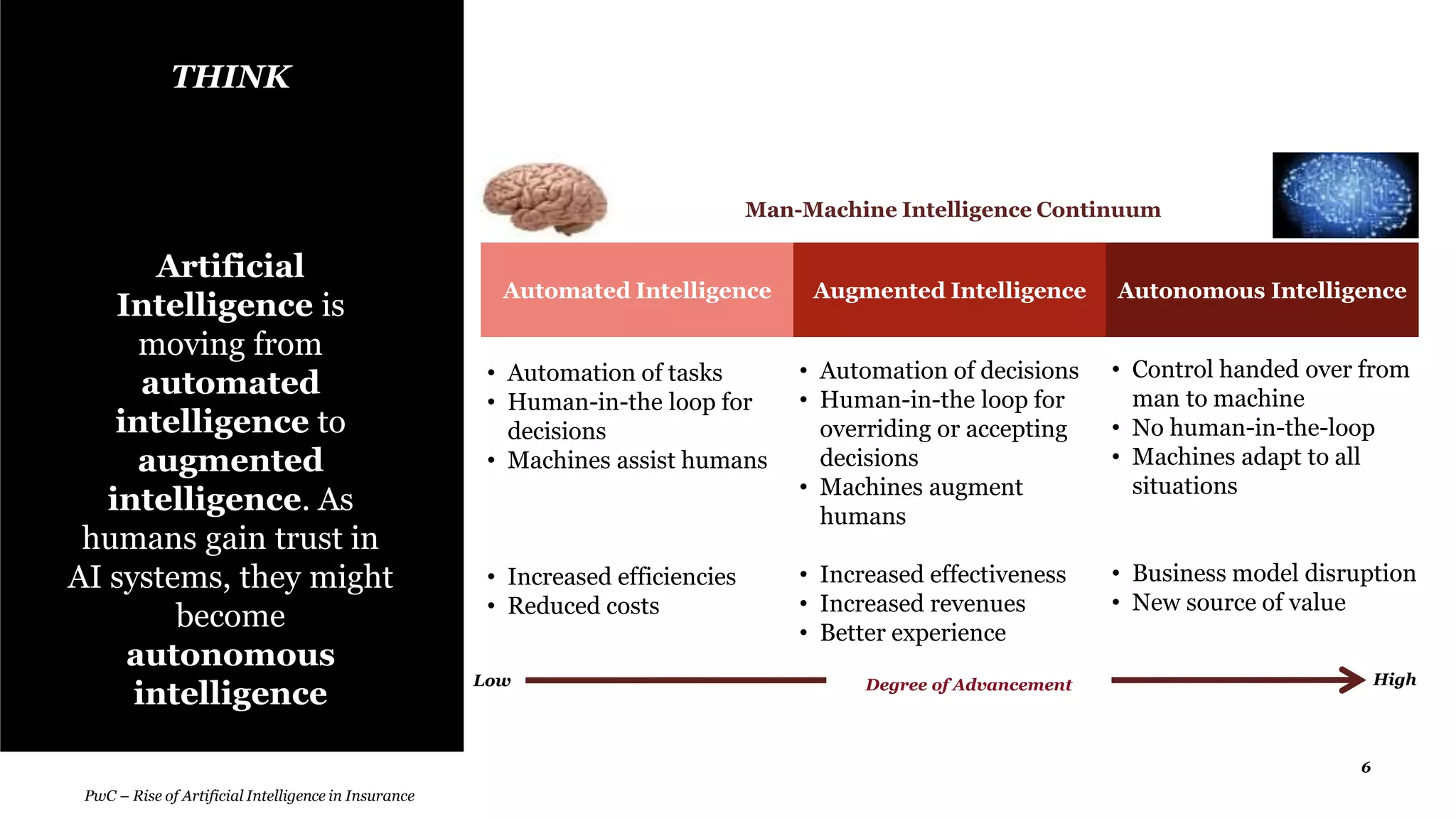

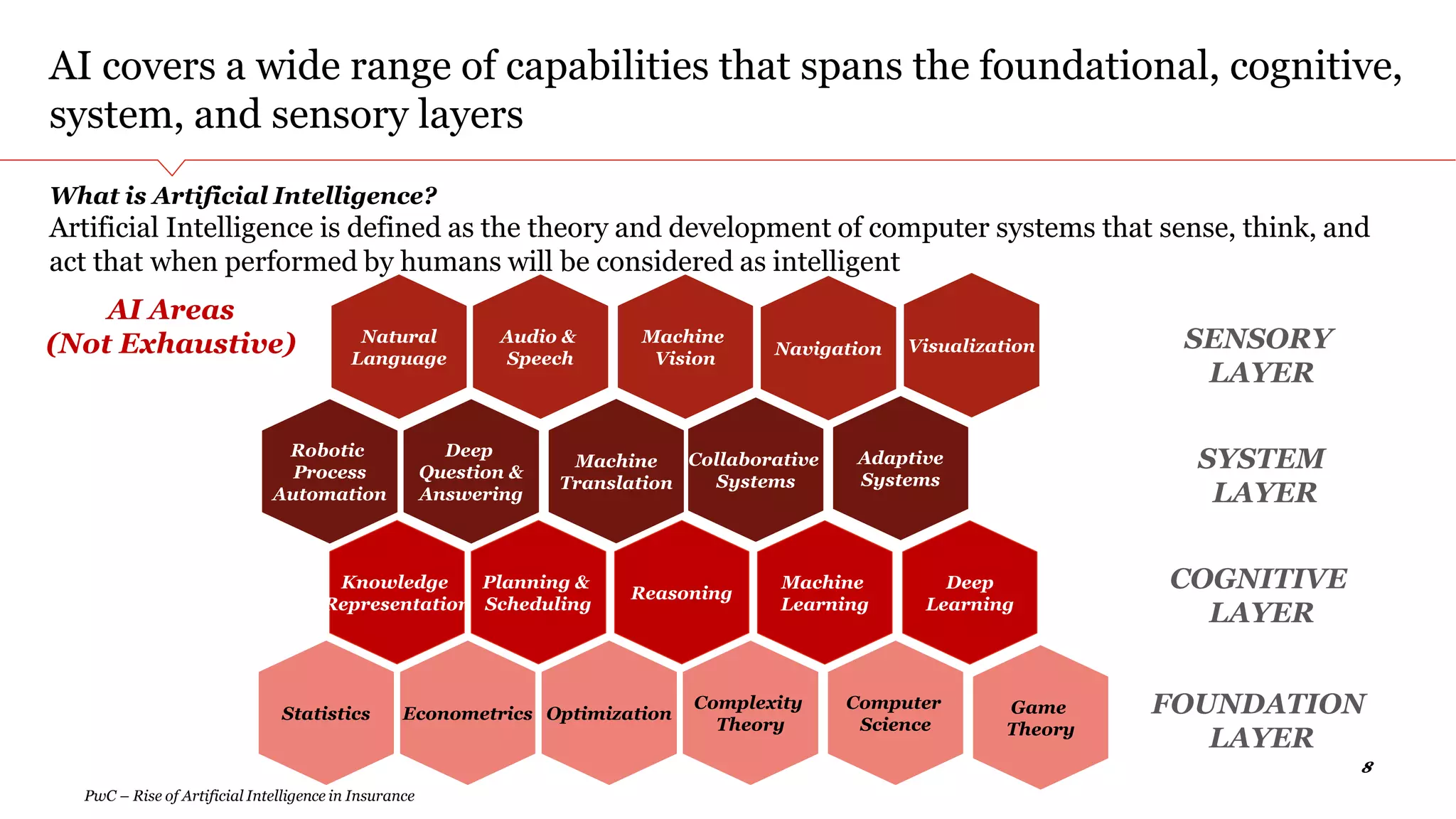

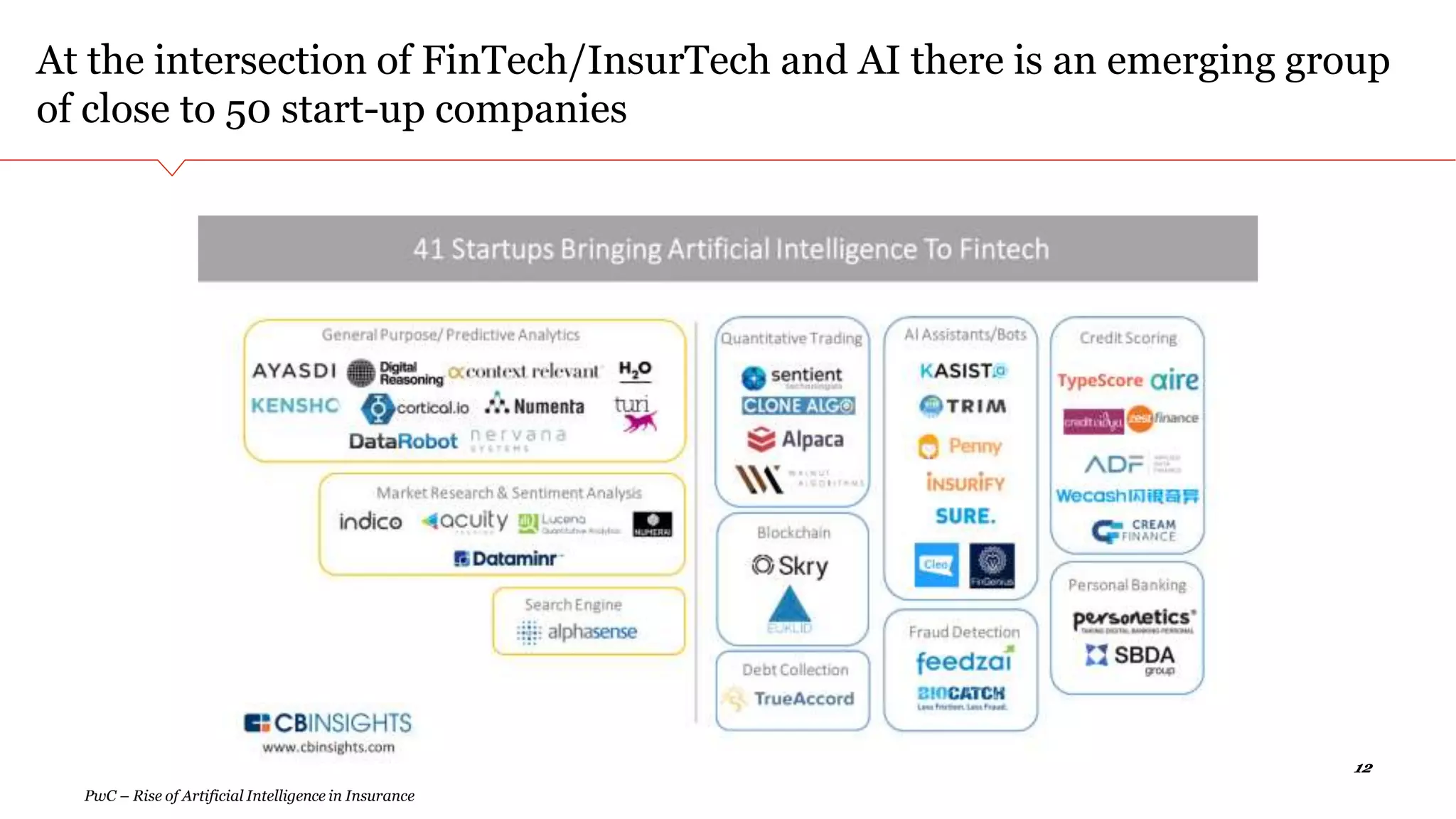

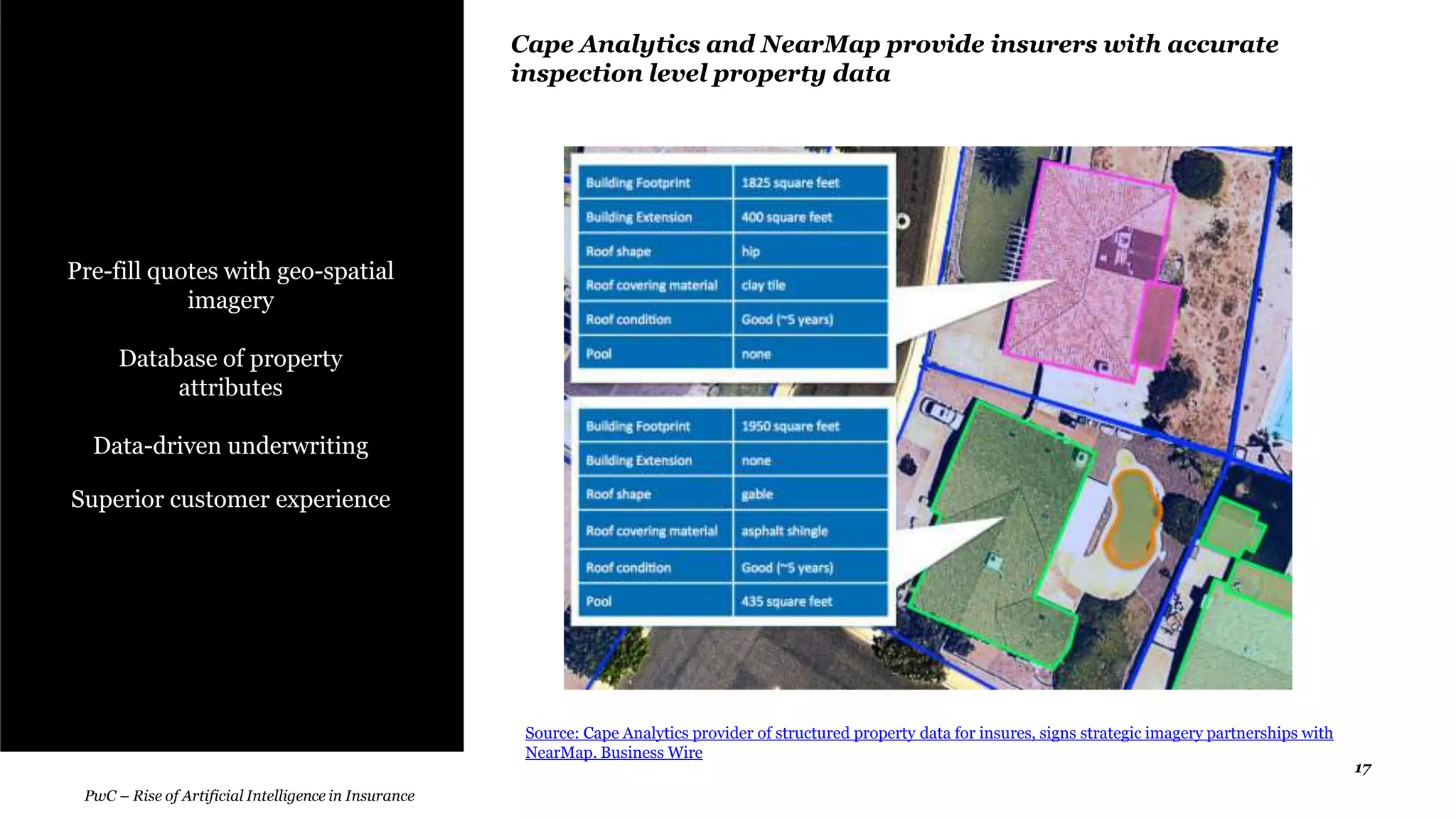

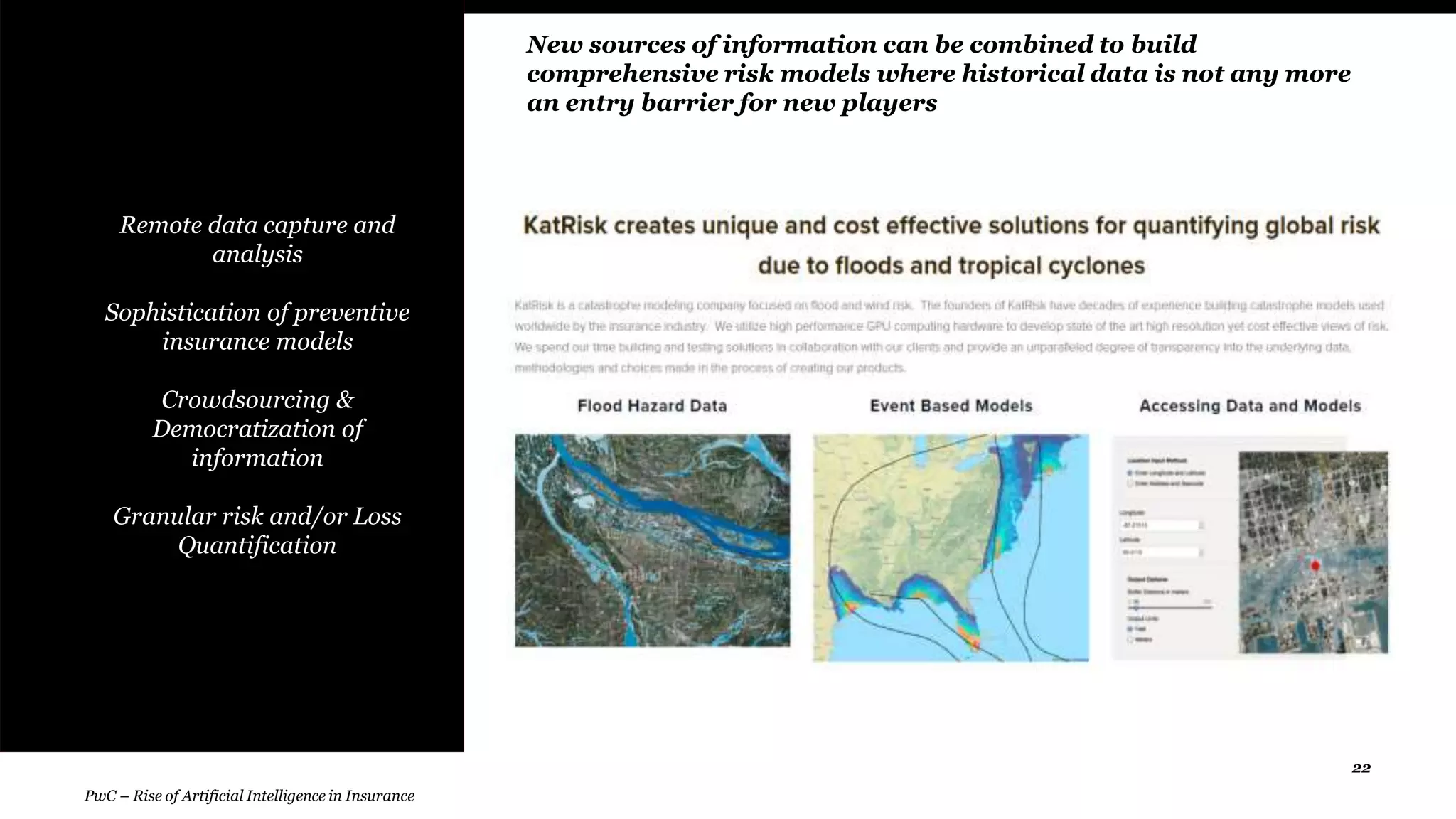

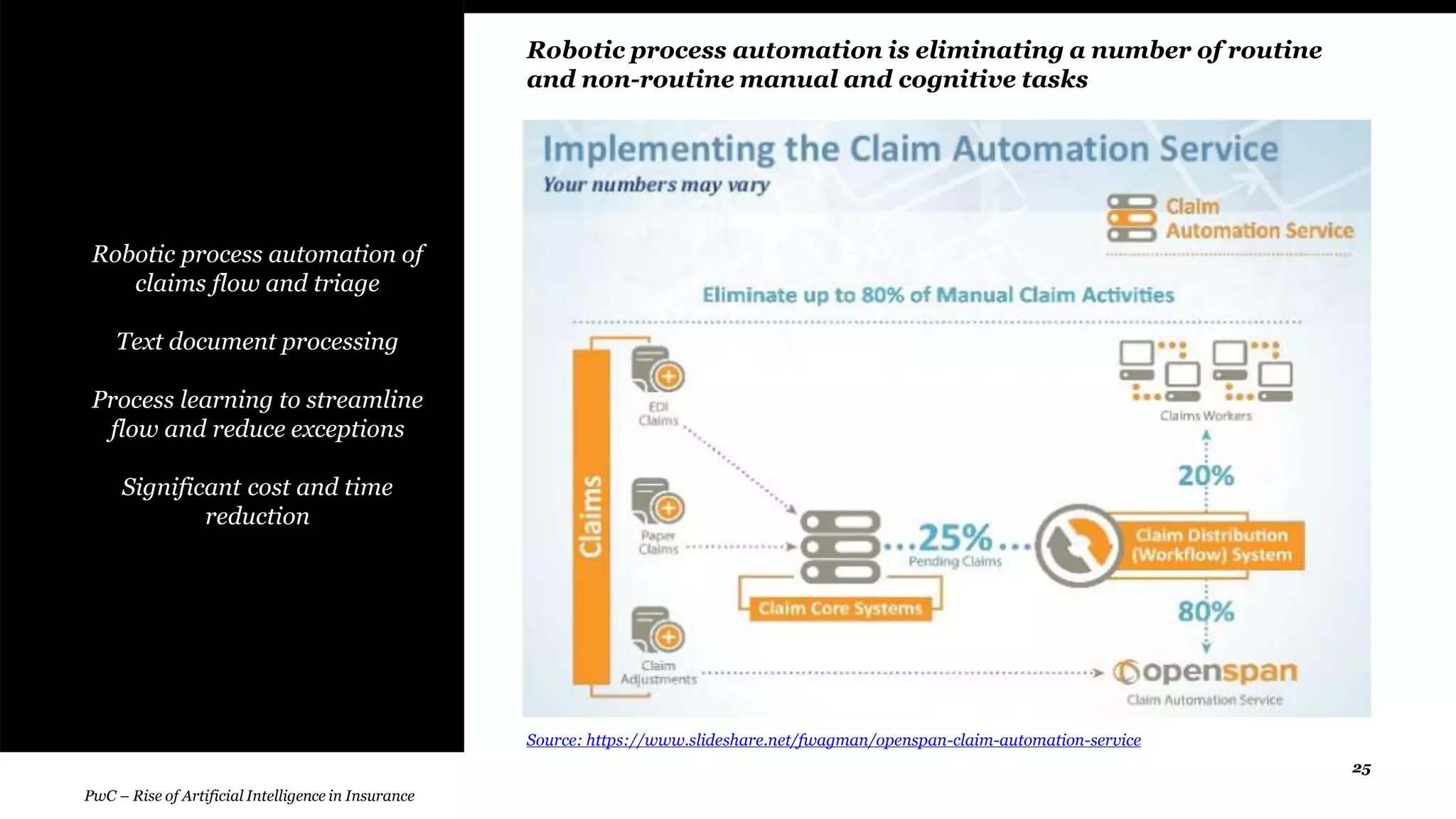

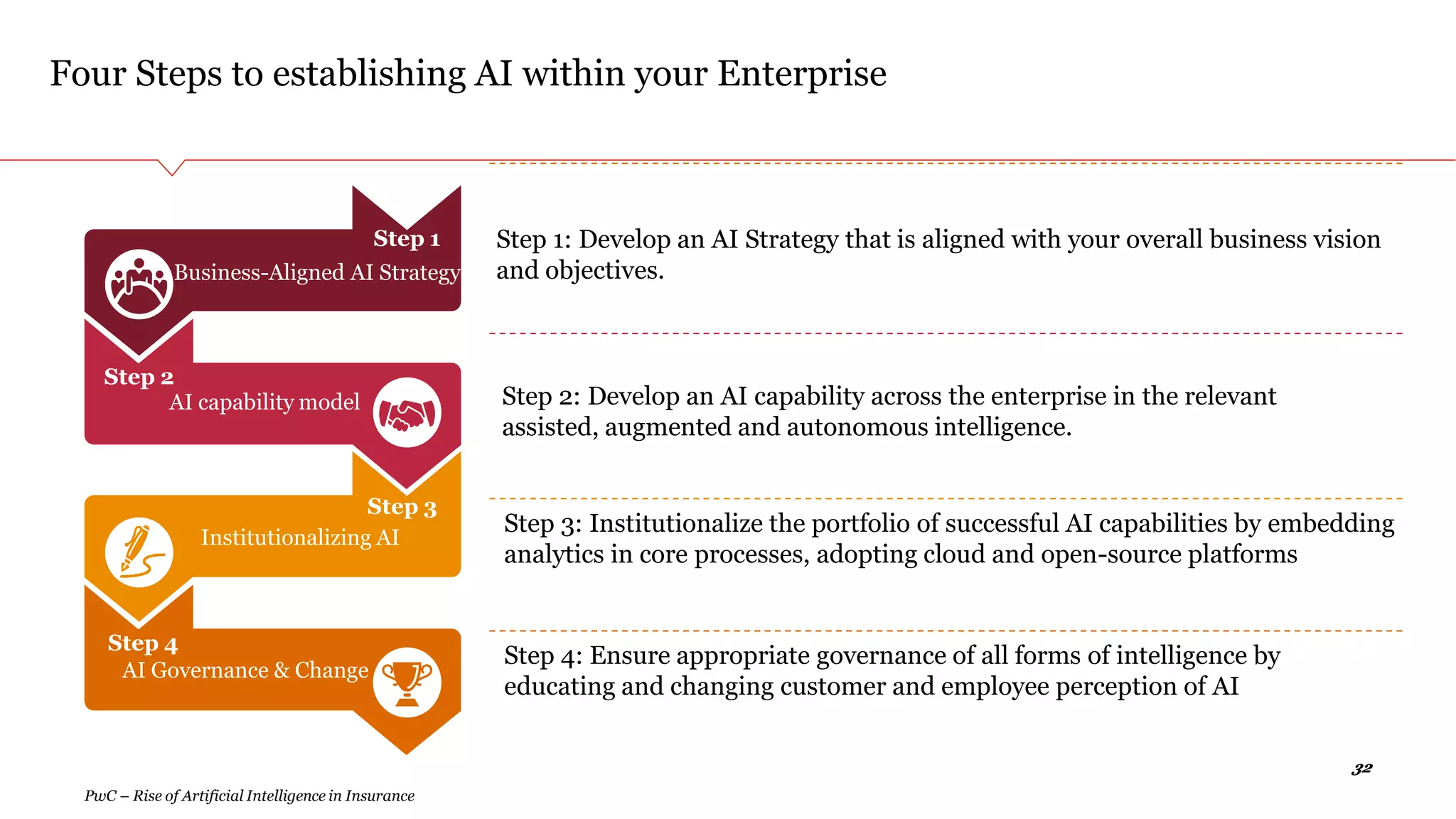

The document discusses the rise of artificial intelligence in the insurance industry. It covers how AI is being applied to key areas like underwriting, loss management, claims, and fraud detection. It also discusses implications for insurers, including developing an AI strategy and building internal AI capabilities. AI technologies like machine learning, deep learning, and robotic process automation are helping insurers automate processes, gain insights from data, and enhance customer experience.