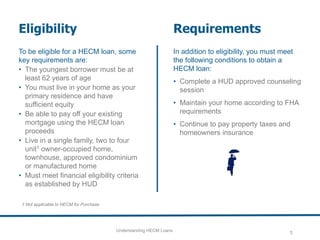

A Home Equity Conversion Mortgage (HECM), commonly known as a reverse mortgage, allows homeowners aged 62 and older to access tax-free funds from the equity in their home without making monthly mortgage payments. A HECM can be used to pay off an existing mortgage, fund home improvements or medical bills, or provide a monthly income stream while continuing to live in your home until you no longer occupy it as your primary residence. The HECM loan has benefits like no monthly payments, tax-free funds that can be used for any purpose, and FHA insurance to protect borrowers.