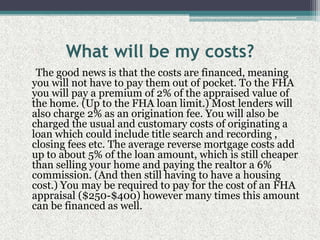

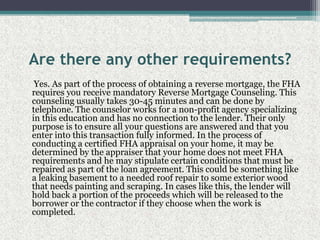

A reverse mortgage allows senior homeowners to access equity in their home without making monthly payments. It provides funds via a monthly payment, lump sum, or line of credit. The homeowner retains ownership and can live in the home until passing away. The loan is repaid upon moving out or passing of the last surviving homeowner. Qualification requires being at least 62 years old, owning the home, and having sufficient equity. Costs of 5% of the loan amount are financed into the loan balance. Counseling is required to ensure the homeowner understands the product.