Embed presentation

Download to read offline

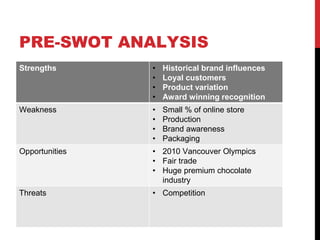

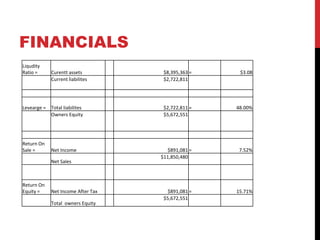

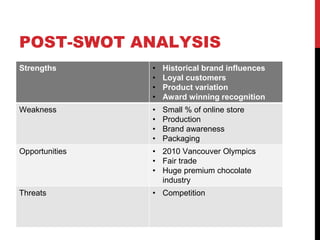

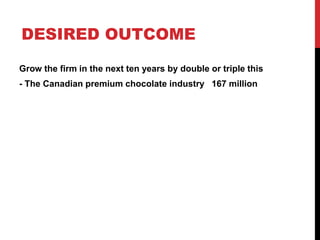

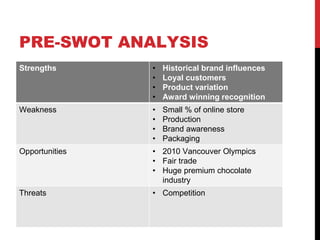

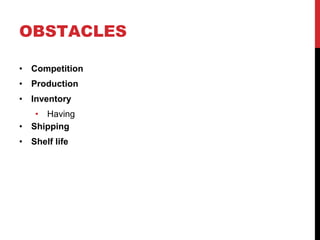

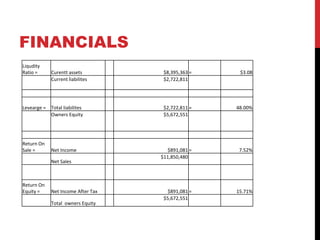

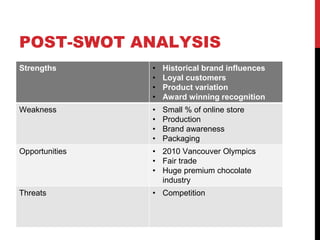

Team #4's case analysis document summarizes a premium chocolate company's goals, strengths, weaknesses, opportunities, threats, competitors, and proposed solution. The company aims to double or triple its size in 10 years. It has strengths in brand influence, loyal customers, product variety, and awards, but weaknesses in online sales, production, brand awareness, and packaging. Expanding its online sales is proposed to address weaknesses and help the company grow. Key competitors include Godiva, Bernard Callebaut, and Lindt.