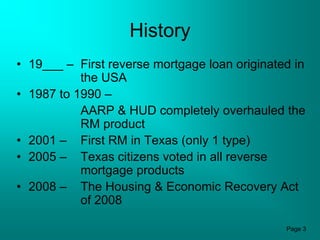

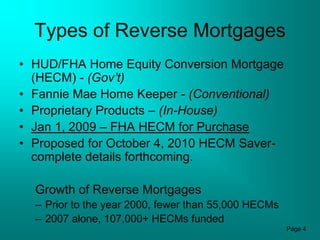

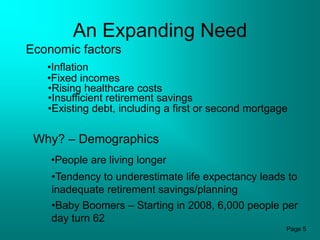

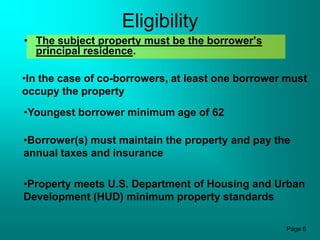

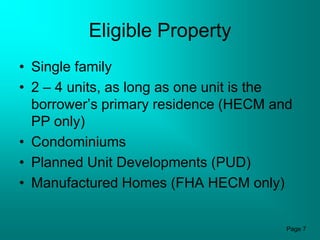

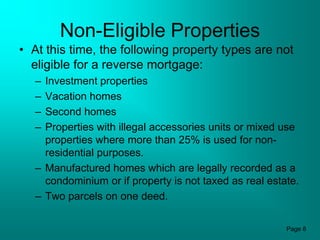

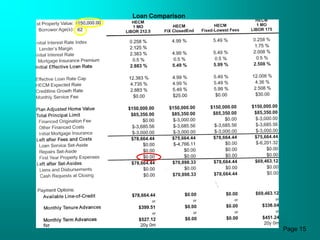

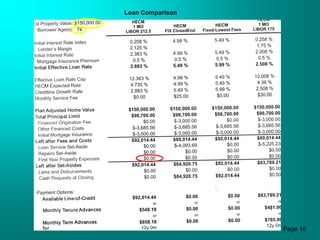

This document provides an overview of reverse mortgages, including what they are, their history, types available, eligibility requirements, fees, repayment structure, and processing times. Key points covered include that reverse mortgages allow homeowners aged 62+ to access equity in their home with no repayment required until they move out or pass away; the most common type is the Home Equity Conversion Mortgage through HUD; and processing a reverse mortgage typically takes 4-6 weeks but can be delayed by title issues or other encumbrances on the property.