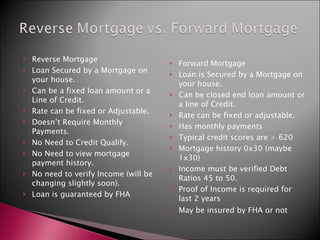

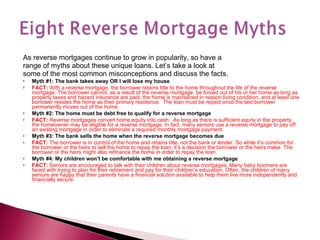

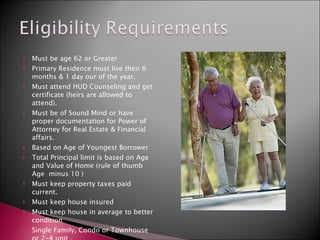

A reverse mortgage allows senior homeowners aged 62 or older to convert equity in their home into tax-free cash payments, while continuing to live in their home. They do not require monthly mortgage payments or repayment of the loan until the last borrower permanently moves out or passes away. Common myths about reverse mortgages include that the borrower could lose ownership of their home or owe more than their home is worth, but reverse mortgages are structured to protect borrowers from these outcomes. Eligibility requires the home to be the borrower's primary residence and for them to receive counseling on reverse mortgage options and costs.

![Senior Mortgage Banker- Frank Stadler Phone 888.302.2762 ext. 143 Cell 847-875-2020 Email: [email_address] 1314 W Northwest Highway Ste 300 Palatine, IL 60067 Website www.firstmortgagedept.com NMLS ID 207128 State of IL Registration # 031.0027235 Other sources of information on reverse mortgages can be found at: AARP http://www.aarp.org/money/credit-loans-debt/reverse_mortgages/ National Reverse Mortgage Lenders Association® http://www.reversemortgage.orrg American Portfolio Mortgage Corp is an IL Residential Mortgage Licensee #MB.0005608 with the Illinois Department of Financial and Professional Regulation - Division of Banking located at 122 S. Michigan Avenue, Suite 2000, Chicago, IL 60603 NMLS ID 175656](https://image.slidesharecdn.com/reversemortgageproductbasics3242010-13013236328911-phpapp01/85/Reverse-Mortgage-Product-Basics-3-24-2010-16-320.jpg)