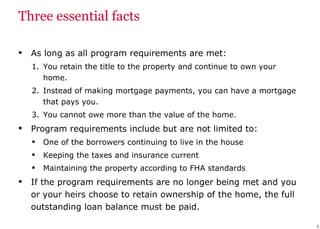

1. A reverse mortgage allows homeowners aged 62 and older to convert their home equity into tax-free cash without making monthly payments. The loan does not need to be repaid as long as the homeowner lives in the property as their primary residence.

2. Homeowners have flexibility in how they receive the loan proceeds, which can be used for any purpose. They retain ownership of their home and the lender cannot force a sale of the property.

3. A reverse mortgage has costs and fees, but it enables older homeowners to access equity in their home to supplement their retirement income or pay for other expenses.

![Financial independence and peace of mind I can help you choose the Reverse Mortgage financing solution that best fits your individual needs and requirements. DAN BATTE Reverse Mortgage Consultant 972-935-0297 Phone 1-800-566-3560 Toll Free [email_address] All program requirements must be met. The information in this presentation is accurate as of the date of printing and is subject to change without notice. Wells Fargo Home Mortgage a division of Wells Fargo Bank, N.A. © 2009 Wells Fargo Bank, N.A. All Rights Reserved. #102107 5/09](https://image.slidesharecdn.com/pptconsumer-12536492396401-phpapp02/85/Pp-Tconsumer-18-320.jpg)