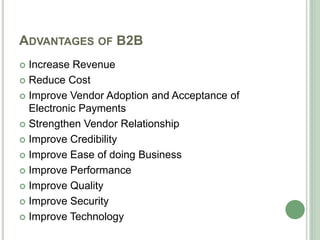

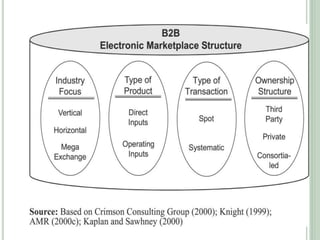

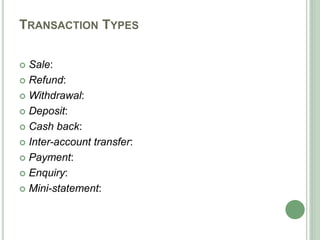

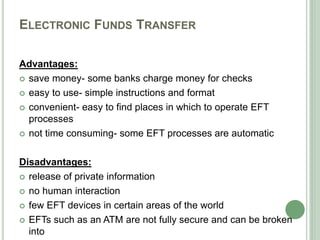

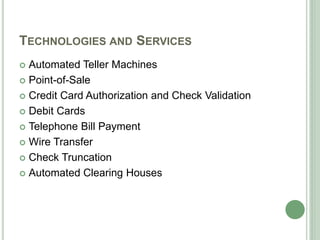

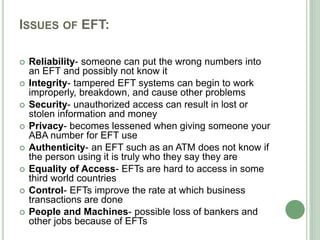

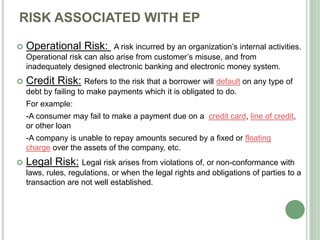

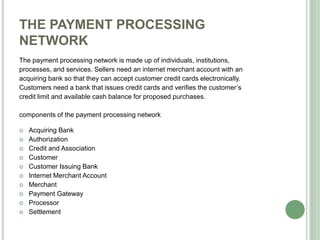

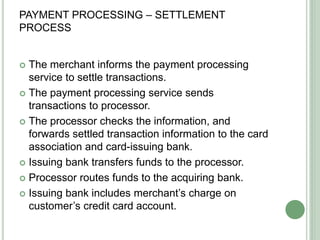

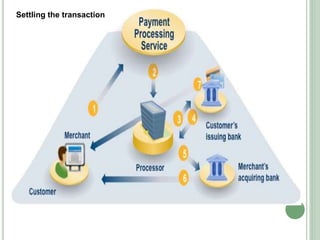

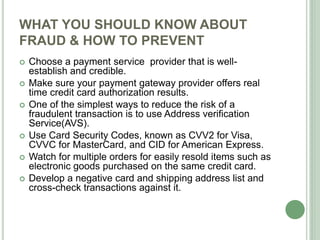

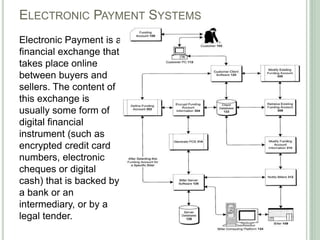

The document discusses electronic payment systems, particularly focusing on electronic funds transfer (EFT) and associated risks. It outlines various B2B electronic payment practices, their advantages, and different transaction types while highlighting the importance of risk management in electronic banking. Additionally, it addresses the components of the payment processing network and issues related to fraud and consumer needs in the context of electronic payments.

![THE GARTNER RESEARCH GROUP ESTIMATES THAT B2B COMPANIES CAN

SAVE $7.25 PER INVOICE USING WEB-BASED BILLING AND PAYMENT.

[DESHMUKH, 2006]](https://image.slidesharecdn.com/eft-231020035033-f62e4720/85/EFT-ppt-6-320.jpg)