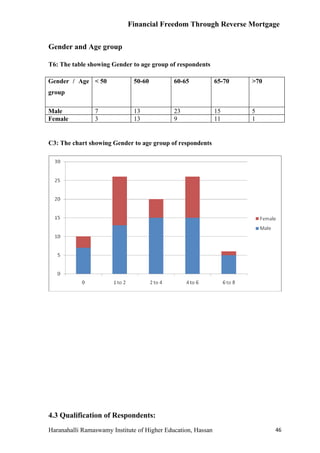

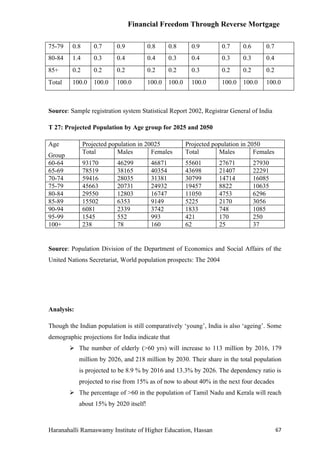

The document discusses reverse mortgages as a tool for financial freedom for senior citizens in India. It notes that housing wealth makes up a large portion of wealth for many elderly Indians and reverse mortgages allow them to access this equity to meet living expenses without having to sell their home. The document covers the concept and workings of reverse mortgages, including eligibility requirements, valuation, risks for lenders and borrowers, and the potential market size in India based on demographics and home ownership rates. It also discusses the objectives and methodology of a research study analyzing awareness and demand for reverse mortgages among Indian seniors.