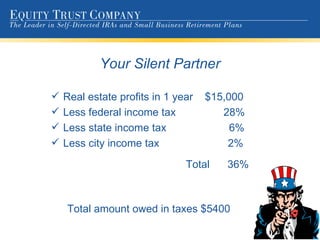

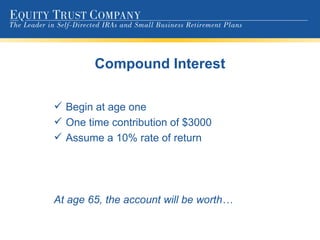

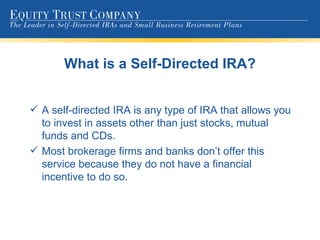

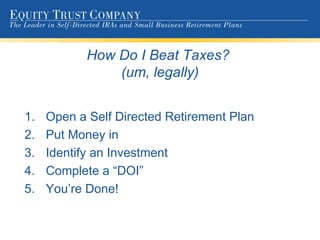

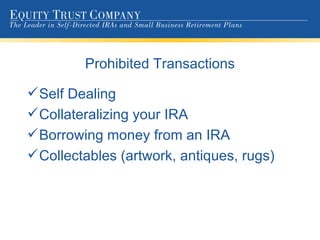

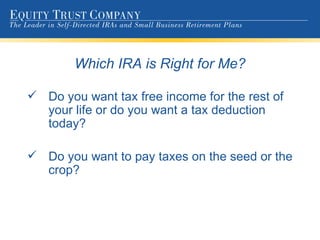

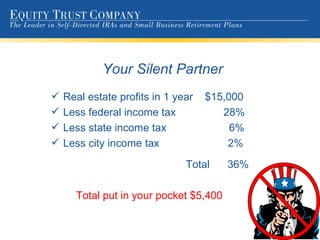

This document discusses the benefits of self-directed IRAs for real estate investing. It explains that a self-directed IRA allows you to invest retirement funds in real estate and other nontraditional assets. Real estate invested through an IRA provides tax benefits like tax-deferred growth and can help maximize returns through leverage and compound interest over time. The document recommends choosing a custodian like Equity Trust that specializes in self-directed IRAs and makes the process easy.

![For More Information Contact Jeff Walker Retirement Plan Specialist (440) 323-5491 ext 169 You can also reach me by e-mail at: [email_address]](https://image.slidesharecdn.com/ira-presentation-1234194263824976-1/85/Ira-Presentation-30-320.jpg)