Embed presentation

Download to read offline

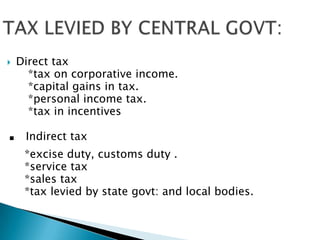

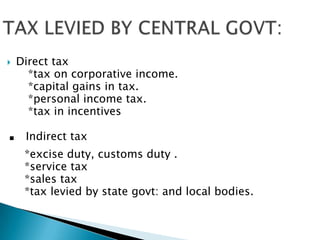

The document provides an overview of taxation systems in India. It discusses the history of taxation in India, noting a large taxable population existed. It also outlines the current tax system, including direct taxes like corporate, capital gains, and personal income tax levied by the central government. Indirect taxes levied by the central government include excise duty, customs duty, service tax, and sales tax. State governments and local bodies also levy certain taxes.