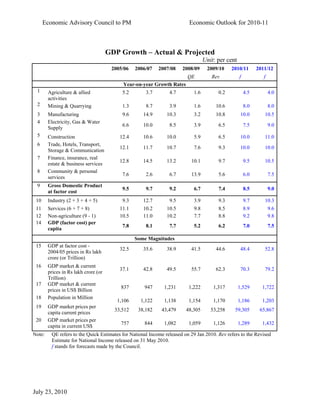

The document provides an economic outlook for India for 2010-11 and 2011-12. It projects that the Indian economy will grow at 8.5% in 2010-11 and 9% in 2011-12, driven by growth in agriculture, industry, and services. Inflation is projected to be 6.5% by March 2011 due to an expected normal monsoon and a rising domestic savings and investment rate. The current account deficit is estimated to remain around 3% of GDP.