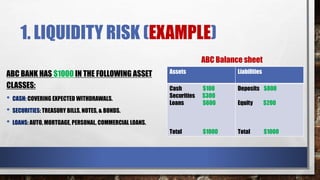

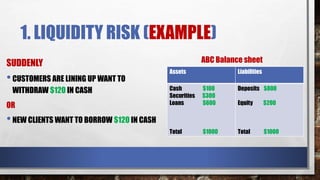

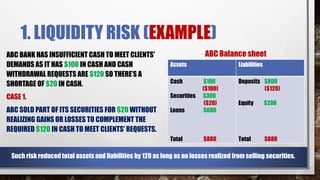

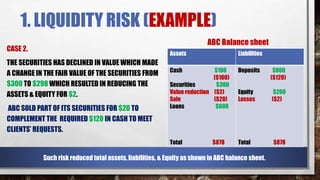

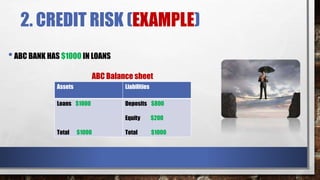

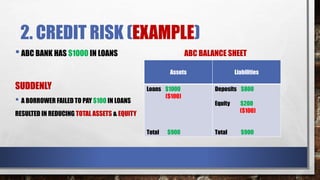

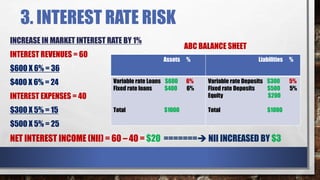

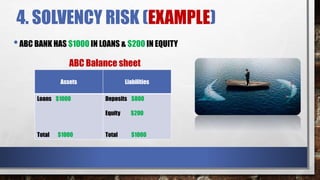

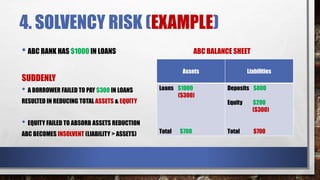

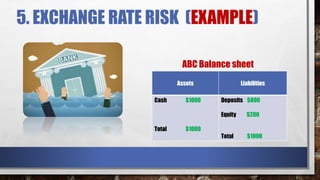

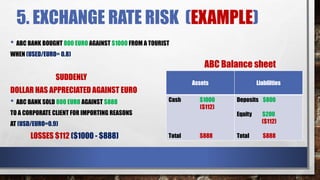

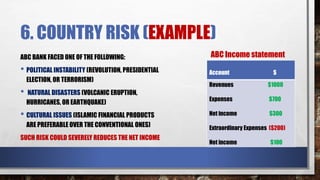

Banks play an important role in allocating financial resources to productive projects that support economic growth. However, banks face various risks that can impact their financial performance and the broader economy. These risks include liquidity risk, credit risk, interest rate risk, solvency risk, exchange rate risk, country risk, market risk, and operational risk. If these risks materialize, they can reduce a bank's assets, equity and earnings, forcing banks to tighten credit terms and lower lending, which slows economic growth. The document provides examples of how each risk could negatively impact a bank's balance sheet if losses are realized.