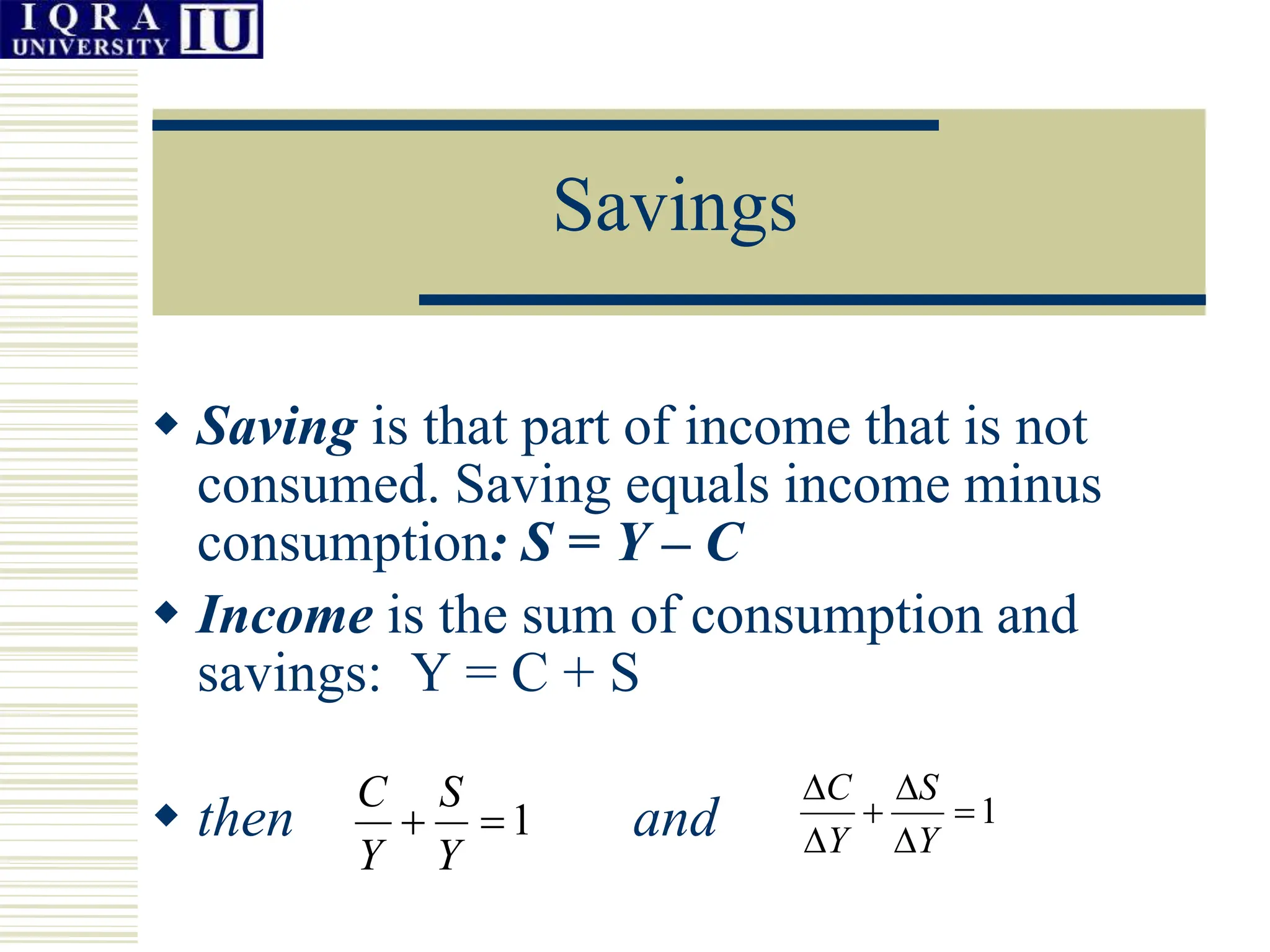

The document discusses key economic concepts such as consumption, savings, and investment. It explains the consumption function and its relationship with income, the marginal propensity to consume, and the concept of savings as the portion of income not spent. Furthermore, it covers the investment multiplier and how changes in investment affect overall output in the economy.