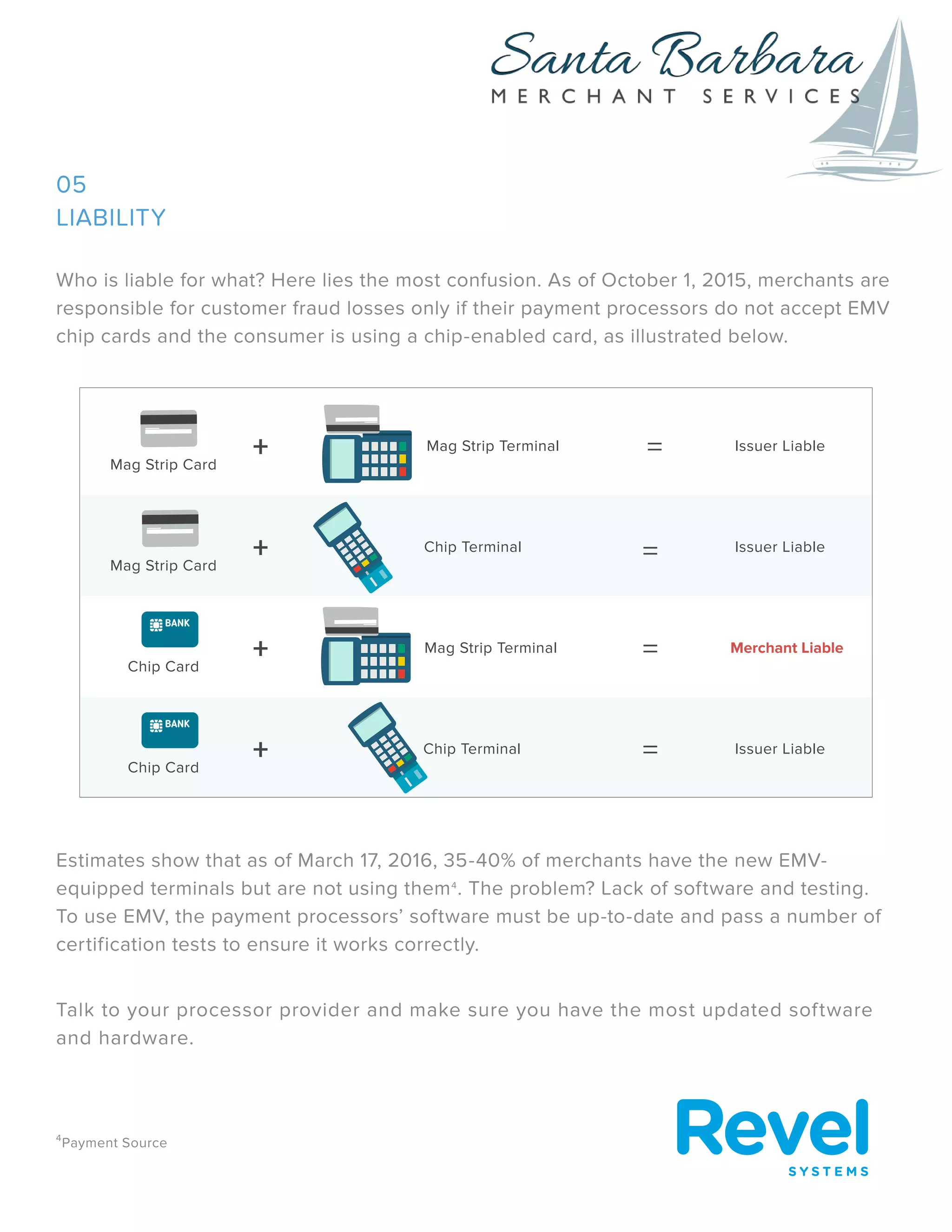

The document discusses EMV chip technology and how it provides more secure payment processing compared to magnetic stripe cards. It explains the basics of EMV (Europay, Mastercard, Visa) chips, how they work, and why the US is shifting to require their use. Merchants are advised to upgrade their point of sale systems and payment processors to be EMV compliant by a liability shift deadline of October 2015, after which they will be responsible for fraudulent transactions if they do not accept EMV chip cards. The case study of Cajun Kitchen restaurant describes how they selected Revel Systems' iPad-based point of sale solution to modernize their operations and ensure EMV compliance across their multiple locations.