This document provides an overview of mortgage insurance and how it can help homebuyers purchase a home with less than a 20% down payment. Some key points:

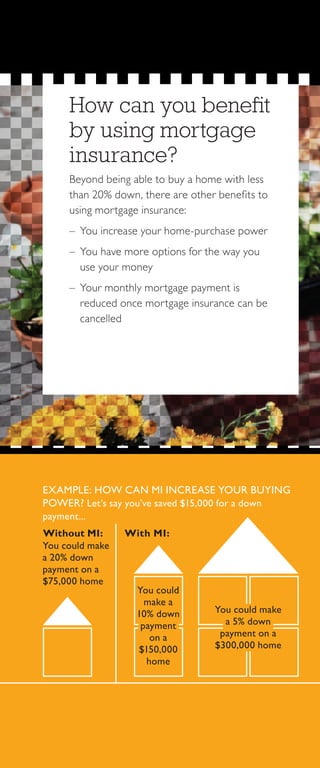

- Mortgage insurance allows homebuyers to purchase a home making as little as a 5% down payment by insuring the lender against losses if the buyer defaults.

- Using mortgage insurance increases a buyer's purchasing power, as they can buy a more expensive home than if they had to put down 20%. It also gives buyers more flexibility in how they use their savings.

- The cost of mortgage insurance is relatively low compared to the increased home value it allows a buyer to purchase. Once the loan balance reaches 80% of the original home