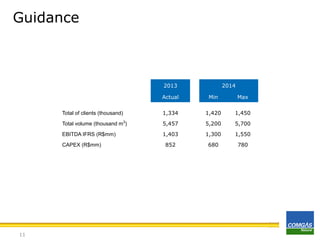

The document provides an annual financial and operational report for Companhia de Gás de São Paulo (COMGÁS) for the year ending December 31, 2013. Some key highlights include:

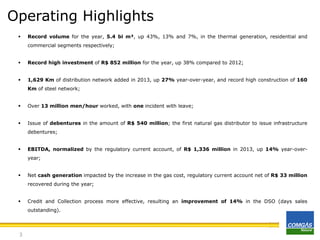

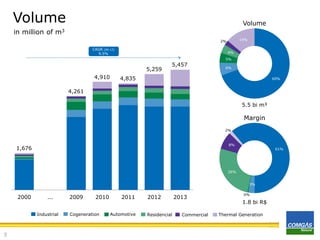

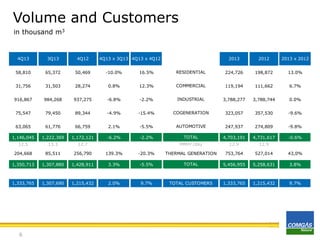

- Record volumes sold of 5.4 billion cubic meters, up 43%, 13%, and 7% in the thermal generation, residential, and commercial segments respectively.

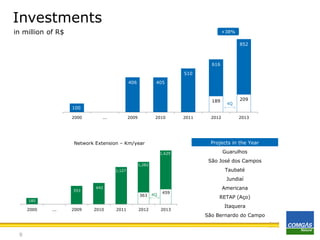

- Record high investment of R$852 million, up 38% compared to 2012, to expand the distribution network by 1,629 km, a 27% increase over the prior year.

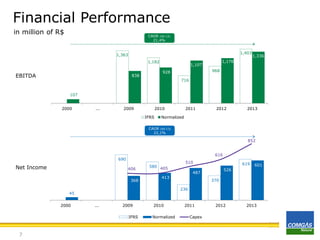

- EBITDA of R$1,336 million in 2013, up 14% year-over-year when normalized for the regulatory current account.