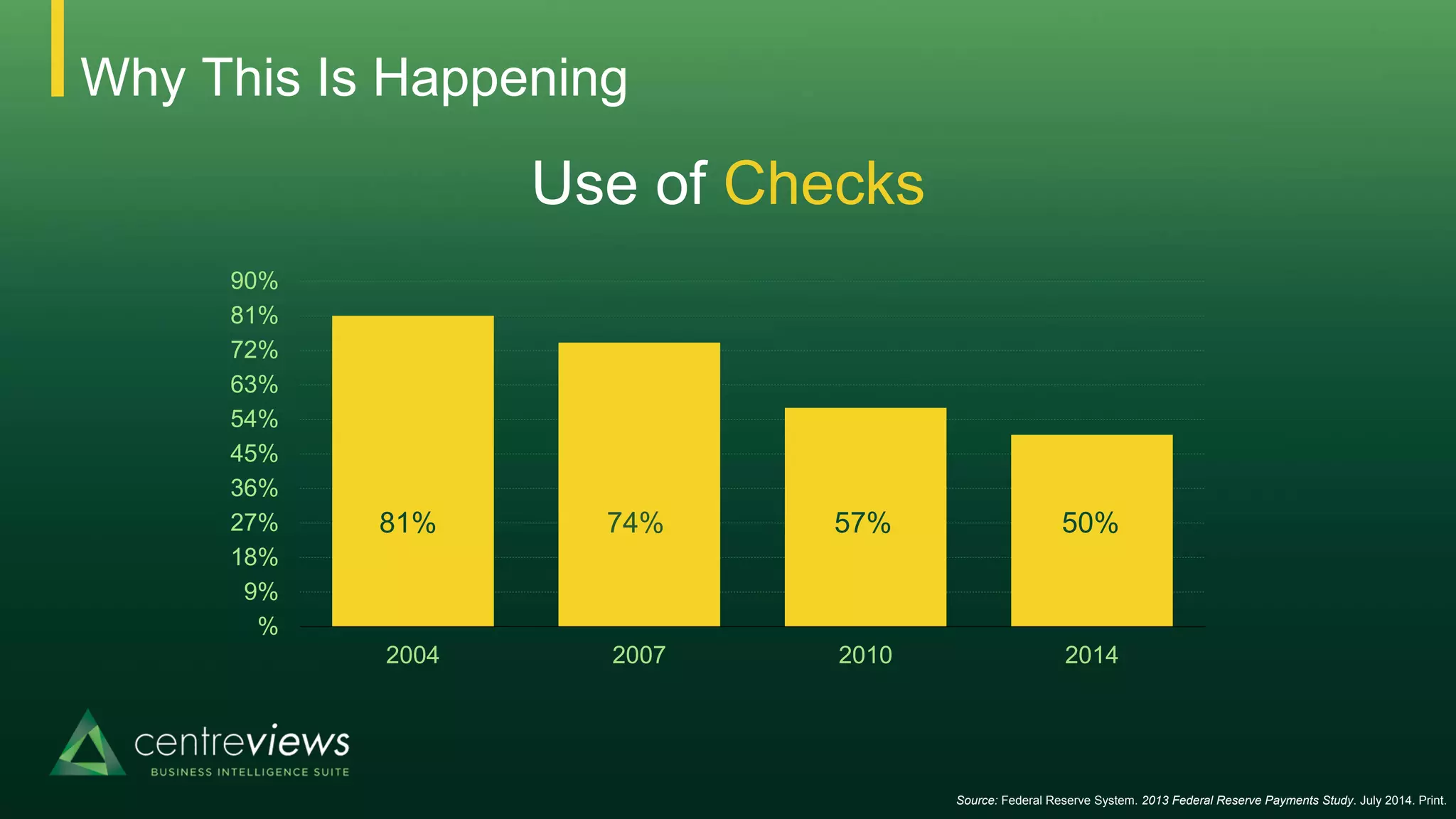

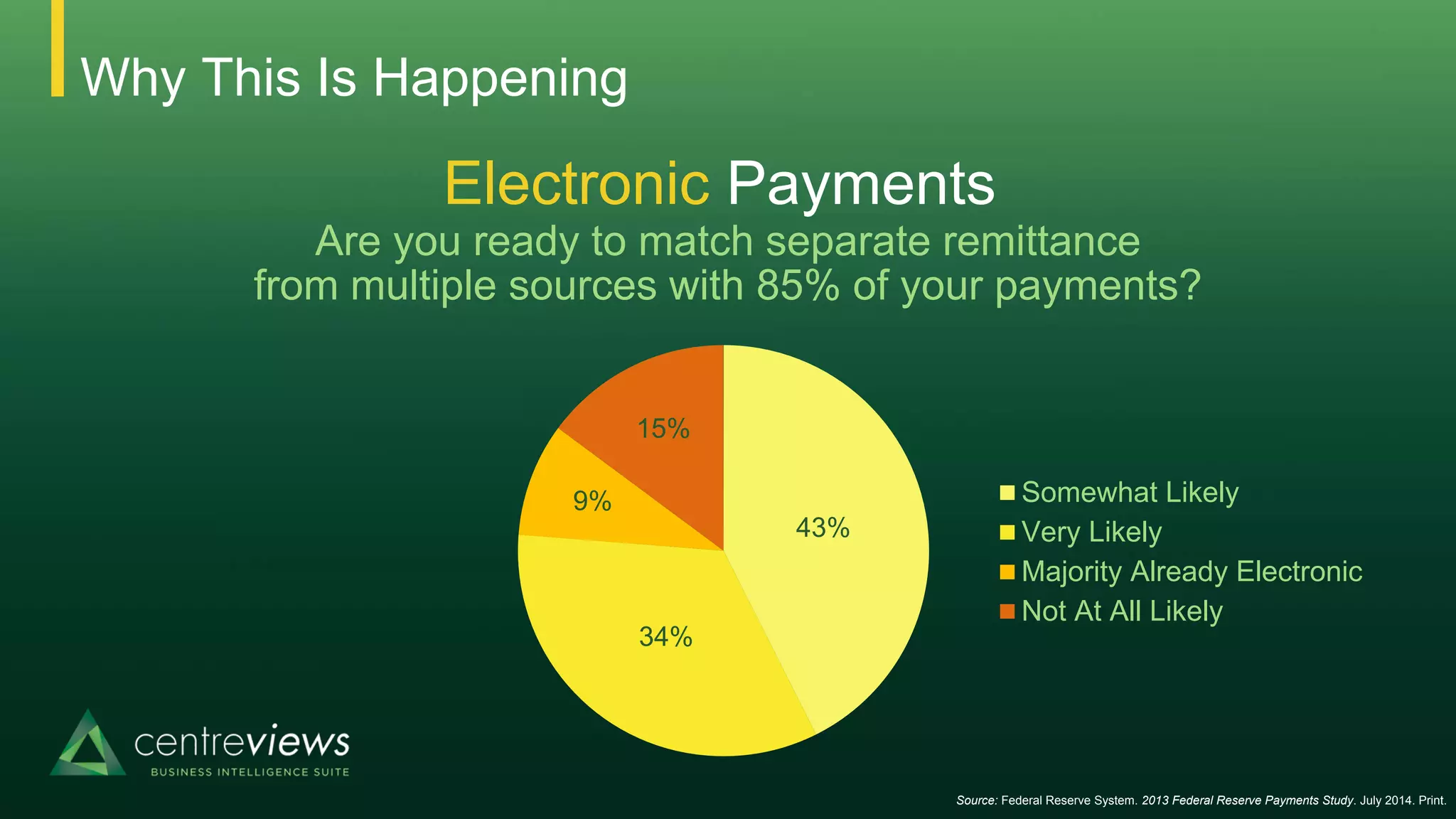

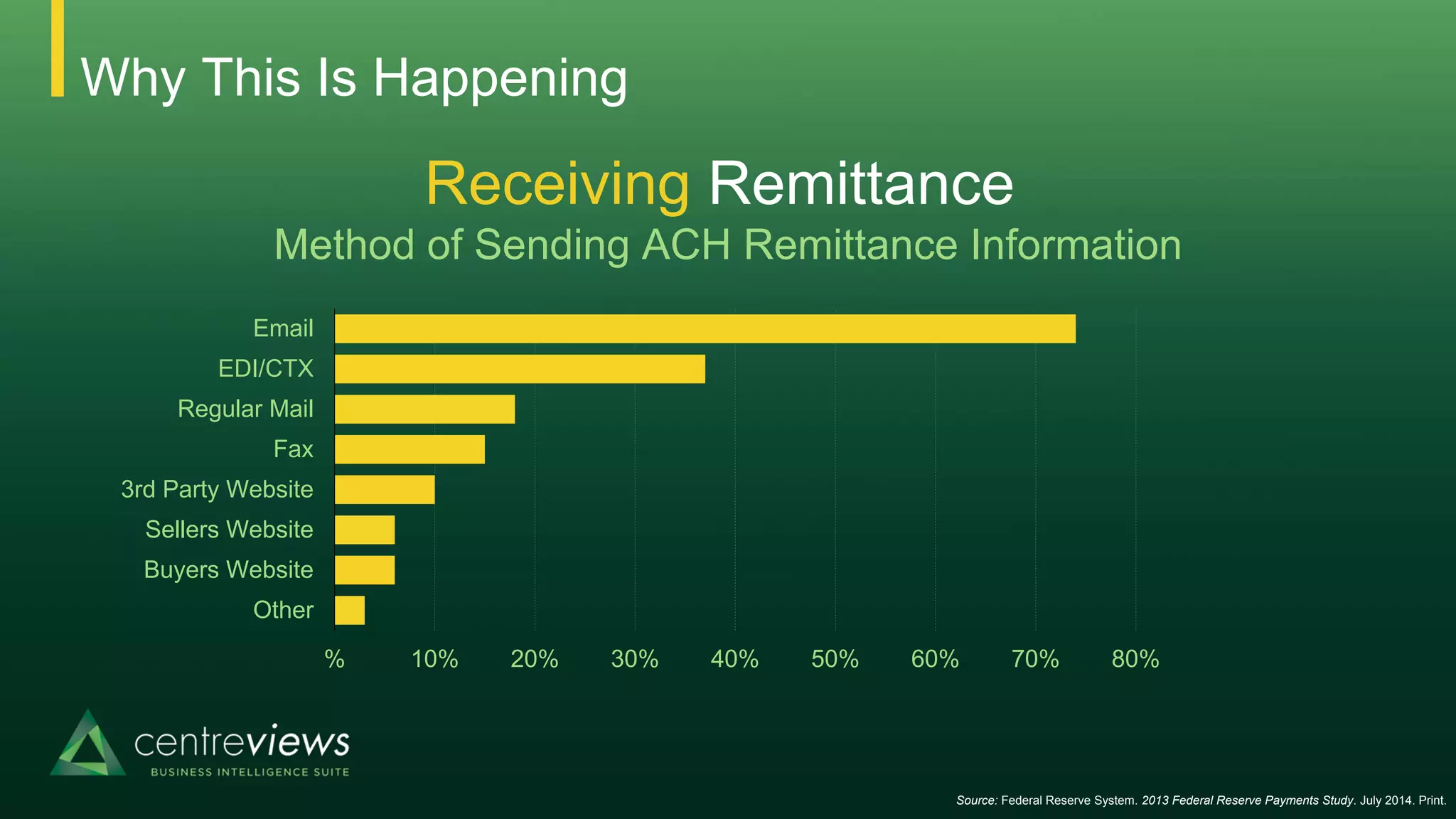

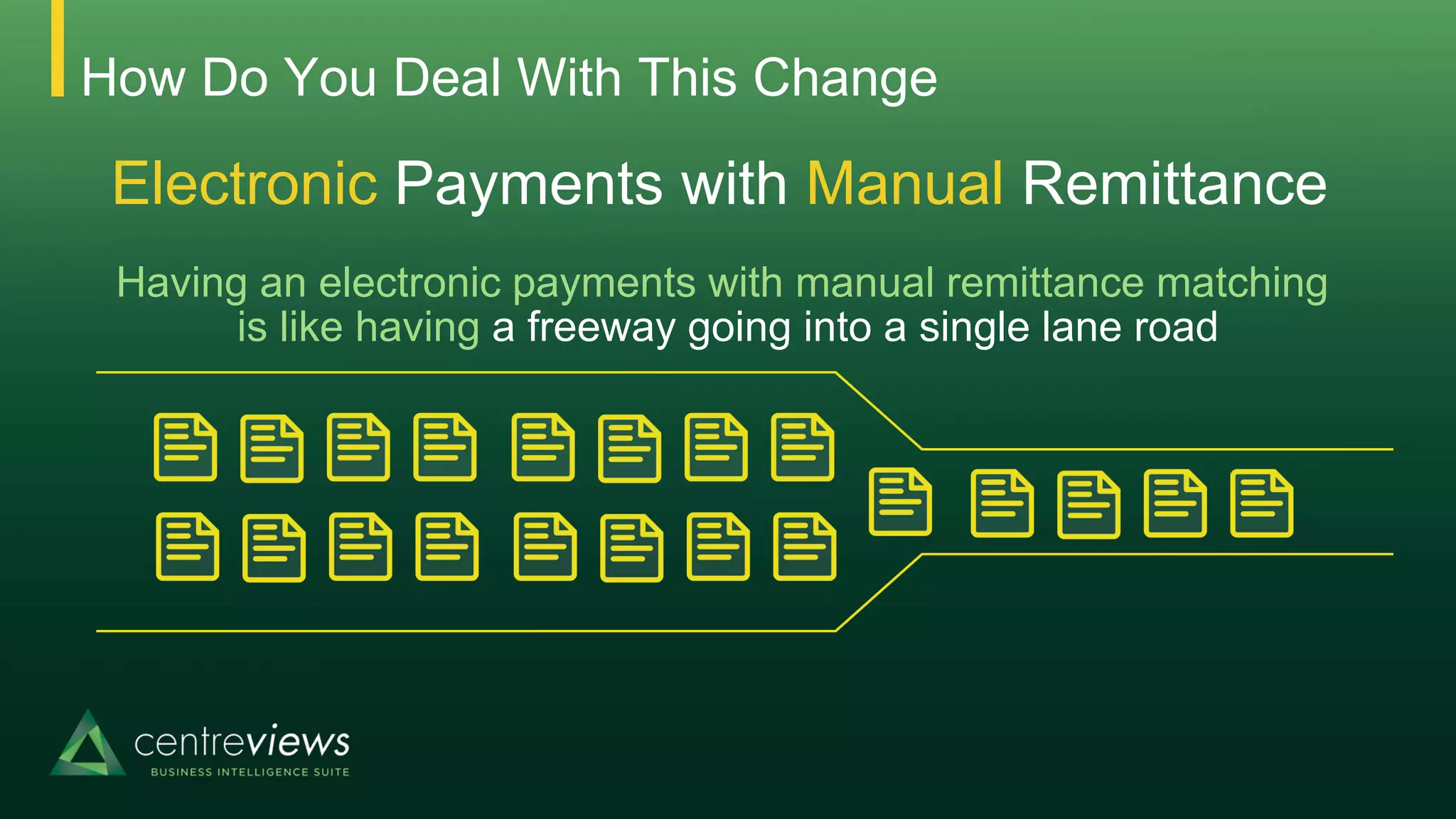

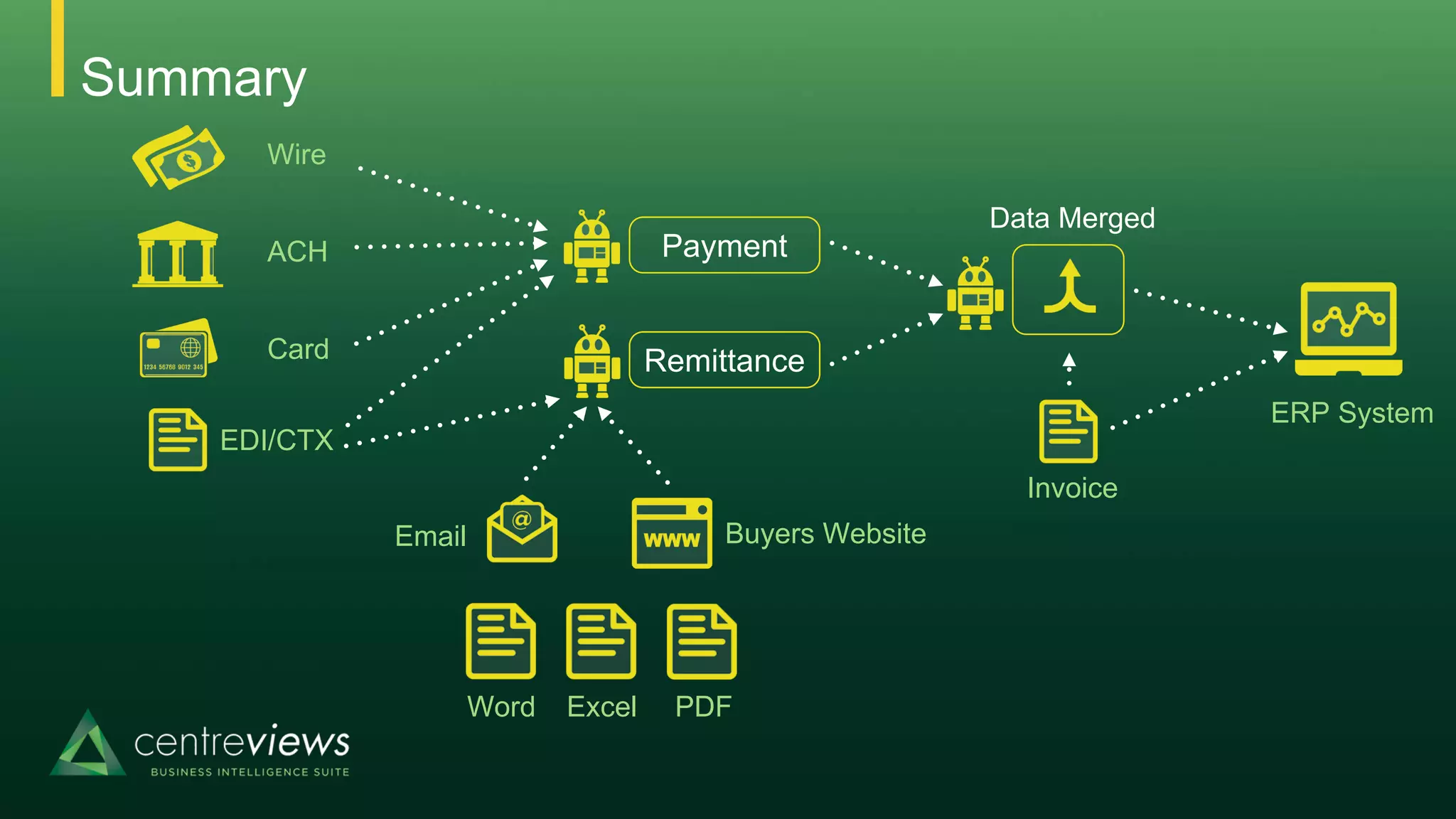

The document discusses the remittance challenges in a digital payment landscape, highlighting issues with matching payments and invoices due to information coming from various sources. It contrasts the advantages and disadvantages of electronic payments for buyers and sellers while emphasizing the need for improved remittance processing solutions. The text suggests considering software as a service for rapid implementation and expertise in managing electronic payment systems.