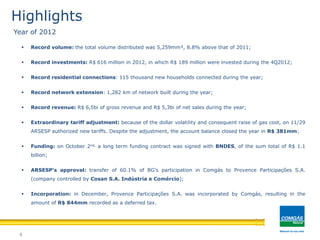

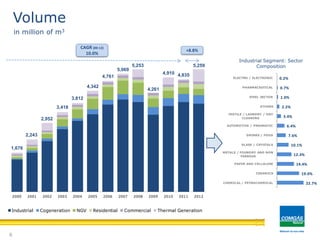

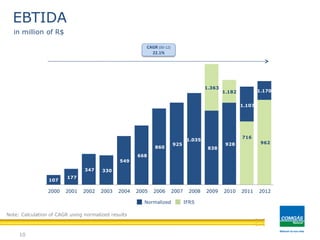

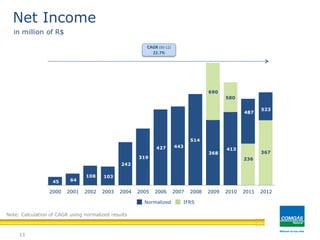

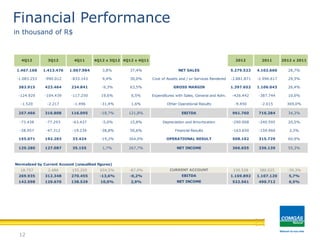

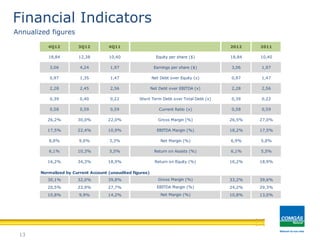

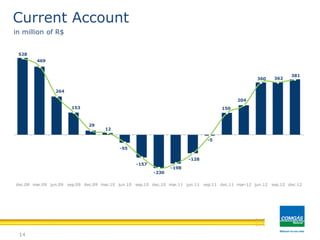

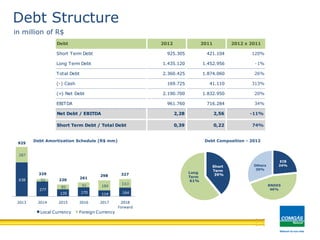

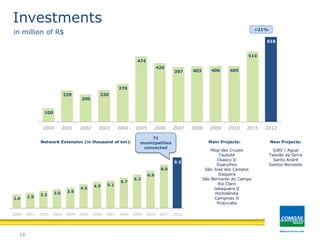

This document provides a summary of financial and operational results for Companhia de Gás de Sao Paulo (COMGÁS) for the year ending December 31, 2012. Some key highlights include record volumes distributed, investments, connections, and network extensions. COMGÁS also saw record revenue but an extraordinary tariff adjustment was authorized to offset rising gas costs. Net income increased substantially over 2011 despite the adjustment. Financial indicators show improved returns and margins year-over-year.