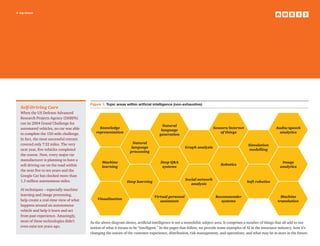

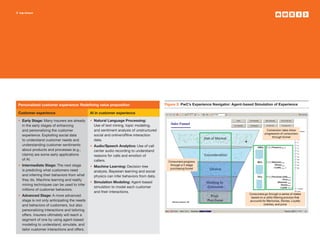

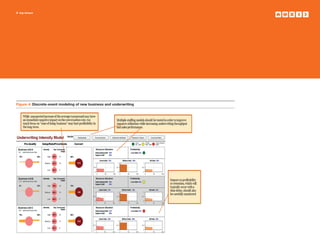

The document discusses the evolution and impact of artificial intelligence (AI) in the insurance industry, particularly focusing on customer experience, underwriting, claims processing, and emerging risks. It outlines the definitions and distinctions between AI, machine learning, and cognitive computing, as well as the stages of AI integration in various insurance processes from early to advanced applications. The text emphasizes the potential for AI to improve efficiencies and effectiveness while identifying new risks and revenue sources in the sector.