The document summarizes the amendments made to Article 287 of the Philippine Labor Code regarding retirement benefits for private sector employees. Key points include:

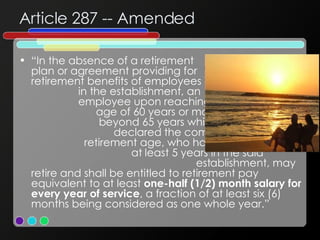

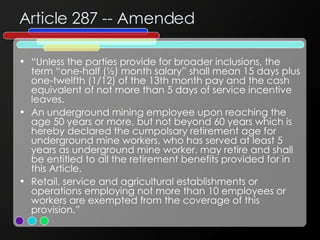

- Article 287 was amended in 1993 and 1998 to establish a minimum retirement benefit for employees in the absence of a retirement agreement and to include underground mining workers.

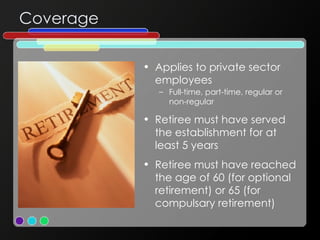

- Employees are entitled to retire optionally at age 60 or compulsorily at age 65 if they have served at least 5 years, and must receive at least half a month's salary for each year of service as retirement pay.