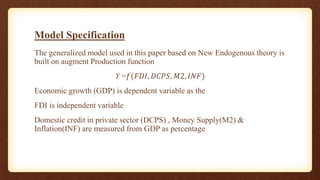

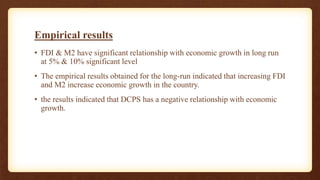

This research paper analyzes the relationship between foreign direct investment (FDI), economic growth, and financial development in Cabo Verde from 1987 to 2014. The findings suggest that FDI has a significant positive effect on economic growth in both the short and long run, while domestic credit in the private sector negatively impacts growth. The study highlights the importance of adopting policies to attract more FDI to enhance economic growth.